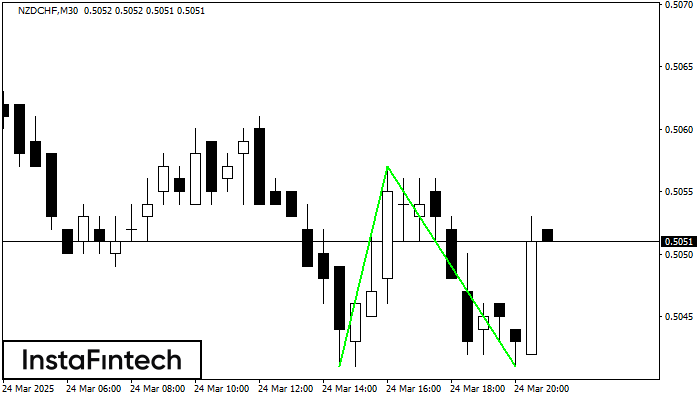

Double Bottom

was formed on 24.03 at 21:01:22 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on NZDCHF M30. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 0.5057 is broken. The further movements will rely on the width of the current pattern 16 points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

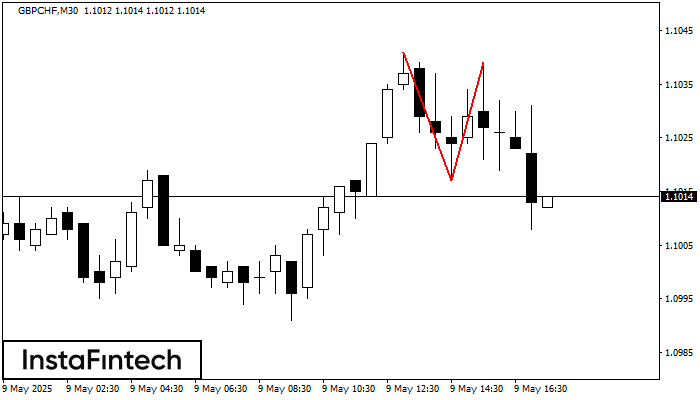

Double Top

was formed on 09.05 at 16:30:11 (UTC+0)

signal strength 3 of 5

The Double Top reversal pattern has been formed on GBPCHF M30. Characteristics: the upper boundary 1.1041; the lower boundary 1.1017; the width of the pattern is 22 points. Sell trades

Open chart in a new window

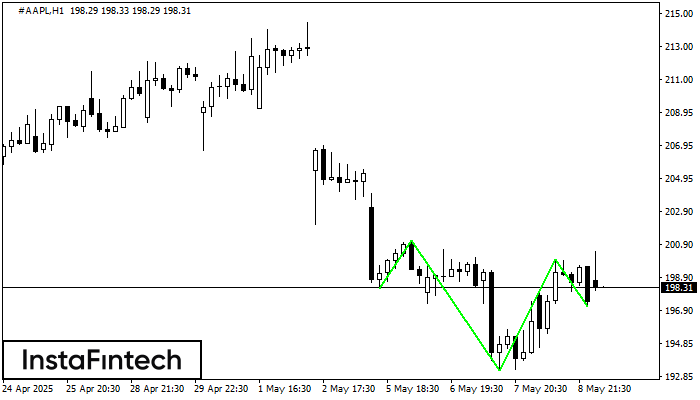

Inverse Head and Shoulder

was formed on 09.05 at 16:29:45 (UTC+0)

signal strength 4 of 5

According to the chart of H1, #AAPL formed the Inverse Head and Shoulder pattern. The Head’s top is set at 200.00 while the median line of the Neck is found

Open chart in a new window

Double Bottom

was formed on 09.05 at 16:20:05 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on GBPAUD M5. Characteristics: the support level 2.0676; the resistance level 2.0752; the width of the pattern 76 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window