Vea también

24.01.2025 09:14 AM

24.01.2025 09:14 AMBitcoin and Ethereum experienced a correction ahead of Donald Trump's speech, but, as is often the case, they rebounded strongly following the positive news that emerged afterward.

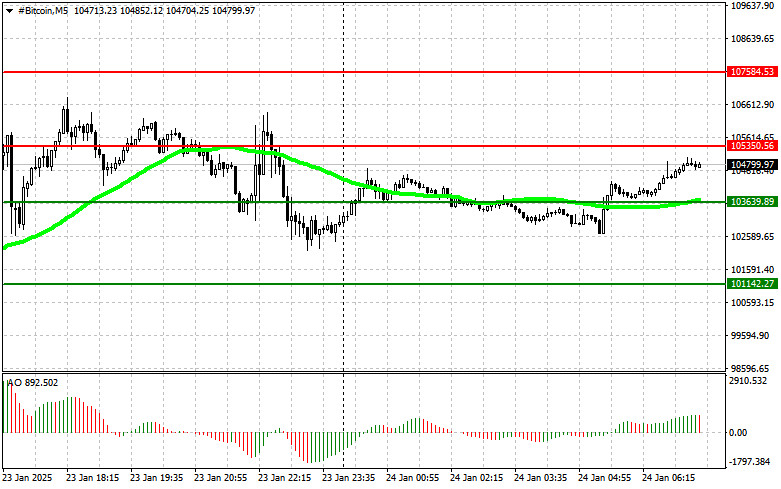

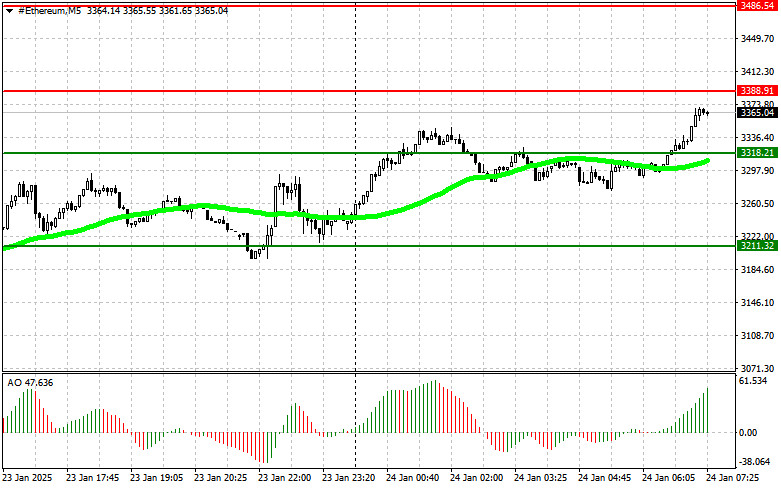

Bitcoin initially climbed above the $106,000 mark but corrected back to the $102,000 range during today's Asian session. Meanwhile, Ethereum demonstrated greater resilience, rising to $3,285 based on Trump's statements and breaking through a significant resistance level around $3,400 today.

According to Glassnode metrics, Bitcoin's current 60-day price range is exceptionally narrow. Historically, such periods of tight price ranges often precede a surge in volatility and a strengthening of Bitcoin. These narrow ranges signal a market in a state of anticipation. Investors typically analyze influencing factors before deciding to buy or sell. During uncertainty, trade volumes decline, reducing liquidity and increasing the potential for sharp price movements in either direction. Historically, after periods of sideways movement, cryptocurrencies often experience a surge in interest from both retail and institutional investors. This surge may be triggered by news, economic events, or shifts in public sentiment toward Bitcoin. It's important to note that this volatility can be either positive or negative.

Yesterday's speech by Trump served as another catalyst for buying Bitcoin and other digital assets. However, the market's failure to reach a new all-time high indicates challenges in sustaining buying momentum at current levels. For Bitcoin to break above $110,000, it will likely need support from large investors, who are currently missing from the market. This situation raises the likelihood of another sharp sell-off, potentially bringing Bitcoin back down to the $90,000 level. Traders should exercise caution.

Despite these challenges, Trump's remarks about the need for innovative financial instruments and decentralized assets have sparked investor interest in Bitcoin and other digital currencies. Trump highlighted that traditional financial systems are often prone to manipulation and crises, making alternative assets increasingly relevant. Many experts now predict that such statements will accelerate the mass adoption of cryptocurrencies. Additionally, rumors that more than half of Trump's assets are invested in various digital currencies are fueling speculation about the continuation of the crypto bull market.

For my intraday strategy in the cryptocurrency market, I plan to continue taking action, especially during any major pullbacks of Bitcoin and Ethereum. I am optimistic about the continuation of the bull market in the medium term, which still appears intact.

Regarding short-term trading, I have outlined my strategy and conditions below.

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching the entry point around $105,350, targeting a rise to $107,500. Around $107,500, I will exit the purchases and sell immediately on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Bitcoin can also be bought from the lower boundary of $103,600, provided there is no market reaction indicating a breakdown, aiming for levels of $105,350 and $107,500.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching the entry point around $103,600, targeting a drop to $101,100. Around $101,100, I will exit the sales and buy immediately on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Bitcoin can also be sold from the upper boundary of $105,350, provided there is no market reaction indicating a breakout, aiming for levels $103,600 and $101,100.

Buy Scenario

Scenario #1: Upon reaching the entry point around $3,388, I will buy Ethereum today, targeting a rise to $3,486. Around $3,486, I will exit the purchases and sell immediately on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Ethereum can also be bought from the lower boundary of $3,318, provided there is no market reaction indicating a breakdown, aiming for levels $3,388 and $3,486.

Sell Scenario

Scenario #1: I will sell Ethereum today upon reaching the entry point around $3,318, targeting a drop to $3,211. Around $3,211, I will exit the sales and buy immediately on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper boundary of $3,388, provided there is no market reaction indicating a breakout, aiming for levels $3,318 and $3,211.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los compradores de el Bitcoin y Ethereum continúan aprovechando bien los momentos de caída del mercado y lo compran bastante rápido, como se demostró hoy durante la sesión asiática

El Bitcoin no mostró ningún movimiento interesante ni el sábado ni el domingo. Sin embargo, el viernes el precio retiró liquidez del último Lower High. Recordemos que la retirada

El Ethereum apenas logró recuperarse hasta el FVG más cercano y durante dos semanas no pudo seguir subiendo. Sin embargo, el Bitcoin finalmente arrastró hacia arriba a su "hermano menor"

El Bitcoin continuó su movimiento ascendente el martes, lo que generó muchas preguntas. Sin embargo, recordemos que el análisis técnico no puede proporcionar señales con una precisión del 100% todo

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.