EURHKD (Euro vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

24 Mar 2025 05:33

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/HKD, which is the cross rate against the U.S. dollar, is not a very popular currency pair on Forex market. There is no U.S. dollar in this currency pair, but the euro and the Hong Kong dollar are under its great influence. To make it clear, just combine the EUR/USD and USD/HKD charts in the same price chart, and you will get the approximate EUR/HKD chart.

The U.S. dollar exercises the profound influence on both currencies. So for a better prediction of the future rate movement of this currency pair, you need to consider the main economic indicators of the economy of the United States. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Remember that the currencies listed above can react differently to the economic situation in the U.S.A.

Hong Kong has one of the largest stock exchanges in the world. Thanks to some factors, Hong Kong leaves behind the number of the major European and American stock exchanges. Today the Hong Kong Stock Exchange is regarded as a leader among the financial centers all over the world.

Hong Kong's economy is characterized by the free trade, low tax rates, and the government policy of the non-interference in the state economy. The country's economy is heavily dependent on the import due to the Hong Kong's shortage of mineral and food resources. The state revenue is provided by the service sector, reexport from China, as well as developed tourism.

In comparison with the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY, this one is relatively illiquid. So when you predict the future movement of this currency pair, you should pay special attention to the currency pairs that consist of the euro and the Hong Kong dollar in tandem with the U.S. dollar.

Please note, that the spread for cross rates is usually higher than for more popular currency pairs. Therefore, before you start dealing with this currency pair, learn carefully the broker's conditions for this specified trade instrument.

See Also

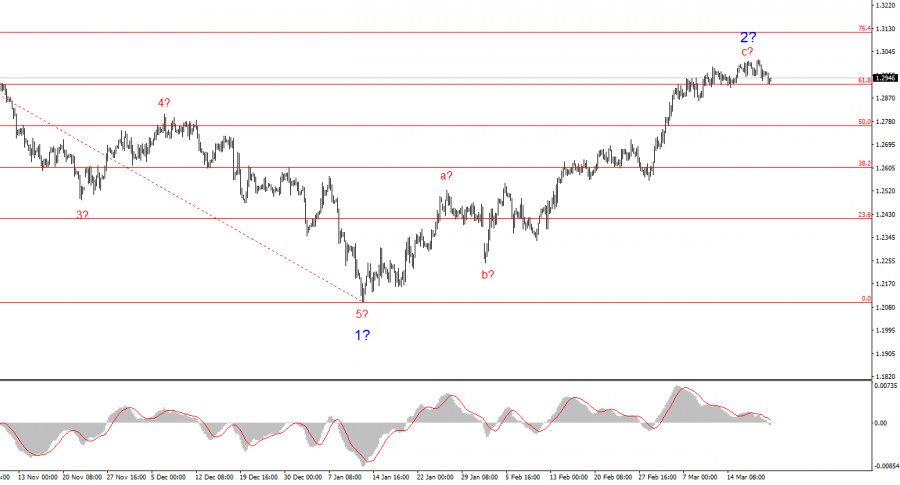

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2713

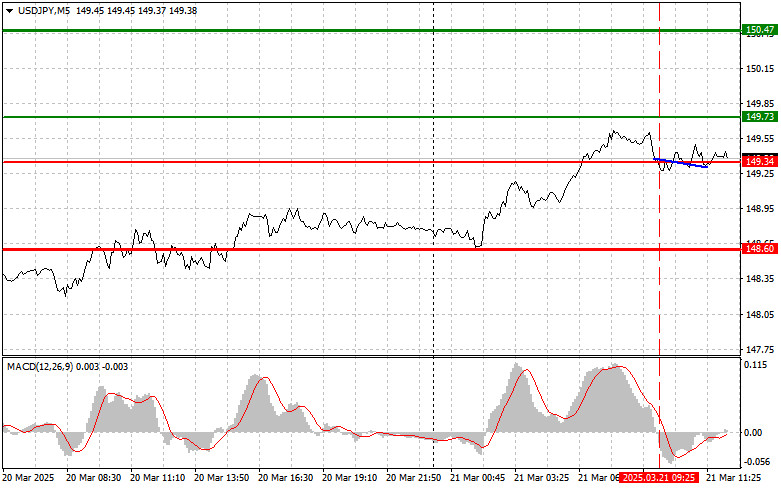

Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.Author: Irina Yanina

12:07 2025-03-21 UTC+2

2593

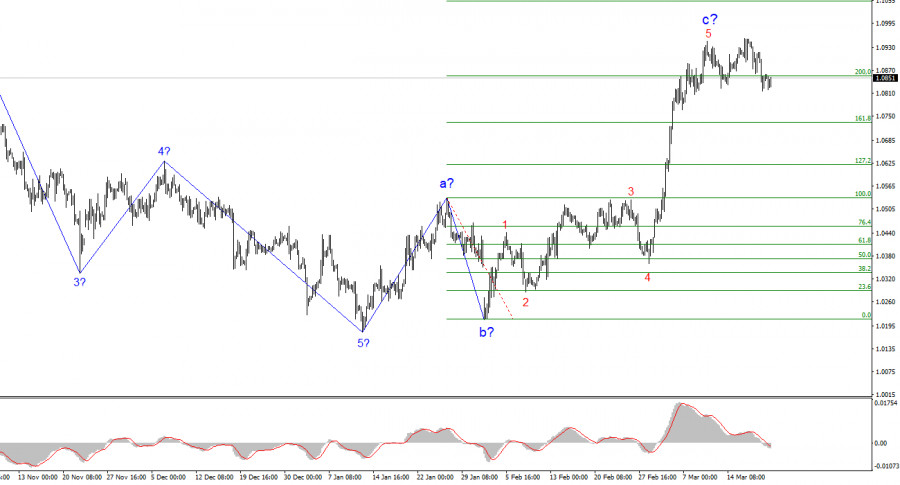

Bulls had the upper hand for two weeks, but it's time for a pauseAuthor: Samir Klishi

12:02 2025-03-21 UTC+2

2563

- Technical analysis

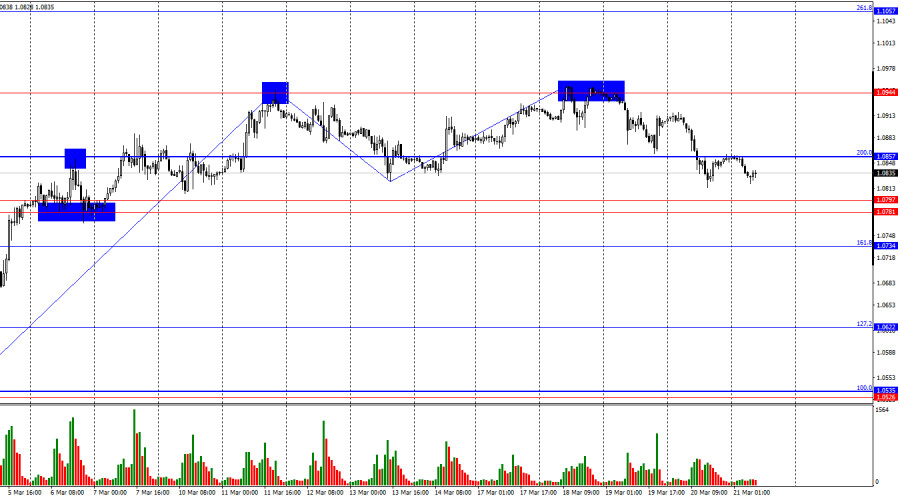

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2533

Technical analysisTrading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

2473

USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Author: Jakub Novak

19:30 2025-03-21 UTC+2

2353

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

2323

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

2233

The outcomes of the Bank of England and FOMC meetings contradicted each otherAuthor: Samir Klishi

11:52 2025-03-21 UTC+2

2143

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2713

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

2593

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

2563

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2533

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

2473

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:30 2025-03-21 UTC+2

2353

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

2323

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

2233

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

2143