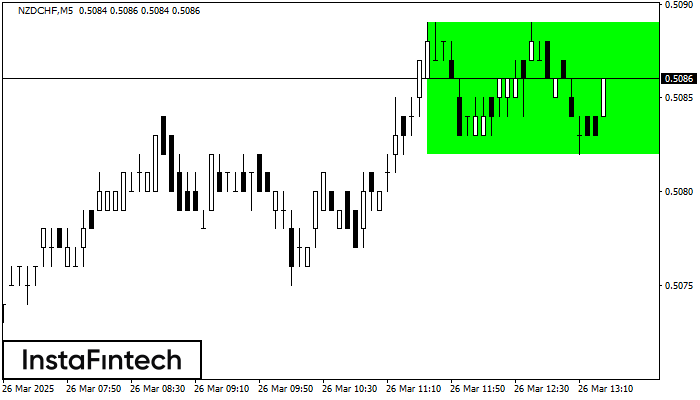

Bullish Rectangle

was formed on 26.03 at 13:25:38 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCHF formed the Bullish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 0.5089 and support 0.5082. In case the resistance level 0.5089 - 0.5089 is broken, the instrument is likely to follow the bullish trend.

The M5 and M15 time frames may have more false entry points.

Vea asimismo

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Double Bottom

was formed on 01.05 at 12:59:53 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on NZDCHF M15. Characteristics: the support level 0.4887; the resistance level 0.4915; the width of the pattern 28 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

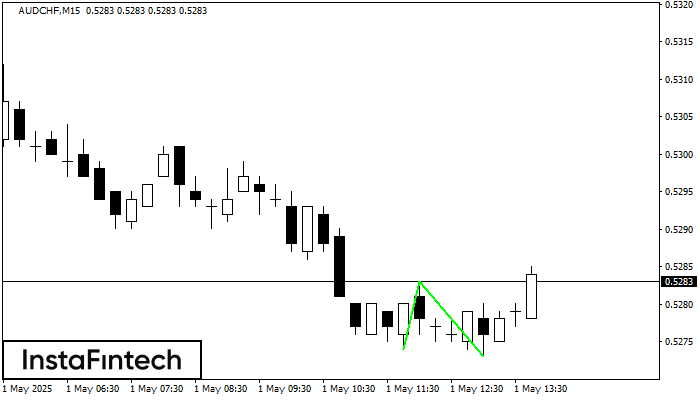

Double Bottom

was formed on 01.05 at 12:59:44 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on AUDCHF M15; the upper boundary is 0.5283; the lower boundary is 0.5273. The width of the pattern is 9 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

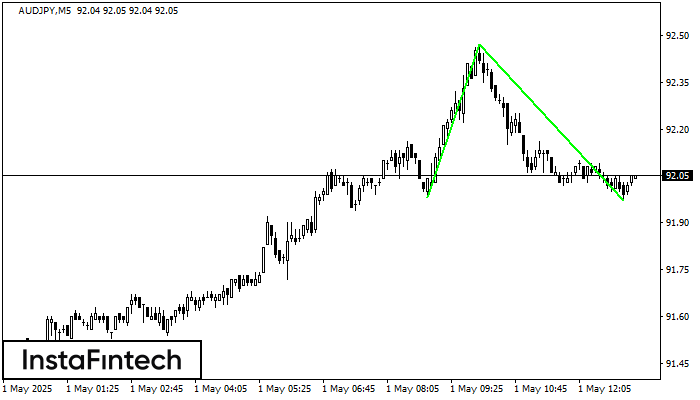

Double Bottom

was formed on 01.05 at 12:15:06 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDJPY M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window