AUDPLN (Australian Dollar vs Polish Zloty). Exchange rate and online charts.

Currency converter

24 Mar 2025 20:23

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The AUD/ PLN pair is not in high demand among forex traders. This is a cross-rate pair and it means that the exchange rate of the AUD/PLN pair is calculated by reference to a third currency, namely the US dollar. So, when comparing the AUD/USD and USD/PLN charts, we can get a more or less clear picture of AUD/PLN movement.

Features of AUD/PLN

The AUD/PLN pair has rather low liquidity compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. That said, this combination can greatly diversify and balance a trader's investment portfolio.

Poland is a developed European country with high living standards. The state's income mainly comes from engineering, metallurgy, chemical industry, coal mining, and shipbuilding, as the country has access to the Baltic Sea.

Poland has been discussing the possibility of introducing the euro for years. However, the government is trying to preserve its own currency, the zloty. It fears that the transition to the euro will cause economic problems. According to experts, the partial loss of sovereignty with the inability to conduct monetary policy will have consequences for Poland. That is why the country's authorities are cautious to take this decision.

How to trade AUD/PLN

The pair has rather low liquidity. Therefore, before making any predictions, it is necessary to focus on those instruments that are quoted against the US dollar or any of the analyzed currencies.

Thus, the US dollar has a significant impact on both currencies. If we take into account such major US economic indicators as an interest rate, GDP, unemployment, and Nonfarm Payrolls, it will be easier to forecast the future movement of the pair.

However, we should keep in mind that each of the currencies in the pair may reflect changes in the US economy at different rates. So, AUD/PLN may be a specific indicator of such changes.

When trading cross-rates, remember that brokers usually set a higher spread on such pairs than on the most popular currency pairs. So, you should carefully study the trading conditions of the broker.

Only a careful analysis will make the AUD/PLN forecast as credible as possible.

See Also

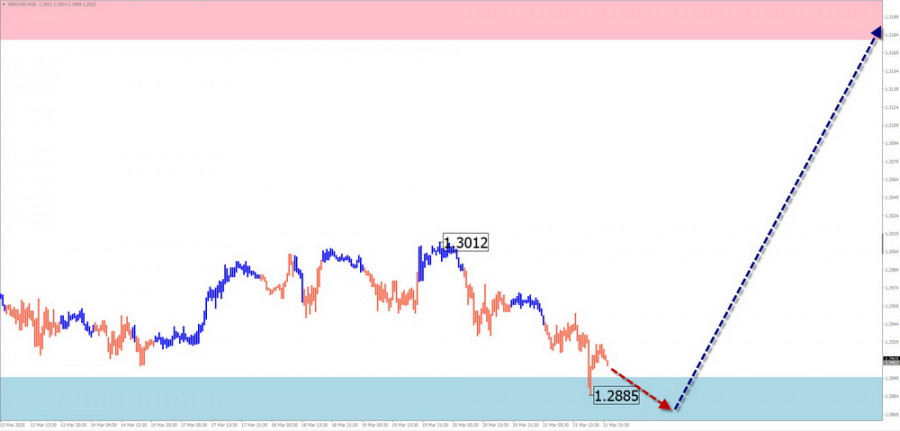

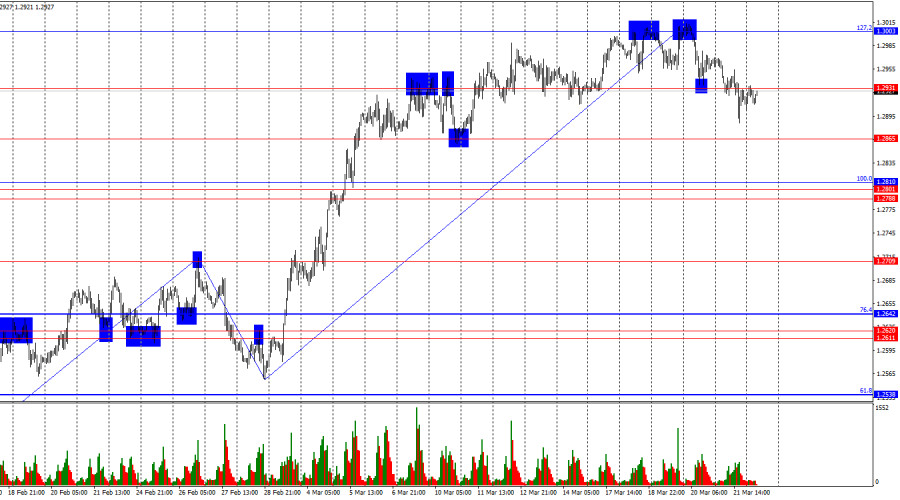

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1093

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

838

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

778

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

748

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

703

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

673

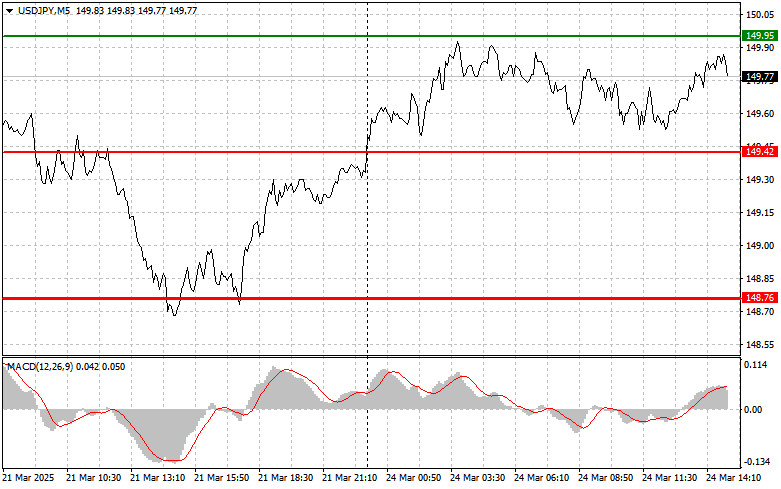

USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:13 2025-03-24 UTC+2

673

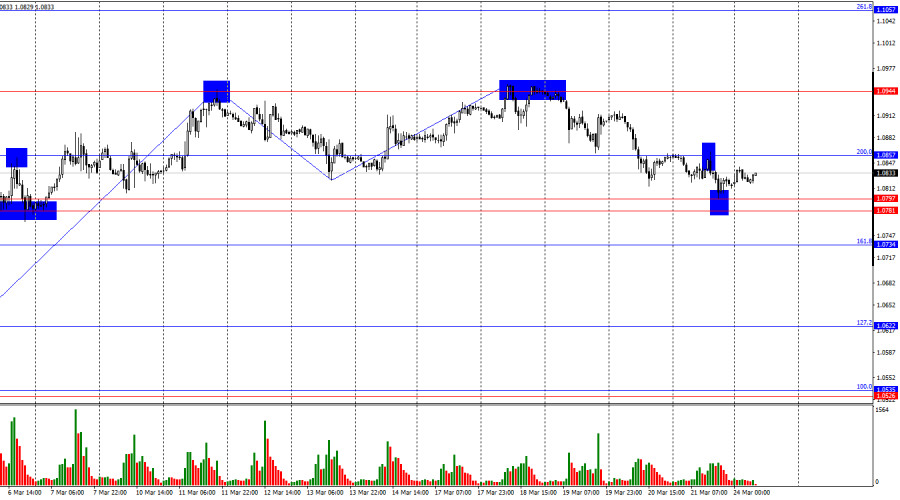

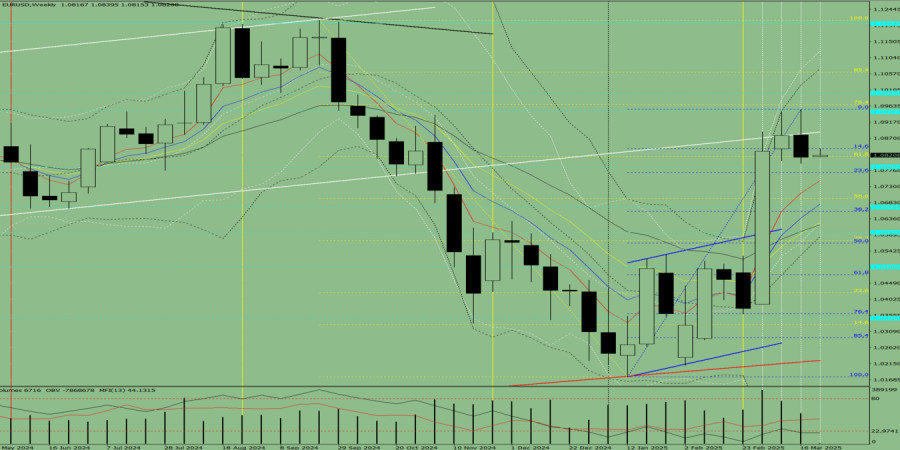

Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:22 2025-03-24 UTC+2

658

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1093

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

838

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

778

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

748

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

703

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

673

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

673

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

658