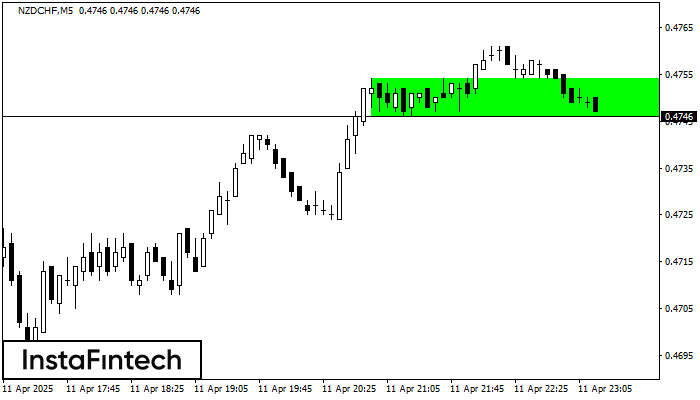

Bullish Rectangle

was formed on 11.04 at 22:20:31 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCHF formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 0.4754, the lower border is 0.4746. The signal means that a long position should be opened above the upper border 0.4754 of the Bullish Rectangle.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

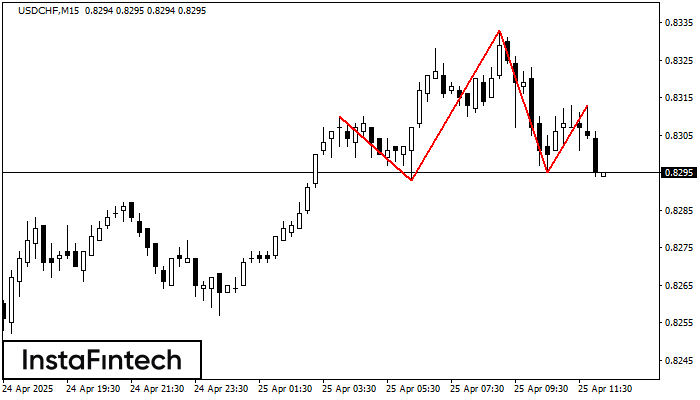

Double Top

was formed on 25.04 at 11:40:02 (UTC+0)

signal strength 1 of 5

On the chart of EURCAD M5 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 1.5778; the lower boundary 1.5752; the width of the pattern 26 points

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Bottom

was formed on 25.04 at 11:34:47 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on USDJPY M5. It has the following characteristics: resistance level 143.53/143.49; support level 143.24/143.25; the width is 29 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Head and Shoulders

was formed on 25.04 at 11:16:23 (UTC+0)

signal strength 2 of 5

The technical pattern called Head and Shoulders has appeared on the chart of USDCHF M15. There are weighty reasons to suggest that the price will surpass the Neckline 0.8293/0.8295 after

The M5 and M15 time frames may have more false entry points.

Open chart in a new window