EURPLN (Euro vs Polish Zloty). Exchange rate and online charts.

Currency converter

25 Mar 2025 21:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/PLN is a popular currency pair on Forex. Poland is an active trading partner with the EU. For this reason, EUR/PLN is favoured by the experienced traders who prefer stability and predictability of the euro area and Poland economies. The most intense bidding on this financial instrument is observed during the European sessions.

EUR/PLN is the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present at this currency pair, it still has a significant influence on it. By combining EUR/USD and USD/PLN price charts, it is possible to get an approximate EUR/PLN chart.

Both currencies are affected by the U.S. dollar, that is why it is better to monitor such U.S. indices as discount rate, GDP, unemployment, new created workplaces and other to correctly predict the further movement of the pair. Is necessary to note that the discussed currencies can react differently to the changes observed in the U.S. economy, therefore, EUR/PLN may be a specific indicator for these currencies.

Poland is going to introduce the euro in near future. At the same time, there are numerous internal problems that exist in the country (the budget deficit, high external debt, etc.) as well as the global economic crisis that prevent it from adopting the European currency on schedule. The European Central Bank announced strict conditions for the euro adoption. Thus, Poland will be able to join the euro area after fulfilling all the requirements.

Poland is a developed industrial country with high living standards. The main economic sectors are engineering, metallurgy, chemical and coal industries. Poland has robust automotive and shipbuilding industries at the shipyards of the Baltic Sea. The country is rich in mineral resources: coal, copper, lead, natural gas, etc. Due to the great amount of hydrocarbons, Polish economy is fully supplied with electricity. The factors that could affect the Polish zloty significantly are the country's international rating as well as the state of Polish and European leading industries.

If you trade cross rates, remember that brokers usually set a higher spread on such pairs compared to the majors. So before you start working with the cross rates, it get acquainted with the conditions offered by the broker to trade with specified trade instrument.

See Also

- Type of analysis

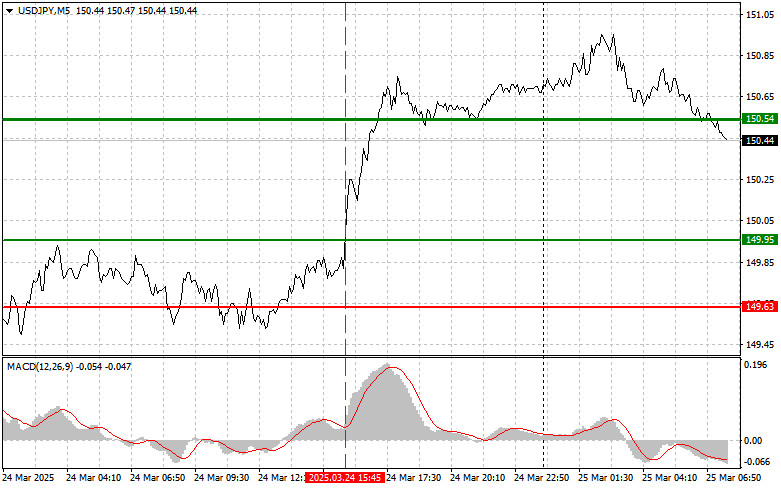

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1423

Will money return to North America?Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1408

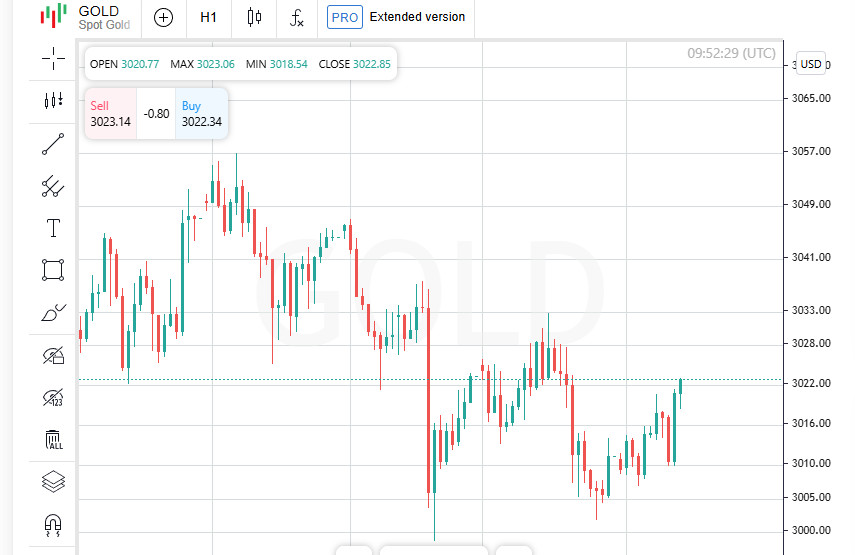

Technical analysisTrading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

1273

- The latest US market headlines

Author: Andreeva Natalya

12:50 2025-03-25 UTC+2

1198

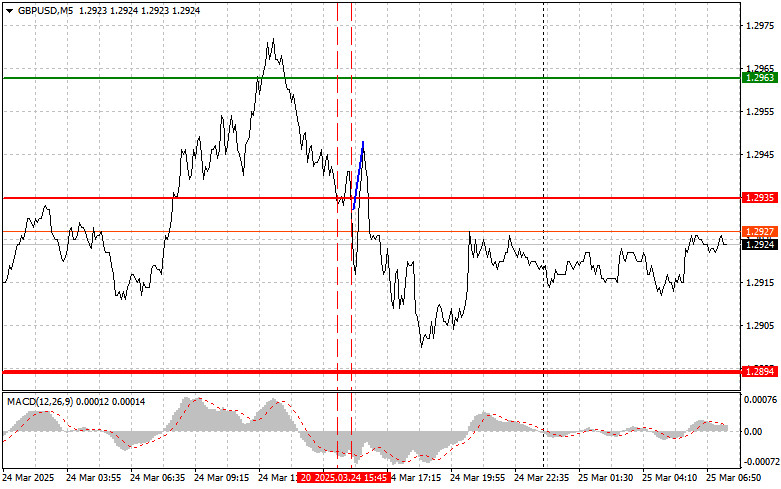

Type of analysisGBP/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1168

Stock MarketsUS stock market gains new bullish momentum. Investors grasp signal that downward correction over

US stock market gains new bullish momentum. Investors grasp signal that downward correction overAuthor: Jozef Kovach

12:08 2025-03-25 UTC+2

1138

- S&P Composite PMI at 53.5 in March vs. 51.6 in February Lockheed Martin Falls After Brokerage Downgrade Crypto Stocks Rise on Bitcoin Gains European Stocks Rise Ahead of Key German Business Sentiment Survey Gold Rally Draws Investors Back to Mining Stocks After Months of Outflow S&P 500.

Author: Thomas Frank

11:57 2025-03-25 UTC+2

1093

Despite the recent growth of the cryptocurrency market, larger upward prospects and a return of Bitcoin to the $100,000 mark remain unrealistic for a while.Author: Jakub Novak

11:00 2025-03-25 UTC+2

943

Trading Recommendations for the Cryptocurrency Market on March 25Author: Miroslaw Bawulski

09:26 2025-03-25 UTC+2

928

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1423

- Will money return to North America?

Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1408

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

1273

- The latest US market headlines

Author: Andreeva Natalya

12:50 2025-03-25 UTC+2

1198

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1168

- Stock Markets

US stock market gains new bullish momentum. Investors grasp signal that downward correction over

US stock market gains new bullish momentum. Investors grasp signal that downward correction overAuthor: Jozef Kovach

12:08 2025-03-25 UTC+2

1138

- S&P Composite PMI at 53.5 in March vs. 51.6 in February Lockheed Martin Falls After Brokerage Downgrade Crypto Stocks Rise on Bitcoin Gains European Stocks Rise Ahead of Key German Business Sentiment Survey Gold Rally Draws Investors Back to Mining Stocks After Months of Outflow S&P 500.

Author: Thomas Frank

11:57 2025-03-25 UTC+2

1093

- Despite the recent growth of the cryptocurrency market, larger upward prospects and a return of Bitcoin to the $100,000 mark remain unrealistic for a while.

Author: Jakub Novak

11:00 2025-03-25 UTC+2

943

- Trading Recommendations for the Cryptocurrency Market on March 25

Author: Miroslaw Bawulski

09:26 2025-03-25 UTC+2

928