یہ بھی دیکھیں

17.01.2025 10:29 PM

17.01.2025 10:29 PMجمعرات کو، برطانوی پاؤنڈ/امریکی ڈالر جوڑے نے کم اتار چڑھاؤ کا مظاہرہ کیا اور زیادہ تر ایک طرف منتقل ہوئے۔ اس ہفتے برطانیہ سے قابل ذکر رپورٹس کی ایک غیر معمولی مقدار سامنے آئی ہے، لیکن ہم ان سے کیا نتیجہ اخذ کر سکتے ہیں؟ افراط زر کی شرح میں کمی آئی ہے، جو کہ GBP کے لیے مندی کا باعث ہے کیونکہ یہ بینک آف انگلینڈ کو تیزی سے شرح سود کم کرنے کا اشارہ دے سکتا ہے۔ مزید برآں، برطانیہ کی معیشت نے نومبر میں توقع سے کم ترقی کا مظاہرہ کیا، بنیادی طور پر بمشکل کسی بھی ترقی کو رجسٹر کیا۔ صنعتی پیداوار، جیسا کہ اکثر ہوتا ہے، ایک بار پھر، اس بار 0.4 فیصد تک سکڑ گیا۔ ان عوامل کو دیکھتے ہوئے، پاؤنڈ کو مضبوط کرنے کی بنیاد دیکھنا مشکل ہے۔ ہمیں امریکہ میں بڑھتی ہوئی افراط زر پر بھی غور کرنا چاہیے، جس سے فیڈرل ریزرو کے کلیدی شرح کو کم کرنے کا رجحان کم ہو جاتا ہے۔ مجموعی طور پر، ایسا لگتا ہے کہ ہفتے کی چار اہم ترین رپورٹیں برطانوی پاؤنڈ/امریکی ڈالر میں کمی کے ممکنہ تسلسل کی تجویز کرتی ہیں۔

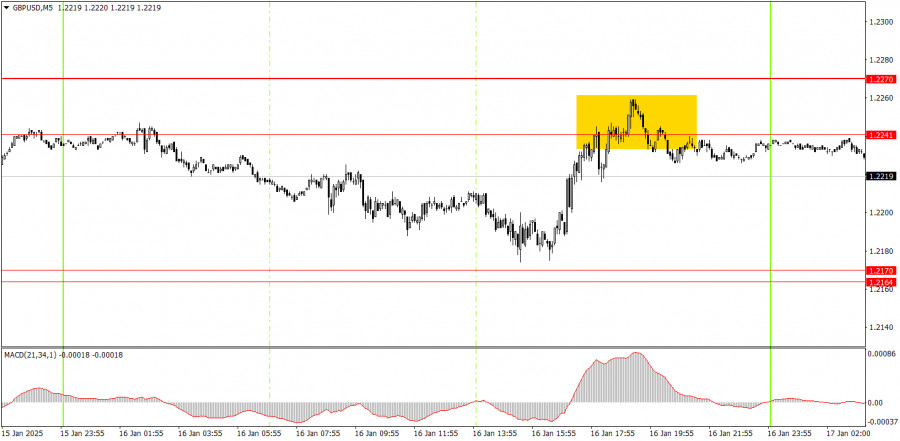

5 منٹ کے ٹائم فریم پر، جمعرات کو صرف ایک سیل سگنل تیار کیا گیا تھا، جو شام کو دیر سے ظاہر ہوتا تھا اور اس میں درستگی کی کمی تھی۔ امریکی تجارتی سیشن کے وسط تک، قیمت 1.2241-1.2270 زون کے قریب پہنچ گئی لیکن اس کو توڑنے میں ناکام رہی۔ اگرچہ کوئی واضح ریباؤنڈ نہیں تھا، کرنسی کے جوڑے میں آج بھی اپنی گراوٹ کو جاری رکھنے کی صلاحیت موجود ہے، کیونکہ میکرو اکنامک ڈیٹا پاؤنڈ کے مقابلے میں ڈالر کی حمایت جاری رکھے ہوئے ہے۔ 1.2170 کی سطح کے قریب ایک مضبوط خرید سگنل قائم کیا جا سکتا تھا۔ تاہم، قیمت صرف 4 پپس تک کم ہو گئی۔

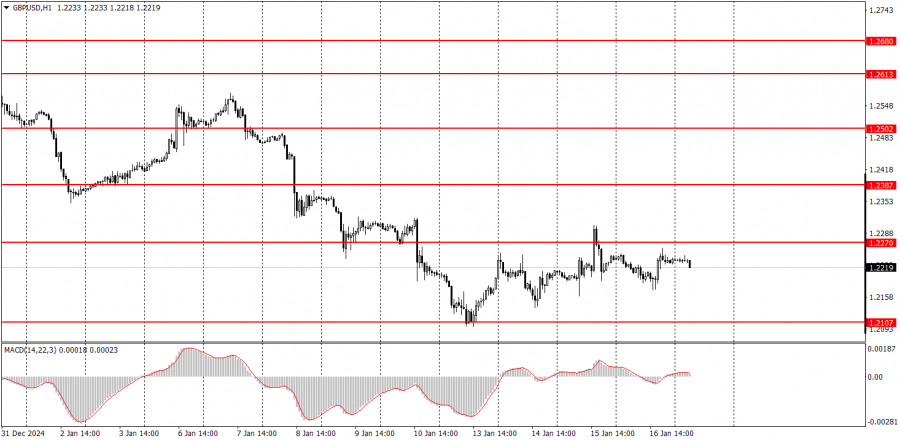

فی گھنٹہ چارٹ پر، برطانوی پاؤنڈ/امریکی ڈالر اپنا نیچے کی طرف رجحان جاری رکھے ہوئے ہے۔ درمیانی مدت میں، ہم پاؤنڈ کے 1.1800 کی طرف گرنے کے منظر نامے کی مکمل حمایت کرتے ہیں، کیونکہ یہ سب سے زیادہ منطقی نتیجہ معلوم ہوتا ہے۔ لہذا، ہم مزید کمی کی توقع کرتے ہیں، لیکن ٹریڈنگ کی رہنمائی تکنیکی اشاروں سے ہونی چاہیے۔ اس ہفتے نے پاؤنڈ میں مسلسل گراوٹ کے معاملے کو مزید تقویت دی ہے، اس کے راستے میں کوئی رکاوٹ نہیں ہے۔

جمعہ کو، برطانوی پاؤنڈ/امریکی ڈالر پرسکون ٹریڈنگ کا تجربہ کر سکتا ہے، اور میکرو اکنامک ڈیٹا اس جوڑے کو 1.2241 اور 1.2270 کے درمیان مزاحمتی زون پر قابو پانے کے قابل نہیں بنا سکتا ہے۔ اس کے نتیجے میں، مزید کمی کا امکان زیادہ لگتا ہے۔

5 منٹ کے ٹائم فریم پر، ٹریڈنگ کے مواقع درج ذیل سطحوں پر مل سکتے ہیں: 1.2010, 1.2052, 1.2089-1.2107, 1.2164-1.2170, 1.2241-1.2270, 1.2316, 1.2316, 1.2323, 1.2347. 1.2502-1.2508، 1.2547، 1.2633، 1.2680-1.2685، 1.2723، اور 1.2791-1.2798۔ جمعہ کو، برطانیہ اپنی خوردہ فروخت کی رپورٹ جاری کرے گا، جس کا پاؤنڈ پر کوئی خاص اثر ہونے کا امکان نہیں ہے۔ امریکہ میں، صنعتی پیداوار اور منظور شدہ عمارت کے اجازت ناموں سے متعلق دو نسبتاً معمولی رپورٹیں جاری کی جائیں گی۔

سگنل کی طاقت: سگنل بننے میں جتنا کم وقت لگتا ہے (ایک ریباؤنڈ یا بریک آؤٹ)، سگنل اتنا ہی مضبوط ہوتا ہے۔

غلط سگنلز: اگر کسی لیول کے قریب دو یا زیادہ تجارت کے نتیجے میں غلط سگنلز نکلتے ہیں، تو اس سطح سے آنے والے سگنلز کو نظر انداز کر دینا چاہیے۔

فلیٹ مارکیٹس: فلیٹ حالات میں، جوڑے بہت سے غلط سگنل پیدا کر سکتے ہیں یا کوئی بھی نہیں۔ فلیٹ مارکیٹ کی پہلی علامات پر تجارت بند کرنا بہتر ہے۔

تجارتی اوقات: یورپی سیشن کے آغاز اور امریکی سیشن کے وسط کے درمیان کھلی تجارت، پھر دستی طور پر تمام تجارتوں کو بند کریں۔

MACD سگنلز: فی گھنٹہ ٹائم فریم پر، صرف اچھے اتار چڑھاؤ کے دوران MACD سگنلز کی تجارت کریں اور ٹرینڈ لائنز یا ٹرینڈ چینلز سے تصدیق شدہ واضح رجحان۔

کلوز لیولز: اگر دو لیولز بہت قریب ہیں (5-20 پِپس کے فاصلے پر)، تو ان کو سپورٹ یا ریزسٹنس زون سمجھیں۔

سٹاپ لاس: قیمت 15 پِپس کو مطلوبہ سمت میں لے جانے کے بعد بریک ایون پر سٹاپ لاس سیٹ کریں۔

سپورٹ اور ریزسٹنس لیولز: یہ پوزیشنز کھولنے یا بند کرنے کے لیے ہدف کی سطحیں ہیں اور ٹیک پرافٹ آرڈرز دینے کے لیے پوائنٹس کے طور پر بھی کام کر سکتی ہیں۔

ریڈ لائنز: چینلز یا ٹرینڈ لائنز جو موجودہ رجحان اور ٹریڈنگ کے لیے ترجیحی سمت کی نشاندہی کرتی ہیں۔

MACD انڈیکیٹر (14,22,3): ایک ہسٹوگرام اور سگنل لائن جو تجارتی سگنلز کے ضمنی ذریعہ کے طور پر استعمال ہوتی ہے۔

اہم واقعات اور رپورٹس: اقتصادی کیلنڈر میں پائے جانے والے، یہ قیمت کی نقل و حرکت پر بہت زیادہ اثر انداز ہو سکتے ہیں۔ تیزی سے الٹ پھیر سے بچنے کے لیے ان کی رہائی کے دوران احتیاط برتیں یا بازار سے باہر نکلیں۔

فاریکس ٹریڈنگ شروع کرنے والوں کو یاد رکھنا چاہیے کہ ہر تجارت منافع بخش نہیں ہوگی۔ طویل مدتی تجارتی کامیابی کے لیے ایک واضح حکمت عملی تیار کرنا اور پیسے کے مناسب انتظام کی مشق کرنا ضروری ہے۔

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

منگل کی تجارت کا تجزیہ برطانوی پاؤنڈ/امریکی ڈالر کا 1گھنٹے کا چارٹ منگل کے روز،برطانوی پاؤنڈ/امریکی ڈالر کا جوڑا بھی انہی وجوہات کی بناء پر کم ٹریڈ ہوا جو یورو/امریکی

برطانوی پاؤنڈ/امریکی ڈالر کا 5 منٹ کا تجزیہ منگل کو، برطانوی پاؤنڈ/امریکی ڈالر کرنسی جوڑے نے بھی انہی وجوہات کی بنا پر کم تجارت کی جس طرح یورو/امریکی ڈالر

تعداد میں انسٹا فاریکس

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.