یہ بھی دیکھیں

The ongoing recession in Europe, compounded by the Western conflict with Russia on Ukrainian territory, is likely to force the European Central Bank (ECB) to lower interest rates to mitigate the region's economic damage.

In such a scenario, rate cuts by the ECB, in contrast to potential rate hikes by the Bank of Japan, could lead to a significant decline in the EUR/JPY pair's rate.

The pair may face selling pressure as the euro weakens against the yen, potentially driving the pair lower today, with further downside expected next week following the ECB's decision to cut rates.

Technical picture and trading idea:

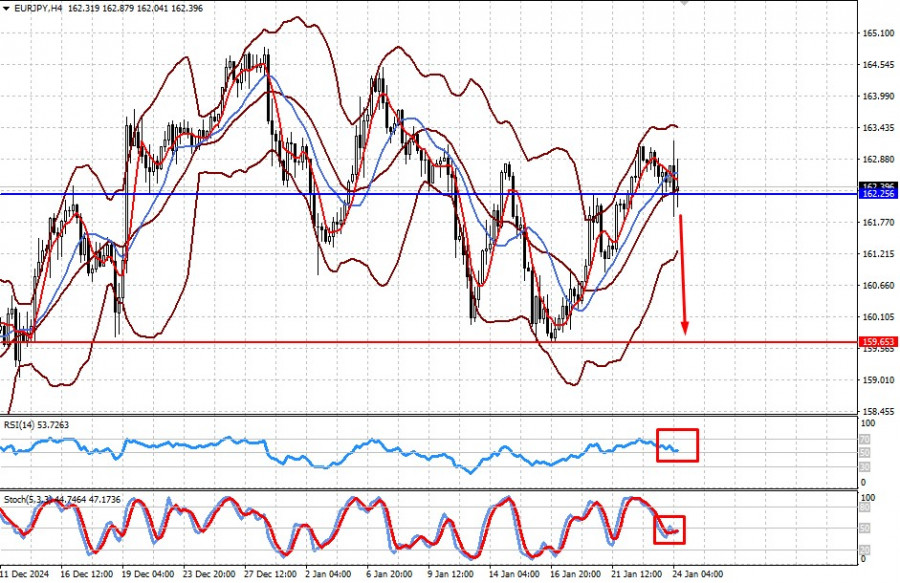

The price is currently at the midline of the Bollinger Bands, below both the 5-period and 14-period SMAs, which are crossing to signal a sell. The RSI remains above the 50% level but is approaching it, with a break below serving as an additional sell signal. Meanwhile, the Stochastic indicator is below 50%, though currently offering limited insight.

A drop below the 162.25 level could lead to a notable decline toward the 159.65 level.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.