یہ بھی دیکھیں

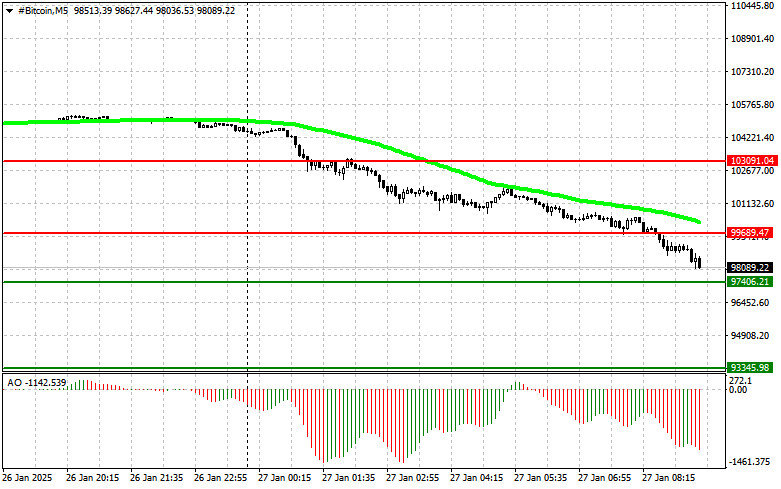

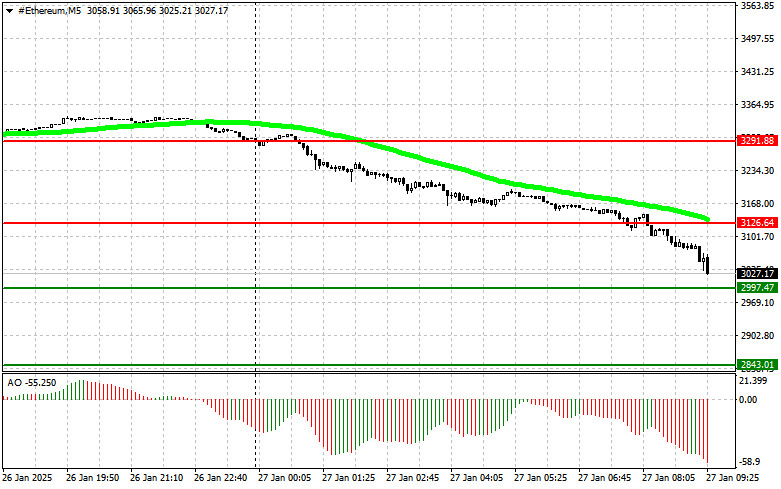

After a relatively calm weekend with no significant market movements, Bitcoin and Ethereum have now experienced substantial drops. Ethereum has already lost over 8%, while Bitcoin has corrected by 5.5%, delivering a harsh blow to those who did not manage their risks effectively.

In the past 24 hours, long positions in Bitcoin have seen liquidations totaling $613 million. However, these movements are still within the bounds of a correction. A break below the $100,000 level was anticipated to cause a significant downturn in the market. For now, this remains a correction, with the bears' primary target set at $90,000. If this level is breached, many market participants could encounter serious challenges.

Understanding that corrections are a natural part of the market cycle is essential, as they often precede the emergence of new strategies and trends. Bearish pressure can significantly impact investor sentiment, leading to panic selling and increased volatility. If the market breaks through the $90,000 level, the consequences could be severe, prompting many funds and private investors to reevaluate their strategies.

Staying cautious and informed about current trends and economic indicators is crucial for successfully navigating this volatility. However, it's also important to recognize that corrections present opportunities. Investors who can capitalize on these moments may benefit significantly by entering the market at lower prices. Keep in mind that every price range comes with its own set of risks and opportunities, and a thoughtful approach to analyzing the situation is key to successful investing.

I will continue to implement my intraday strategy in the cryptocurrency market, focusing on significant drawdowns of Bitcoin and Ethereum. I believe that the bull market is still in progress and remains intact in the medium term.

For short-term trading, I have outlined the strategy and conditions below.

Buy Scenario

Sell Scenario

Buy Scenario

Sell Scenario

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

ای میل / ایس ایم ایس

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.