Vea también

The euro and Ether have stabilized following the cryptocurrency market sell-off earlier this week. Bitcoin has returned to the $88,000 level, while Ether has rebounded above $2,000 and is now trading around $2,100.

For now, the market remains in a pause, which does not signal the end of the bearish trend observed since the beginning of last week. Yesterday, in his latest essay, Arthur Hayes stated that the crypto market is still in a bull trend, with the worst-case scenario being a drop in BTC to $70,000.

This bold assessment certainly contradicts the prevailing sentiment leaning towards further correction. Investors remain cautious due to macroeconomic uncertainty, particularly in the stock market, creating an atmosphere of restraint and pressure on the crypto market. Many experts predict a deeper fall, citing historical data and current market indicators.

However, Arthur Hayes, known for his unconventional views, points to fundamental factors supporting the long-term uptrend of cryptocurrencies. He highlights the growing institutional adoption, Bitcoin's supply shortage, and Donald Trump's administration's initiatives to develop the crypto industry. His argument is that short-term fluctuations are inevitable, but the overall trajectory remains bullish. Time will tell how accurate his forecast is.

Intraday crypto trading strategy

As for my intraday strategy, I will continue to act based on any major pullbacks in Bitcoin and Ether, betting on the medium-term bullish market, which remains intact. Below are my short-term trading plans and strategy.

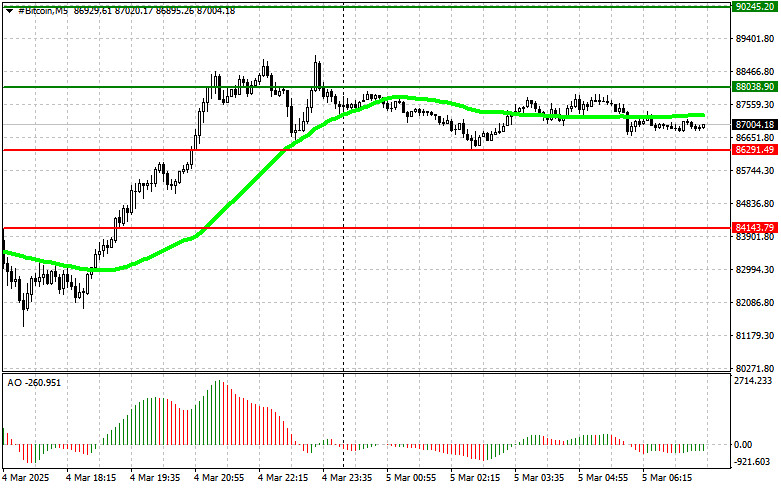

Bitcoin

Buy scenario

Scenario #1: I will buy Bitcoin today if it reaches the entry point around $88,000, targeting a rise to $90,200. I will exit long positions around $90,200 and sell immediately on the pullback. Before buying on a breakout, I must confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Bitcoin from the lower border at $86,300 is possible if there is no market reaction to break below it. The target levels for growth are $88,000 and $90,200.

Sell scenario

Scenario #1: I will sell Bitcoin today if it reaches the entry point around $86,300, targeting a drop to $84,100. I will exit short positions around $84,100 and buy immediately on the dip. Before selling on a breakout, I must confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: It makes sense to sell Bitcoin from the upper border at $88,000 if there is no market reaction to break above it. The target levels for the decline are $86,300 and $84,100.

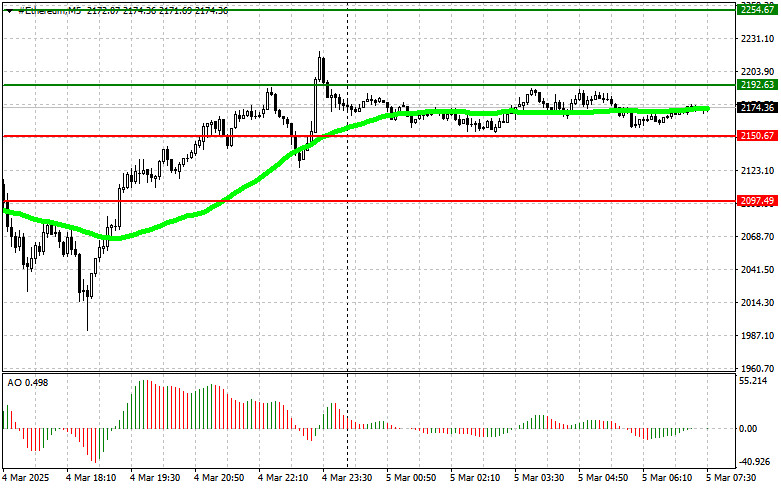

Ethereum

Buy scenario

Scenario #1: I will buy Ether today if it reaches the entry point around $2,192, targeting a rise to $2,254. I will exit buy positions around $2,254 and sell immediately on the rebound. Before buying on a breakout, I must confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Ether from the lower border at $2,150 is reasonable if there is no market reaction to break below it. The target levels for growth are $2,192 and $2,254.

Sell scenario

Scenario #1: I will sell Ether today if it reaches the entry point around $2,150, targeting a drop to $2,097. I will exit sell positions around $2,097 and buy immediately on the dip. Before selling on a breakout, I must check out that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Ether from the upper border at $2,192 is a good idea if there is no market reaction to break above it. The target levels for the decline are $2,150 and $2,097.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.