Veja também

08.04.2025 08:15 AM

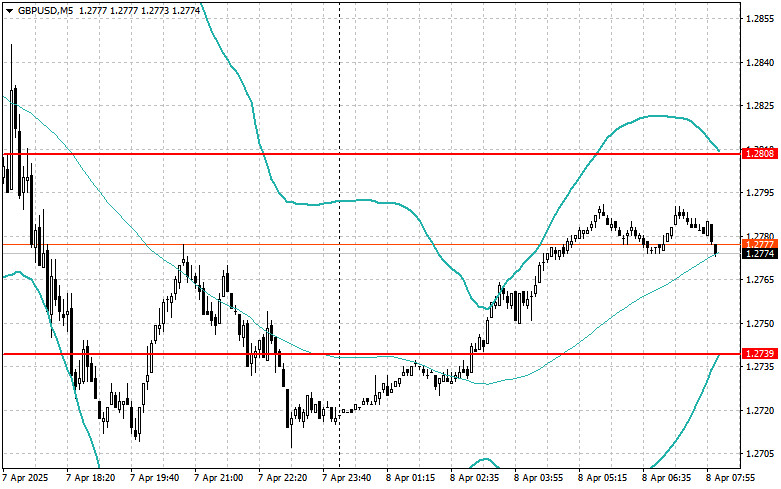

08.04.2025 08:15 AMThe euro held its ground more or less, while the pound fared significantly worse. A break below the daily low triggered a new, more extensive sell-off in GBP/USD, effectively establishing a new bearish market trend.

Yesterday's weak eurozone data did little to support the euro, while the Federal Reserve's emergency meeting revived demand for the dollar in risk-related currency pairs. In the short term, the dollar may continue to strengthen. However, even though the market has likely already priced in expectations of a more aggressive Fed policy, any unexpected dovish signals could prompt a correction. From a medium-term perspective, fundamental factors favor the dollar.

The European economy is still facing more serious challenges than the U.S. economy. The energy crisis, high inflation risks due to tariffs, and geopolitical uncertainty continue to pressure the eurozone. Meanwhile, the U.S. economy remains resilient despite new trade tariffs, supported by a strong labor market and the Fed's more aggressive policy stance.

Today, aside from France's trade balance data, there are no other notable macro releases, which leaves euro buyers with limited chances of pushing the pair higher. Investors will likely assess the trade data regarding its impact on the eurozone's overall economic activity. Weak figures could heighten recession fears and pressure the European Central Bank to slow its pace of rate hikes. But even if France's trade balance beats expectations, that may not be enough to shift the broader outlook for the euro.

Bank of England officials in the UK are scheduled to speak today, which might help temporarily halt the bearish momentum seen in recent sessions. However, it's unlikely their comments will trigger a trend reversal.

If the data meets economists' expectations, it's best to trade using a Mean Reversion strategy. A Momentum strategy is recommended if the data comes in significantly higher or lower than expected.

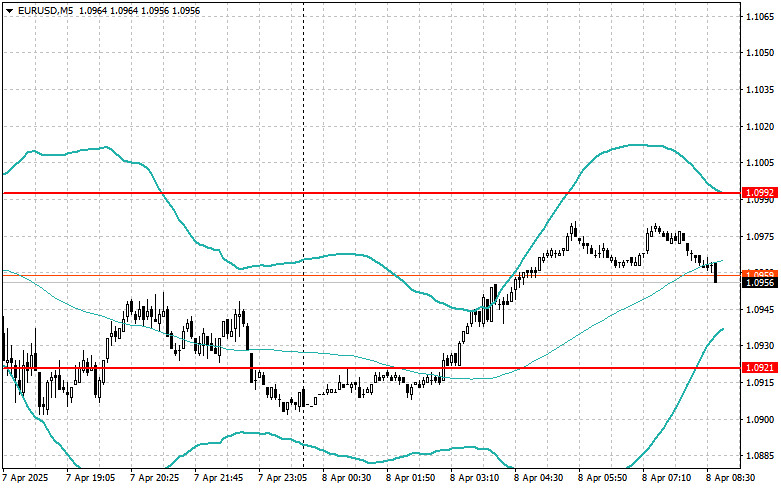

Buying on a breakout above 1.0985 could lead to a rise toward 1.1045 and 1.1085.

Selling on a breakout below 1.0940 could lead to a decline toward 1.0885 and 1.0845.

Buying on a breakout above 1.2800 could push the pound toward 1.2842 and 1.2887.

Selling on a breakout below 1.2754 could trigger a fall toward 1.2711 and 1.2679.

Buying on a breakout above 147.85 could lead to an advance toward 148.20 and 148.58.

Selling on a breakout below 147.52 could lead to a decline toward 147.18 and 146.78.

Look for short positions after a failed breakout above 1.0992 and a return below it.

Look for long positions after a failed breakout below 1.0921 and a return above it.

Look for short positions after a failed breakout above 1.2808 and a return below it.

Look for long positions after a failed breakout below 1.2739 and a return above it.

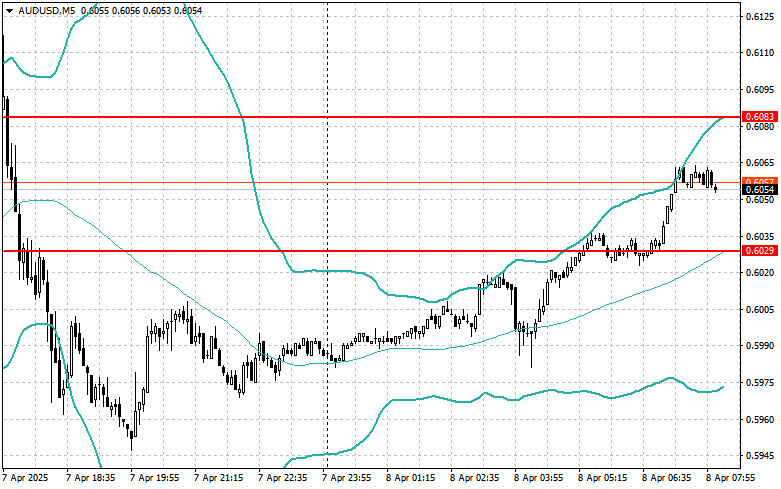

Look for short positions after a failed breakout above 0.6083 and a return below it.

Look for long positions after a failed breakout below 0.6029 and a return above it.

Look for short positions after a failed breakout above 1.4182 and a return below it.

Look for long positions after a failed breakout below 1.4123 and a return above it.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O teste do nível de preço em 143,75 na primeira metade do dia ocorreu justamente quando o indicador MACD já havia se afastado significativamente da linha zero, o que limitou

O teste de preço em 1,1441 coincidiu com o momento em que o indicador MACD começou a subir a partir da linha zero, confirmando o ponto de entrada ideal para

Petróleo de volta aos holofotes Os contratos futuros do Brent ultrapassaram a marca de US$ 67,5 por barril nesta quarta-feira, atingindo o maior nível em oito semanas. Vários fatores contribuíram

O teste do nível de 1,1440 ocorreu quando o indicador MACD já havia subido significativamente acima da linha zero, limitando o potencial de alta do par. Por esse motivo

O teste do nível de 144,21 ocorreu quando o indicador MACD começou a subir a partir da linha zero. Isso confirmou um ponto de entrada válido para a compra

O teste do nível de 1,3562 na segunda metade do dia coincidiu com o início do movimento de queda do indicador MACD a partir da linha zero, o que confirmou

O teste de preço em 1,1420 ocorreu exatamente quando o indicador MACD começou a se mover para baixo a partir da marca zero, confirmando um ponto de entrada válido para

Análise das operações e dicas para negociar a libra britânica O teste de preço em 1,3567, ocorrido durante a primeira metade do dia, aconteceu quando o indicador MACD já havia

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.