Triple Bottom

was formed on 26.03 at 07:00:22 (UTC+0)

signal strength 3 of 5

The Triple Bottom pattern has formed on the chart of USDCAD M30. Features of the pattern: The lower line of the pattern has coordinates 1.4312 with the upper limit 1.4312/1.4297, the projection of the width is 42 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 1.4270, the price is most likely to continue the upward movement.

Veja também

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

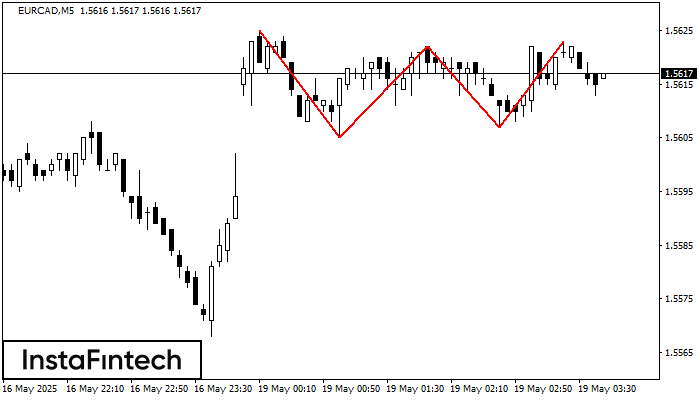

Topo triplo

was formed on 19.05 at 02:45:05 (UTC+0)

signal strength 1 of 5

O padrão Topo triplo foi formado no gráfico do instrumento de negociação EURCAD M5. É um padrão de reversão com as seguintes características: nível de resistência 2, nível de suporte

Os intervalos M5 e M15 podem ter mais pontos de entrada falsos.

Open chart in a new window

Triângulo Simétrico de Alta

was formed on 19.05 at 02:33:43 (UTC+0)

signal strength 1 of 5

De acordo com o gráfico de M5, EURUSD formaram o padrão de Triângulo Simétrico de Alta. Descrição: Este é o padrão de uma continuação de tendência. 1.1194 e 1.1179

Os intervalos M5 e M15 podem ter mais pontos de entrada falsos.

Open chart in a new window

Triângulo Simétrico de Alta

was formed on 19.05 at 02:04:32 (UTC+0)

signal strength 1 of 5

De acordo com o gráfico de M5, EURCAD formaram o padrão de Triângulo Simétrico de Alta. Descrição: Este é o padrão de uma continuação de tendência. 1.5625 e 1.5604

Os intervalos M5 e M15 podem ter mais pontos de entrada falsos.

Open chart in a new window