XPDUSD (Palladium vs US Dollar). Exchange rate and online charts.

Currency converter

25 Mar 2025 09:53

(0.03%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Palladium

Palladium is a white precious metal resistant to corrosion and included in the platinum metals group. It is one of the rarest metals on our planet. Palladium is also one of the noble metals.

Russia accounts for almost half of global palladium production, whereas the second part of the world's palladium is dug up by Southern African miners. The price of this precious metal is highly volatile because the palladium market directly depends on production in both countries.

On this webpage, you can find the current palladium price from the London exchange.

History of discovery

A new noble metal was discovered in the summer of 1802 by William Hyde Wollaston. Palladium is named after the asteroid Pallas that was discovered two months earlier. Then, palladium chloride was prescribed as a treatment for tuberculosis.

How to trade palladium

There are several ways to invest in palladium:

- To buy the metal. The price of a bullion will include a broker’s commission that will make it higher.

- To trade futures or options. Before opening positions on these trading instruments, traders should learn how to work with them.

- To invest in stocks, mutual investment funds, and exchange traded funds (ETF).

Changes in palladium price in last 10 years

Production of palladium is a bit limited and this, in turn, affects its price. During the last 10 years, the metal’s price has been rising. In February 2020, palladium hit its peak, exceeding $2,500. Later, the metal began losing in value amid the coronavirus pandemic. By now, it has recovered as supply slumped in both Russia and South Africa.

See Also

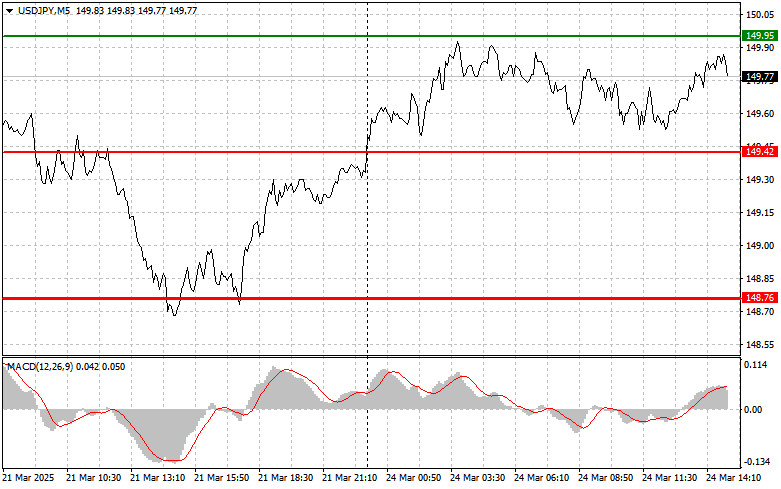

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

1033

Technical analysisTrading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

1018

On Monday, EUR/USD traders concentrated on factors that benefitted the U.S. dollar, while negatively impacting the euro. Insider reports from U.S. media concerning the "April 2 tariffs" supported the pair's sellers.Author: Irina Manzenko

01:00 2025-03-25 UTC+2

928

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

868

GBPUSD: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:10 2025-03-24 UTC+2

853

Trading planTrading Recommendations and Analysis for EUR/USD on March 25: The Dollar Strengthened Against the Odds

On Monday, the EUR/USD currency pair initially showed an upward move, followed by a decline, making the entire trading day somewhat contradictoryAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

808

- Fundamental analysis

EUR/USD Pair Overview – March 25: The Euro Continues to Creep Downward in a Correction

The EUR/USD currency pair showed relatively low volatility on MondayAuthor: Paolo Greco

05:02 2025-03-25 UTC+2

793

Trading planTrading Recommendations and Analysis for GBP/USD on March 25: The Roller Coaster Continues

The GBP/USD currency pair managed to move both upward and downward on MondayAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

763

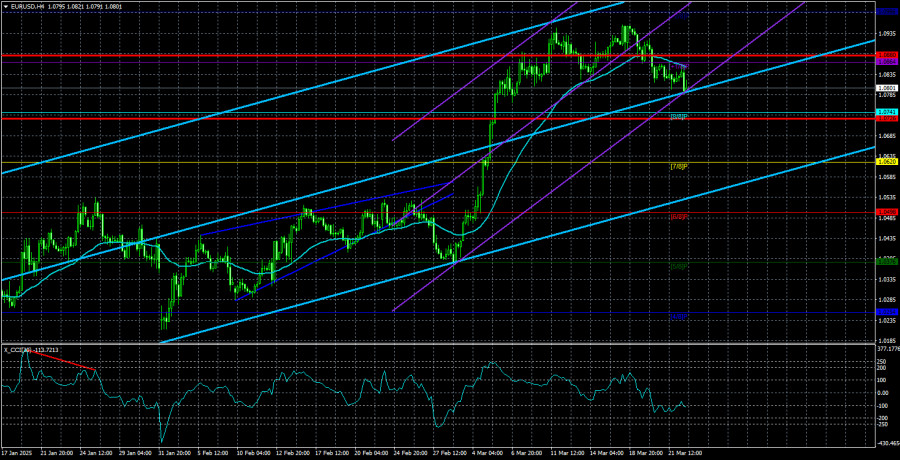

EURUSD: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:07 2025-03-24 UTC+2

748

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

1033

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

1018

- On Monday, EUR/USD traders concentrated on factors that benefitted the U.S. dollar, while negatively impacting the euro. Insider reports from U.S. media concerning the "April 2 tariffs" supported the pair's sellers.

Author: Irina Manzenko

01:00 2025-03-25 UTC+2

928

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

868

- GBPUSD: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:10 2025-03-24 UTC+2

853

- Trading plan

Trading Recommendations and Analysis for EUR/USD on March 25: The Dollar Strengthened Against the Odds

On Monday, the EUR/USD currency pair initially showed an upward move, followed by a decline, making the entire trading day somewhat contradictoryAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

808

- Fundamental analysis

EUR/USD Pair Overview – March 25: The Euro Continues to Creep Downward in a Correction

The EUR/USD currency pair showed relatively low volatility on MondayAuthor: Paolo Greco

05:02 2025-03-25 UTC+2

793

- Trading plan

Trading Recommendations and Analysis for GBP/USD on March 25: The Roller Coaster Continues

The GBP/USD currency pair managed to move both upward and downward on MondayAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

763

- EURUSD: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:07 2025-03-24 UTC+2

748