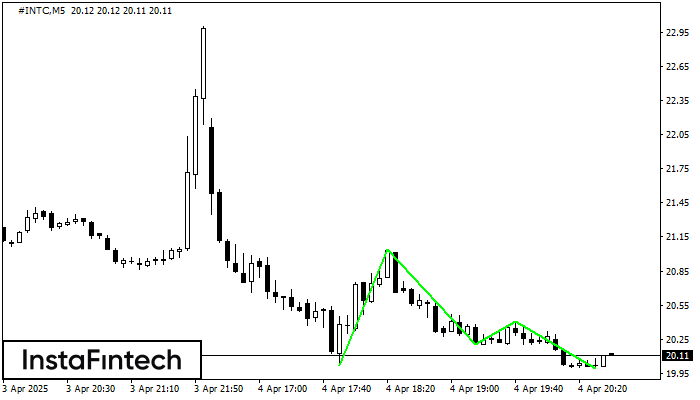

Triple Bottom

was formed on 04.04 at 19:40:28 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of #INTC M5. Features of the pattern: The lower line of the pattern has coordinates 21.04 with the upper limit 21.04/20.41, the projection of the width is 102 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 20.02, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

Xem thêm

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Pennant Aliran Menurun

was formed on 21.04 at 21:30:29 (UTC+0)

signal strength 4 of 5

Corak Pennant Aliran Menurun telah dibentuk pada carta #FB H1. Jenis corak ini dicirikan oleh sedikit penurunan di mana selepas itu harga akan bergerak ke arah aliran asal. Sekiranya harga

Open chart in a new window

Triple Bottom

was formed on 21.04 at 21:30:21 (UTC+0)

signal strength 2 of 5

Corak Triple Bottom telah dibentuk pada #AAPL M15. Ia mempunyai ciri-ciri berikut: tahap rintangan 191.73/191.10; tahap sokongan 189.80/190.18; lebar corak adalah 193 mata. Dalam situasi penembusan paras rintangan 191.73, harga

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

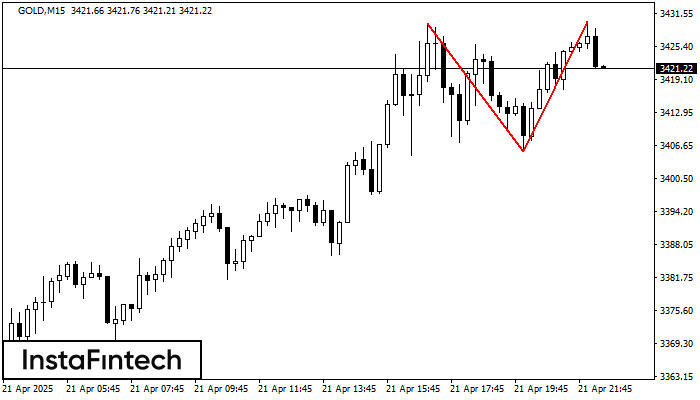

Double Top

was formed on 21.04 at 21:30:13 (UTC+0)

signal strength 2 of 5

Corak pembalikan Double Top telah dibentuk pada GOLD M15. Ciri-ciri: sempadan atas %P0.000000; sempadan bawah 3429.80; sempadan bawah 3405.54; lebar corak adalah 2449 mata. Dagangan menjual adalah lebih baik untuk

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window