Triple Top

was formed on 03.04 at 07:15:39 (UTC+0)

signal strength 2 of 5

On the chart of the GBPAUD M15 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 2.0775, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 65 points.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Rectangle

was formed on 06.05 at 09:01:14 (UTC+0)

signal strength 4 of 5

According to the chart of H1, USDJPY formed the Bearish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: lower border 143.55

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 06.05 at 08:45:22 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPJPY formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 190.88/191.11 whereas the upper border goes across 191.31/191.11

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

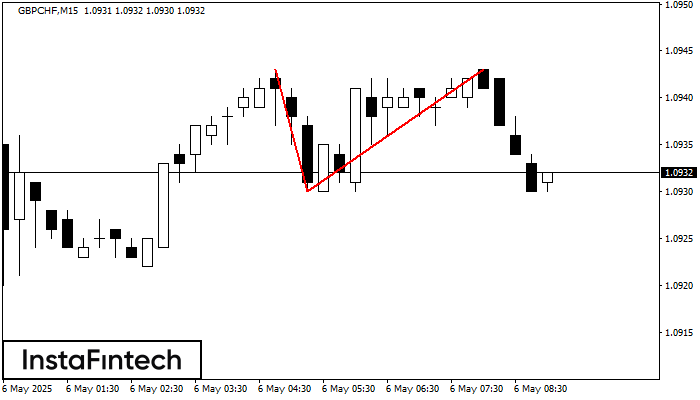

Double Top

was formed on 06.05 at 08:00:10 (UTC+0)

signal strength 2 of 5

On the chart of GBPCHF M15 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 1.0943; the lower boundary 1.0930; the width of the pattern 13 points

The M5 and M15 time frames may have more false entry points.

Open chart in a new window