Bullish Symmetrical Triangle

was formed on 01.04 at 18:50:43 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #AAPL formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 221.96/222.64 whereas the upper border goes across 223.40/222.64. If the Bullish Symmetrical Triangle pattern is in progress, this evidently signals a further upward trend. In other words, in case the scenario comes true, the price of #AAPL will breach the upper border to head for 222.79.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Triple Bottom

was formed on 14.05 at 00:00:30 (UTC+0)

signal strength 3 of 5

The Triple Bottom pattern has been formed on EURNZD M30. It has the following characteristics: resistance level 1.8864/1.8842; support level 1.8820/1.8815; the width is 44 points. In the event

Open chart in a new window

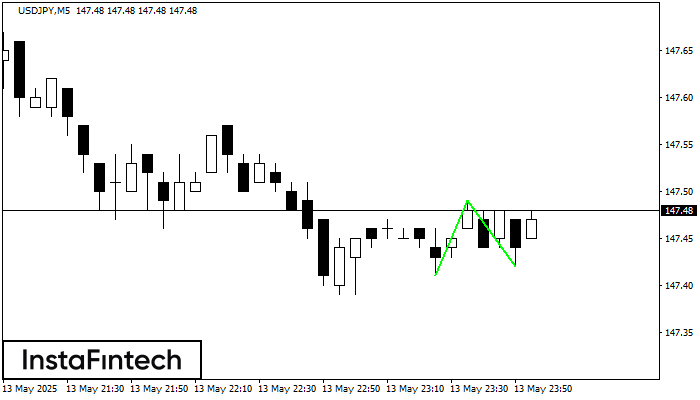

Double Bottom

was formed on 13.05 at 23:02:28 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on USDJPY M5. Characteristics: the support level 147.41; the resistance level 147.49; the width of the pattern 8 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

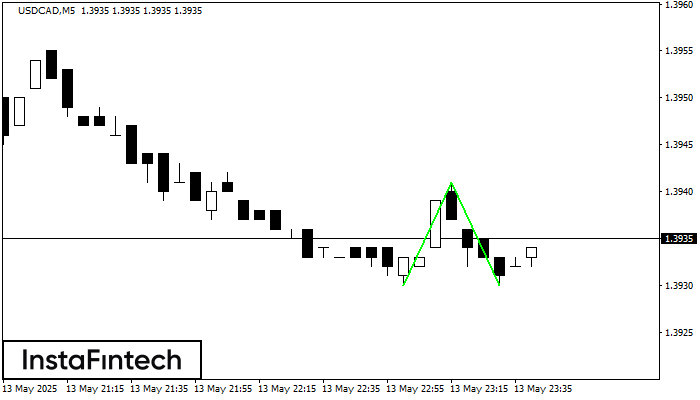

Double Bottom

was formed on 13.05 at 22:45:59 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on USDCAD M5; the upper boundary is 1.3941; the lower boundary is 1.3930. The width of the pattern is 11 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window