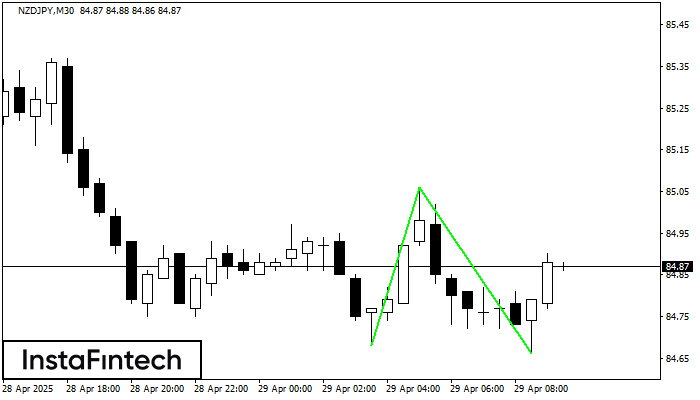

Double Bottom

was formed on 29.04 at 08:30:03 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on NZDJPY M30. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 85.06 is broken. The further movements will rely on the width of the current pattern 38 points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

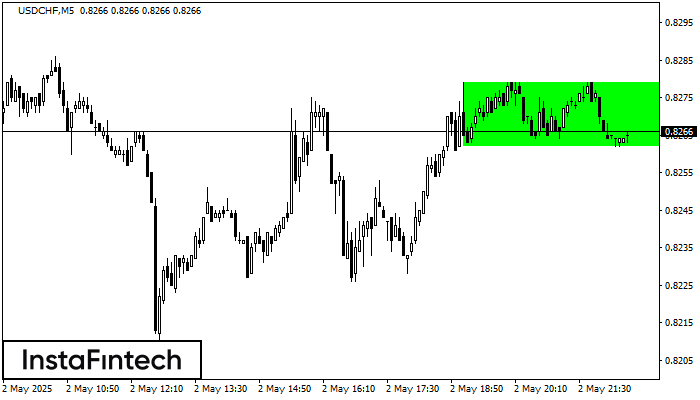

Bullish Rectangle

was formed on 02.05 at 21:36:06 (UTC+0)

signal strength 1 of 5

According to the chart of M5, USDCHF formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 0.8279, the lower border is 0.8262. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

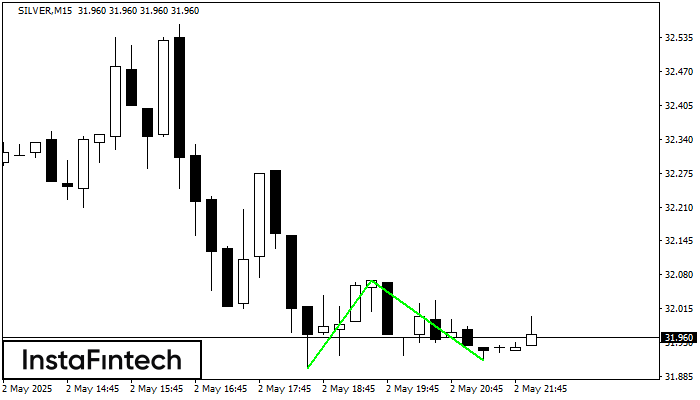

Double Bottom

was formed on 02.05 at 21:16:02 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on SILVER M15. Characteristics: the support level 31.90; the resistance level 32.07; the width of the pattern 170 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Bottom

was formed on 02.05 at 21:15:39 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on GBPUSD M15. Characteristics: the support level 1.3263; the resistance level 1.3329; the width of the pattern 66 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window