Veja também

27.03.2025 06:42 AM

27.03.2025 06:42 AMThere are very few macroeconomic events scheduled for Thursday, and even fewer are deemed important. The only report that deserves attention is the third estimate of U.S. GDP for the fourth quarter of last year. Markets expect the U.S. economy to have grown by 2.3%. If the actual figure comes in lower, the dollar may come under selling pressure, although likely not significantly, as the macroeconomic backdrop is currently not the primary focus for traders. The U.S. will also release jobless claims data, but this report is far from crucial and rarely deviates from forecasts. The publication calendars for Germany, the EU, and the UK are empty today.

Among Thursday's fundamental events, a range of speeches by representatives from the Bank of England, the Federal Reserve, and the European Central Bank can be noted. The most important one is Christine Lagarde's speech, but it's worth remembering that all three central banks held meetings recently, so it's unlikely that the sentiment of the central banks or their leaders has changed in just a week or two. In any case, Lagarde's speech is scheduled for the evening, so it will not affect traders during the day, even in theory.

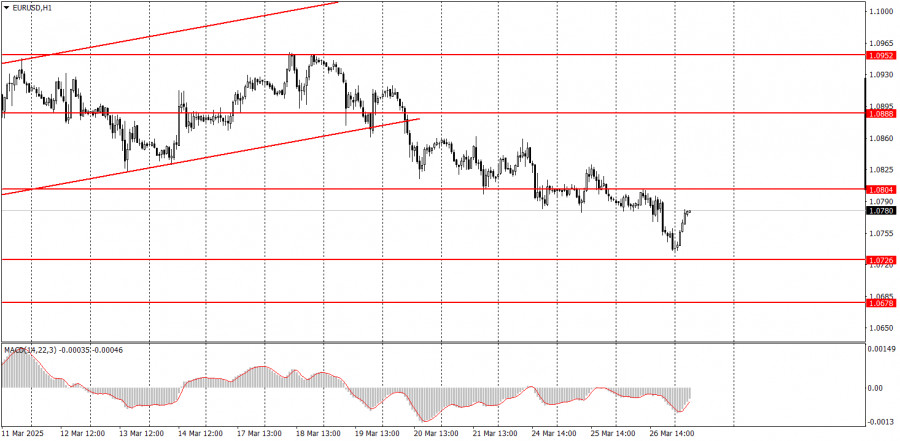

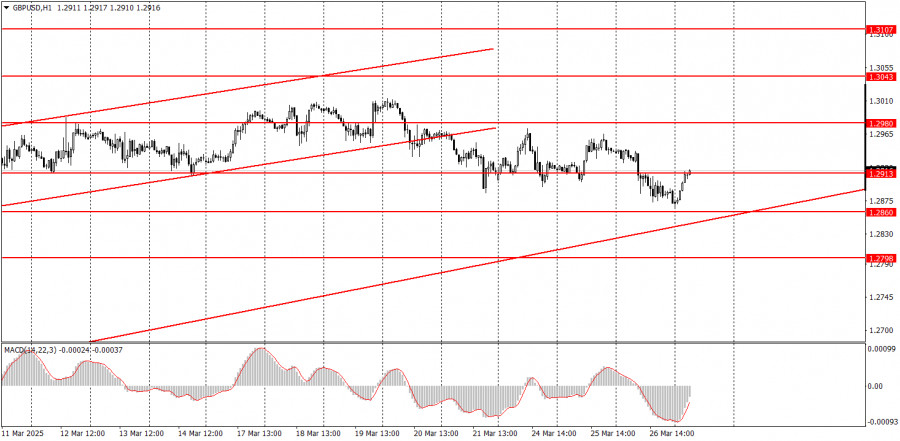

During the fourth trading day of the week, both currency pairs may continue the declines that have been building in recent weeks. Both pairs have consolidated below their ascending channels, and the Fed's stance allows the dollar to reclaim part of the ground it lost unfairly. Of course, no one knows when Trump will announce new trade tariffs or what they entail, but this factor cannot continuously drive the dollar lower. The British pound appears more prone to a sideways movement (flat) than a downward correction.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Os mercados globais estão sendo significativamente influenciados pelos acontecimentos nos Estados Unidos, onde as esferas política e econômica continuam oscilando como um pêndulo. No início desta semana, após o Tribunal

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.