Bearish Symmetrical Triangle

was formed on 01.04 at 09:18:41 (UTC+0)

signal strength 4 of 5

According to the chart of H1, NZDJPY formed the Bearish Symmetrical Triangle pattern. Description: The lower border is 84.61/84.93 and upper border is 85.30/84.93. The pattern width is measured on the chart at -69 pips. The formation of the Bearish Symmetrical Triangle pattern evidently signals a continuation of the downward trend. In other words, if the scenario comes true and NZDJPY breaches the lower border, the price could continue its move toward 84.53.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

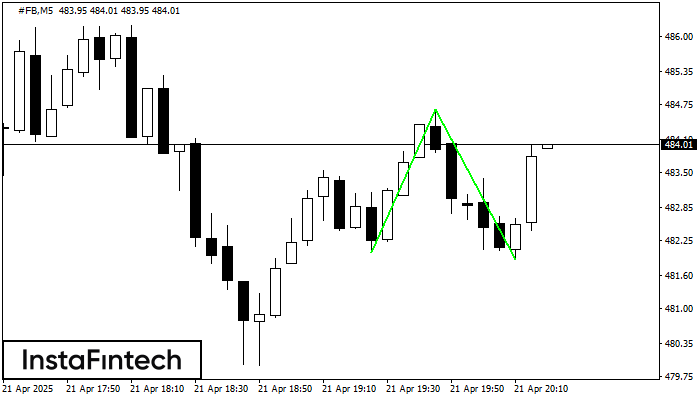

Double Bottom

was formed on 21.04 at 19:20:14 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on #FB M5; the upper boundary is 484.65; the lower boundary is 481.90. The width of the pattern is 263 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Bottom

was formed on 21.04 at 19:00:13 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on GBPUSD M5. It has the following characteristics: resistance level 1.3392/1.3382; support level 1.3377/1.3374; the width is 15 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

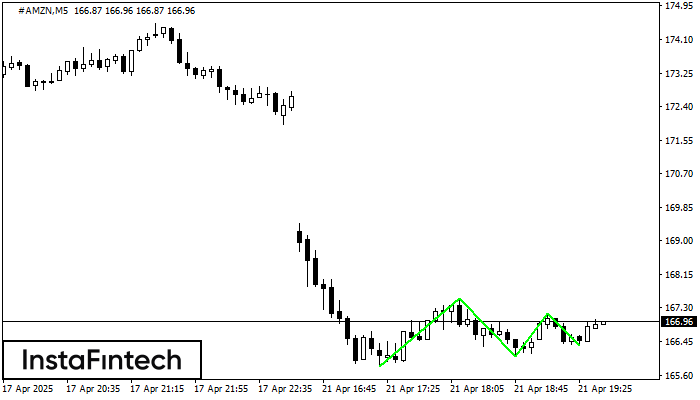

Triple Bottom

was formed on 21.04 at 18:40:14 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of the #AMZN M5 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window