Bullish pennant

was formed on 24.03 at 21:30:30 (UTC+0)

signal strength 4 of 5

The Bullish pennant pattern is formed on the #MA H1 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high of 544.23, a further uptrend is possible.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

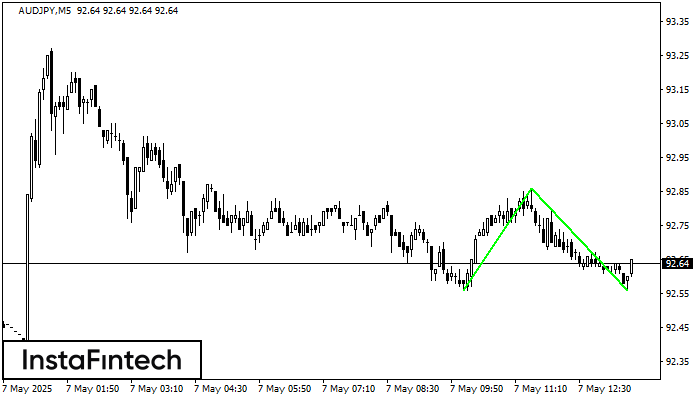

Double Bottom

was formed on 07.05 at 12:39:47 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDJPY M5; the upper boundary is 92.86; the lower boundary is 92.56. The width of the pattern is 30 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

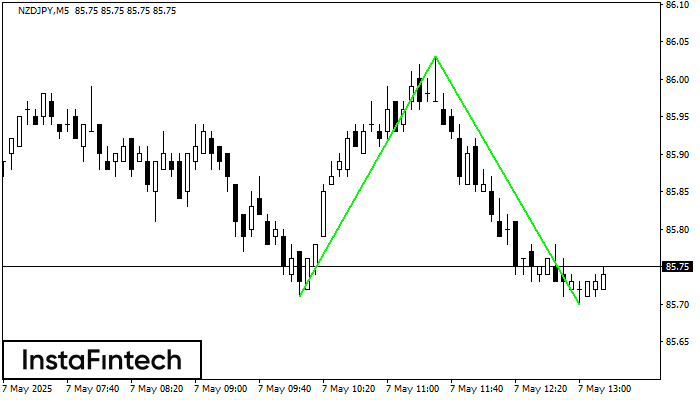

Double Bottom

was formed on 07.05 at 12:20:04 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on NZDJPY M5. Characteristics: the support level 85.71; the resistance level 86.03; the width of the pattern 32 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

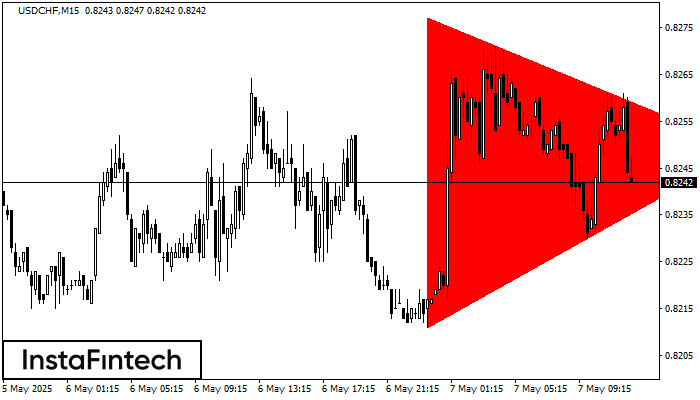

Bearish Symmetrical Triangle

was formed on 07.05 at 11:37:52 (UTC+0)

signal strength 2 of 5

According to the chart of M15, USDCHF formed the Bearish Symmetrical Triangle pattern. This pattern signals a further downward trend in case the lower border 0.8211 is breached. Here

The M5 and M15 time frames may have more false entry points.

Open chart in a new window