یہ بھی دیکھیں

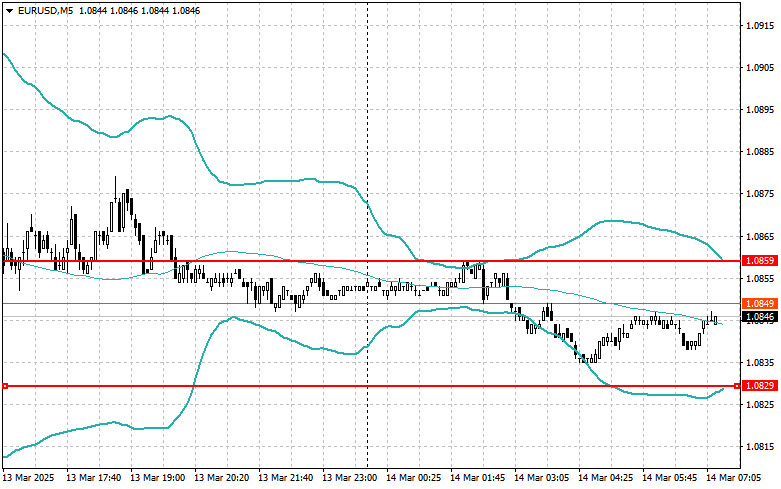

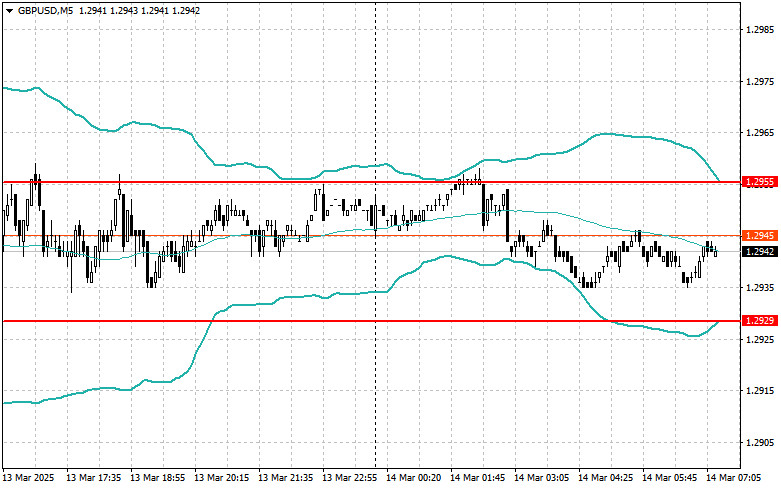

The euro and the pound are both experiencing a correction, although it's not very pronounced and could quickly shift into a new wave of growth for risk assets, with weekly highs being updated.

Yesterday, the dollar showed little reaction to the news that producer prices in the U.S. remained unchanged compared to the previous month, despite forecasts predicting a significant increase. This surprising stability can be attributed to several factors. First, the market may have already priced in expectations of a more dovish Federal Reserve policy, making the neutral data unsurprising. Second, many investors believe that a single report of price stagnation is insufficient to change the Fed's stance, especially as Trump continues to impose new trade tariffs. It is evident that market participants see the current level of inflation as a temporary issue.

Today's economic indicators from the eurozone could raise serious concerns. Germany's Consumer Price Index, a key inflation measure, may come in higher than expected, potentially pushing the European Central Bank toward a more hawkish monetary policy. A similar trend is observed in France, where consumer price growth might also exceed the ECB's target levels.

Meanwhile, a decline in industrial production in Italy would indicate economic weakness in the country and could pose risks for the entire eurozone. The combination of high inflation and slowing economic growth presents a difficult situation for the ECB, which will have to balance inflation control with economic support. These factors are putting pressure on the euro.

As for the pound, today will bring key economic reports from the UK, including changes in GDP and industrial production data. Strong figures will bolster interest in the British currency, as encouraging GDP and industrial sector data could signal a recovery from recent economic difficulties, making the pound more attractive.

If the data aligns with economists' expectations, it is advisable to use a Mean Reversion strategy. In contrast, if the data greatly exceeds or falls short of expectations, the Momentum strategy is recommended.

Buying on a breakout above 1.0852 could lead to euro growth toward 1.0897 and 1.0945;

Selling on a breakout below 1.0835 could lead to a euro decline toward 1.0810 and 1.0770.

Buying on a breakout above 1.2950 could lead to pound growth toward 1.2985 and 1.3028;

Selling on a breakout below 1.2930 could lead to a pound decline toward 1.2910 and 1.2875.

Buying on a breakout above 148.55 could lead to dollar growth toward 148.97 and 149.32;

Selling on a breakout below 148.30 could trigger dollar sell-offs toward 148.00 and 147.57.

Selling will be considered after an unsuccessful breakout above 1.0859 if the price returns below this level;

Buying will be considered after an unsuccessful breakout below 1.0829 if the price returns to this level.

Selling will be considered after an unsuccessful breakout above 1.2955 if the price returns below this level;

Buying will be considered after an unsuccessful breakout below 1.2929 if the price returns to this level.

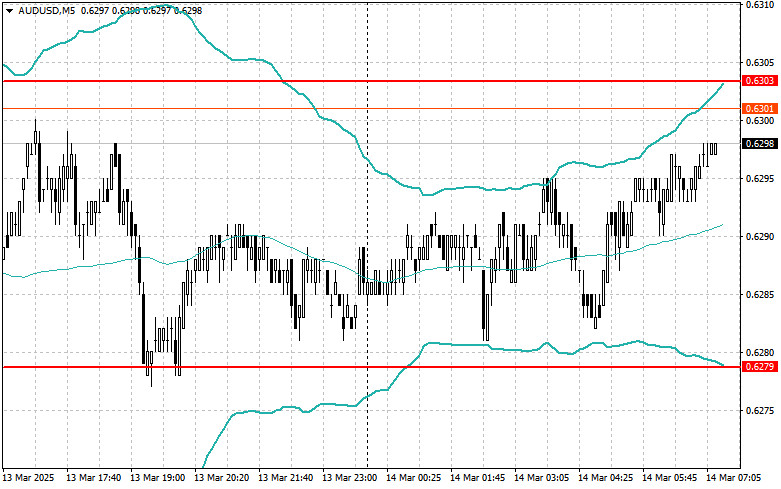

Selling will be considered after an unsuccessful breakout above 0.6303 if the price returns below this level;

Buying will be considered after an unsuccessful breakout below 0.6279 if the price returns to this level.

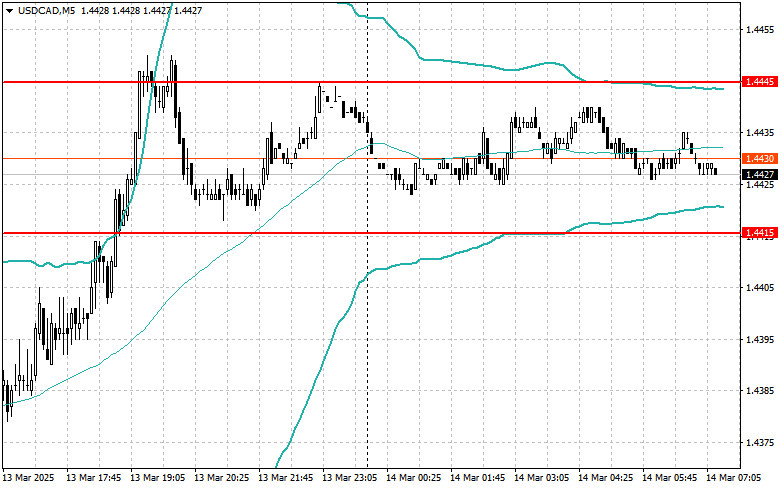

Selling will be considered after an unsuccessful breakout above 1.4445 if the price returns below this level;

Buying will be considered after an unsuccessful breakout below 1.4415 if the price returns to this level.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

انسٹا فاریکس کلب

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.