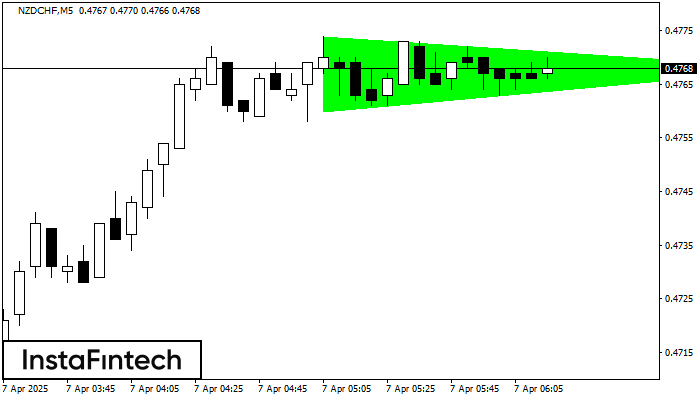

Bullish Symmetrical Triangle

was formed on 07.04 at 05:17:14 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCHF formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 0.4774 and 0.4760 are the coordinates of the upper and lower borders respectively. The pattern width is measured on the chart at 14 pips. Outlook: If the upper border 0.4774 is broken, the price is likely to continue its move by 0.4783.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

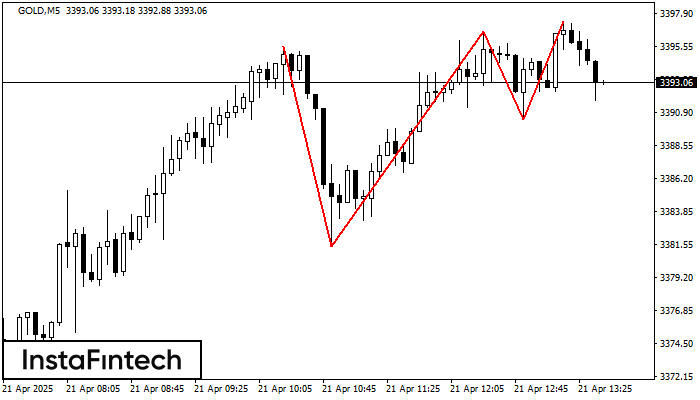

Triple Top

was formed on 21.04 at 12:40:05 (UTC+0)

signal strength 1 of 5

On the chart of the GOLD M5 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish Symmetrical Triangle

was formed on 21.04 at 12:20:58 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPCHF formed the Bearish Symmetrical Triangle pattern. Trading recommendations: A breach of the lower border 1.0783 is likely to encourage a continuation

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Bottom

was formed on 21.04 at 12:15:45 (UTC+0)

signal strength 2 of 5

The Triple Bottom pattern has formed on the chart of USDJPY M15. Features of the pattern: The lower line of the pattern has coordinates 140.99 with the upper limit 140.99/140.92

The M5 and M15 time frames may have more false entry points.

Open chart in a new window