CHFSGD (Swiss Franc vs Singapore Dollar). Exchange rate and online charts.

Currency converter

24 Mar 2025 20:21

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CHF/SGD currency pair is not actively traded on the Forex market. The CHF/SGD is the cross currency pair as it does not include the U.S. dollar. However, the U.S. currency has a significant influence on it. This can be seen if you combine two price charts: CHF/USD and USD/SGD. Thus, you can get an approximate CHF/SGD chart.

The U.S. dollar influences both currencies much. So, a CHF/SGD trader should allow for the major U.S. economic indicators in order to make a correct projection of a future trend of this financial asset. The indicators which are important to keep track of: the Federal Reserve discount rate, GDP, unemployment rate, new jobs, etc. It is also worth noting that the currencies comprising the pair can respond at a different rate on changes in the U.S. economy. Therefore, the CHF/SGD may be considered as a specific indicator reflecting these currencies’ changes.

The Swiss economy remains strong for several centuries. For this reason, its national currency enjoys a great confidence all over the world as one of the most reliable and stable currencies. The Swiss franc is also a safe haven for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against other currencies. This feature of Swiss economy should be taken into account when you trade this financial asset.

The CHF/SGD is an exotic-cross. As a rule, the pair witnesses slow movements in its exchange rate. Currently, the Singapore dollar is one of the most stable currencies worldwide. The economic situation is marked by fairly low inflation rates and the predominance of exports over imports with high level of foreign exchange reserves.

Singapore is said to be a developed industrial country with high living standards and robust economy. The country is so highly developed by virtue of its favorable geographical position at the crossroads of main global shipping routes, which opened doors for Singapore to actively trade with all the major economies in the world. Currently, Singapore’s chief exports include consumer electronics, information technologies, pharmaceuticals, shipbuilding products and financial services. The economic situation of the country and the national currency is strongly dependent on exports.

Singapore has a highly developed economy included in the group known as the Asian Tigers. This is due to its economy standing on a level with such major nations as the U.S., Germany, France, Great Britain, etc.

This trading instrument is relatively illiquid compared with major currency pairs such as the EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you forecast its further movement, you should primarily focus on the pairs quoted against the U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for crosses than for more popular currency pairs, so you should carefully read the conditions the broker offers for trading this type of currency pairs.

See Also

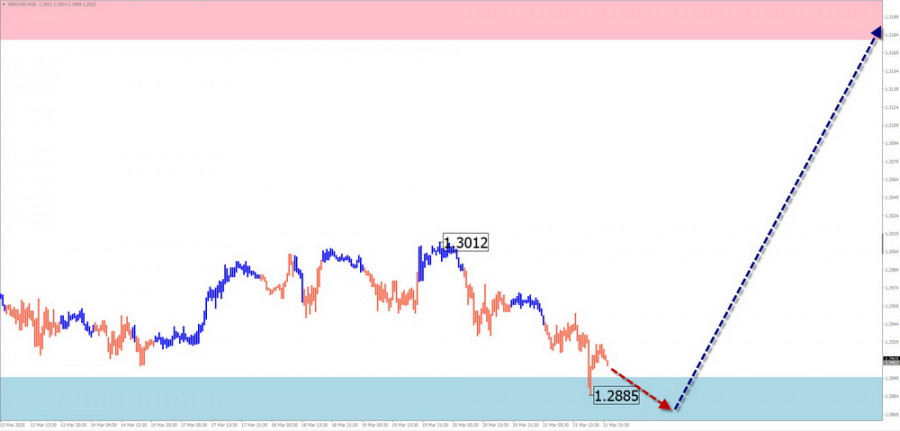

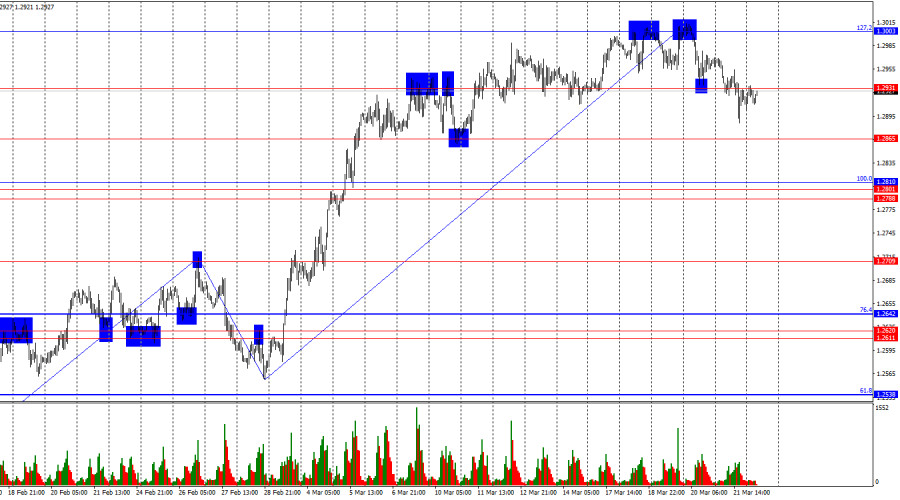

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1093

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

838

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

778

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

748

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

703

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

673

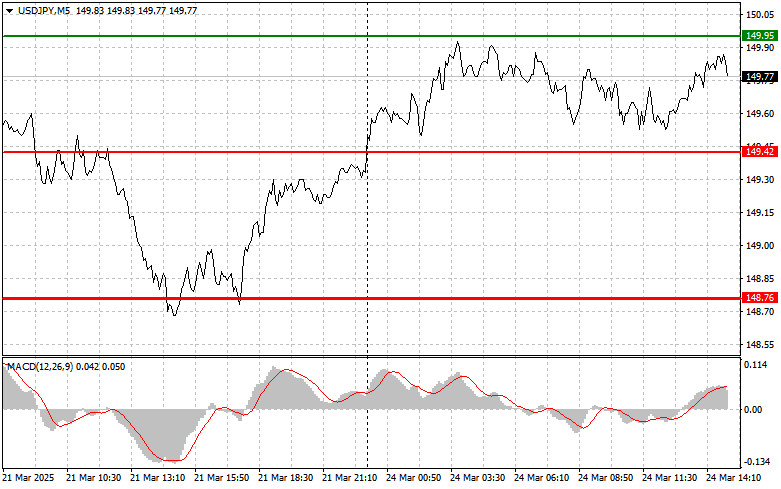

USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:13 2025-03-24 UTC+2

673

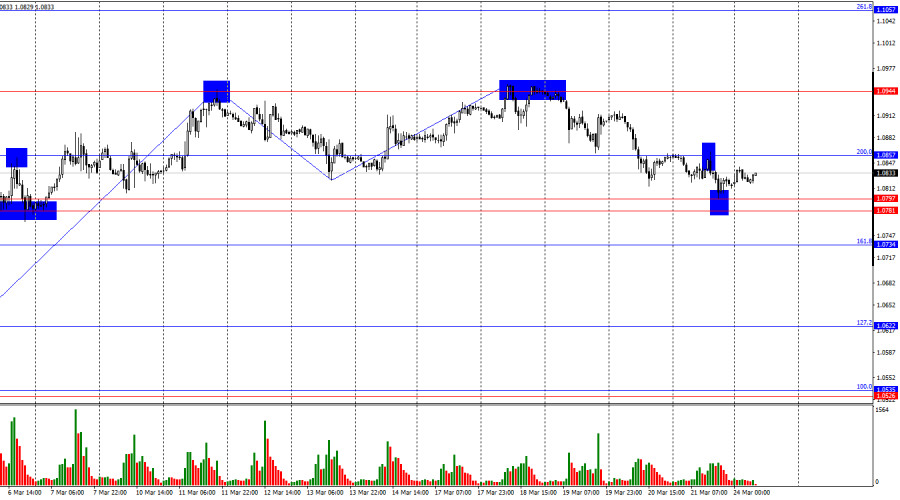

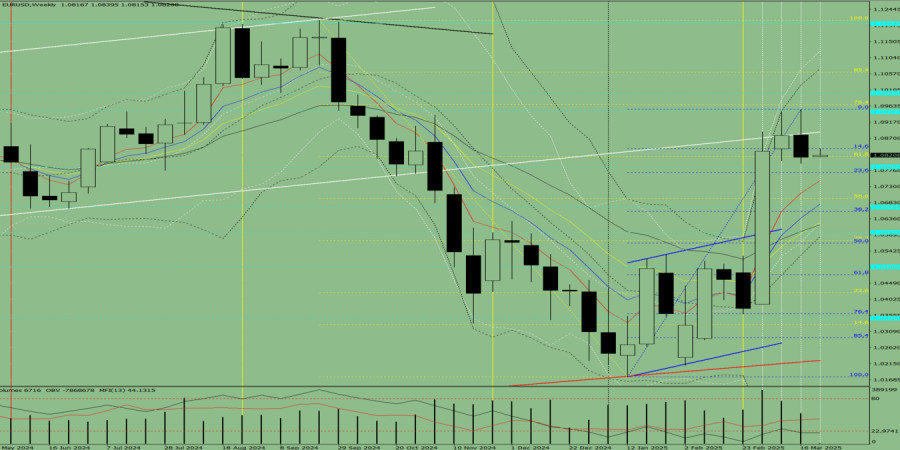

Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:22 2025-03-24 UTC+2

658

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1093

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

838

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

778

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

748

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

703

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

673

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

673

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

658