Veja também

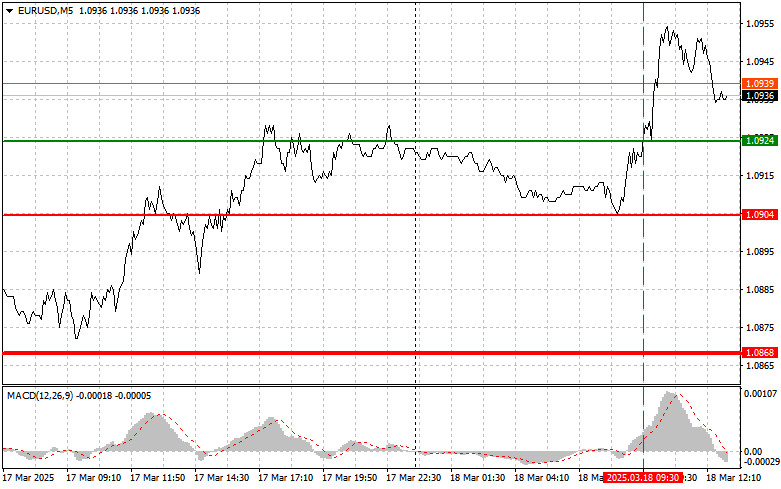

The test of the 1.0924 price level occurred when the MACD indicator had already moved significantly upward from the zero mark, limiting the pair's upward potential. For this reason, I did not buy the euro and missed a small upward move.

Strong ZEW index data from Germany and the Eurozone helped the euro update its weekly high, but many traders reacted cautiously, likely waiting for more convincing signs of a sustained economic recovery. The situation around Ukraine also supports the currency market and risk assets. Today's conversation between Putin and Trump could be highly significant, and if the dialogue is positive, demand for the euro could rise further. Additionally, expectations regarding the Federal Reserve's next moves are playing a key role in dollar-related currency pairs. The FOMC's rate decision will be announced tomorrow.

During today's U.S. session, a series of housing market reports will be released. The data release will begin with the number of building permits issued, a key indicator of builder optimism and investment willingness. This metric serves as a leading indicator for future construction activity and may influence overall economic sentiment. Next, attention will shift to housing starts, which provide a more concrete measure of market activity by showing how many new construction projects have begun. An increase in this metric signals rising housing demand and potential economic growth, whereas a decline could indicate a market slowdown and uncertainty among buyers and developers. Analyzing these reports together will provide a clearer picture of the U.S. real estate market and its outlook.

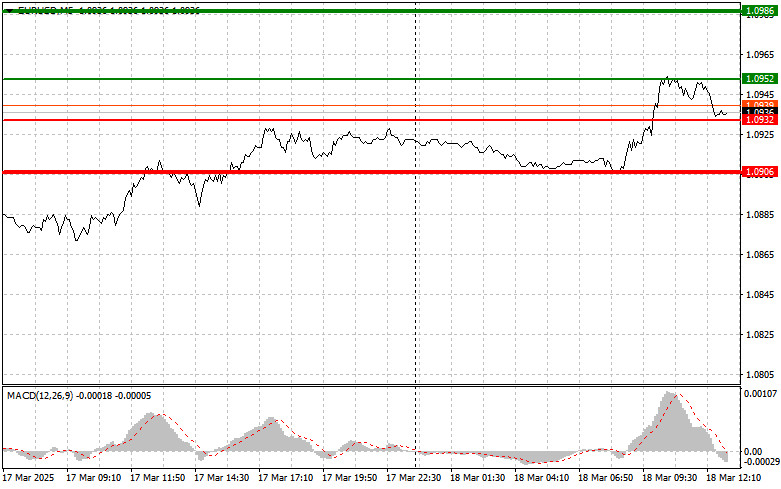

Regarding intraday trading strategy, I will focus on Scenario #1 and Scenario #2.

Scenario #1: Buy the euro today at 1.0952 (green line on the chart) with a target of 1.0986. At 1.0986, I plan to exit the trade and sell the euro for a 30-35 point pullback. Expecting euro growth today as the uptrend continues. Important: Before buying, ensure the MACD indicator is above zero and just starting to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.0932 twice, while the MACD is in the oversold area. This will limit the pair's downward potential and trigger a reversal to the upside, targeting 1.0952 and 1.0986.

Scenario #1: I plan to sell the euro after reaching 1.0932 (red line on the chart), with a target of 1.0906, where I will exit the trade and buy immediately for a 20-25 point pullback. Selling pressure could return if U.S. data is strong. Important: Before selling, ensure the MACD indicator is below zero and just starting to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.0952 twice, while MACD is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward, targeting 1.0932 and 1.0906.

Forex trading requires careful decision-making. It is best to stay out of the market before major fundamental reports to avoid unexpected price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you risk losing your entire deposit quickly, especially if you trade with large volumes and do not follow risk management rules.

For successful trading, you need a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for an intraday trader.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Vídeo de treinamento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.