Vea también

11.04.2025 06:04 AM

11.04.2025 06:04 AMA relatively large number of macroeconomic events are scheduled for Friday, but none are expected to impact the market. Of course, we may see short-term reactions to individual reports, but it is widely understood that the market continues to be driven by Trump. His actions will determine how the U.S. dollar behaves on the last trading day of the week. And the dollar, in turn, influences all other currencies. The reports highlight the UK's GDP and industrial production data, the U.S. PCE index, and the University of Michigan consumer sentiment index.

There is no point in discussing fundamental developments other than Trump's trade war. The dollar's decline may continue for an indefinite period. We advise traders to pay close attention to statements made by top officials from major countries and alliances regarding tariffs. Trump has said that any response to his actions aimed at "eliminating unfairness" will be met with severe retaliation through new sanctions and tariffs.

At the same time, yesterday, the U.S. president introduced a 90-day grace period for all countries except China, during which a unified 10% tariff on imports will apply. According to Trump, this time is meant to be used for negotiating trade deals. However, we must point out that the chances of reaching agreements with the EU or China are extremely low. Tariffs against China continue to rise, and there is no reason to expect Beijing to back down.

On the week's final trading day, both currency pairs (EUR/USD and GBP/USD) could move in either direction. The market remains in panic and chaos, with no room for logical price movement. News related to the trade war emerges every few hours, and it is impossible to predict its appearance or forecast Trump's next steps.

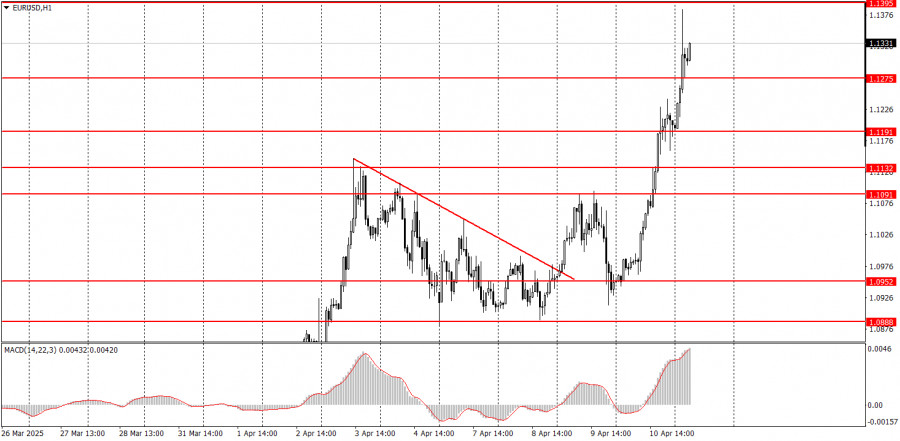

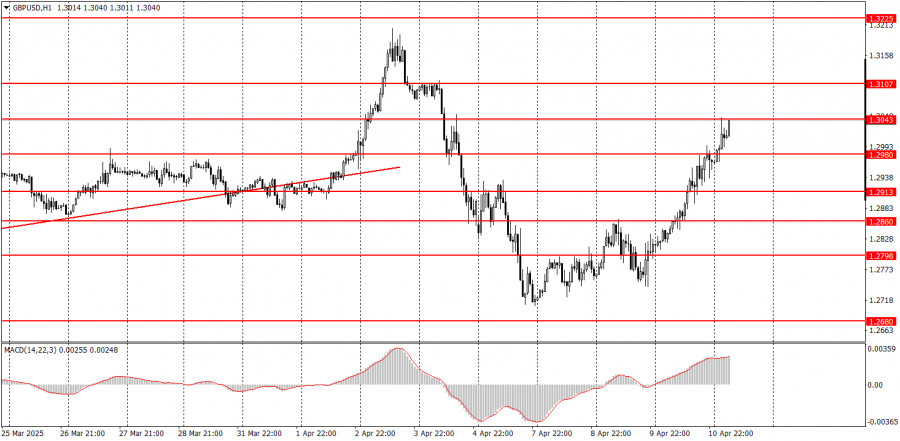

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas GBP/USD continuó cayendo durante el jueves. El dólar fortaleció sus posiciones durante tres días consecutivos, para lo cual objetivamente no había ninguna razón. El contexto macroeconómico

El par de divisas EUR/USD volvió a negociarse el jueves con bastante calma, pero esta vez la divisa estadounidense ya no logró mostrar un fuerte crecimiento. Lo bueno, en pequeñas

El par GBP/USD se corrigió ligeramente a la baja después de subir el lunes sin motivo aparente. Sin embargo, llamar a este movimiento mínimo hacia abajo un «crecimiento del dólar»

El par de divisas GBP/USD también se negoció el lunes con baja volatilidad y prácticamente en una dirección lateral, aunque la libra esterlina mantiene una ligera inclinación alcista. A pesar

El par de divisas GBP/USD el viernes también se negoció con baja volatilidad y sin ningún entusiasmo. Sin embargo, la libra esterlina todavía mantiene una ligera inclinación alcista

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.