Vea también

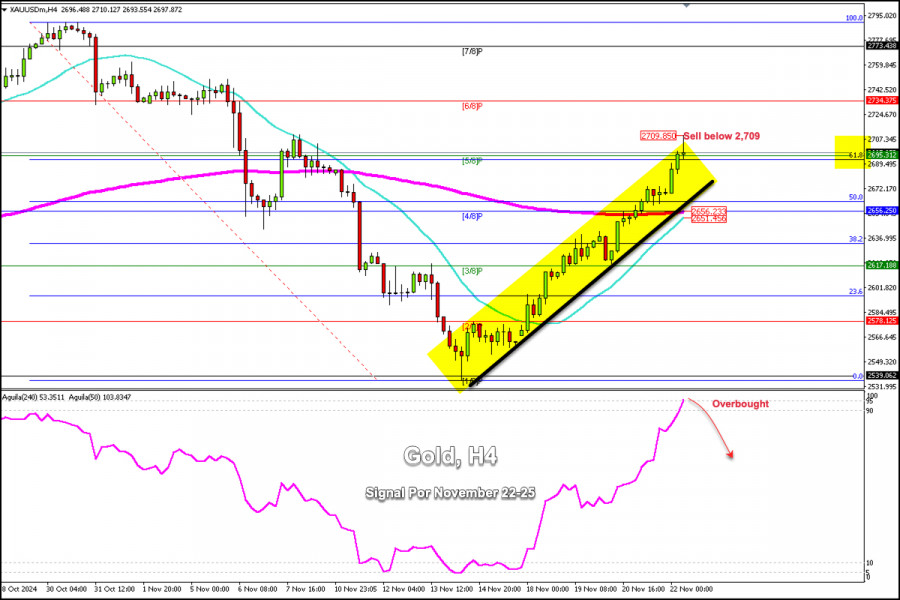

Early in the American session, gold is trading around 2,698, above 5/8 Murray, and above the 200 EMA and 21 SMA with a strongly bullish bias. The metal is about to reach extremely overbought levels.

Gold accelerated its upward movement during the European session and reached a high of 2,709.85, the level last seen at the beginning of November. Gold will likely make a strong technical correction in the next few hours, with the target at about 4/8 of Murray located at 2,656.

Since gold has broken all technical levels, it is now located around the 61.8% Fibonacci level, which represents a key level for a technical reversal. So, we will look for opportunities to sell below the 5/8 Murray level located at 2,695.

In case gold continues its bullish bias, we can expect it to find strong resistance around 6/8 Murray located at 2,734. This level could be a strong barrier for gold, but we believe that a technical correction could occur first and then, the price will continue its bullish cycle.

The eagle indicator reached the 95-point zone which means that a technical correction could occur in the next few days and we even expect gold to return to levels around 2,560 where it left the gap at the beginning of the trading week.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.