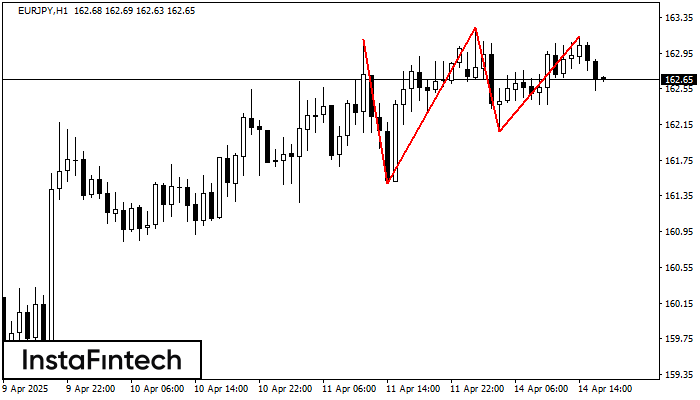

Triple Top

was formed on 14.04 at 16:00:26 (UTC+0)

signal strength 4 of 5

The Triple Top pattern has formed on the chart of the EURJPY H1. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 161.49/162.07 with the upper limit 163.10/163.14; the projection of the width is 161 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 161.49, the price is most likely to continue the downward movement.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

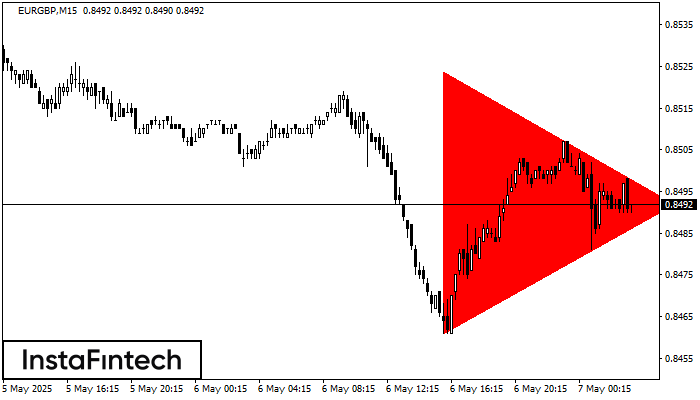

Segi Tiga Simetri Menurun

was formed on 07.05 at 02:30:44 (UTC+0)

signal strength 2 of 5

Berdasarkan carta M15, EURGBP membentuk corak Segi Tiga Simetri Menurun. Cadangan dagangan: Penembusan sempadan bawah 0.8461 mungkin mendorong kepada kesinambungan aliran menurun

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

Double Bottom

was formed on 07.05 at 01:00:48 (UTC+0)

signal strength 4 of 5

Corak Double Bottom telah dibentuk pada USDCHF H1; sempadan atas adalah 0.8264; sempadan bawah adalah 0.8211. Lebar corak adalah 49 mata. Sekiranya penembusan sempadan atas 0.8264, perubahan aliran boleh diramalkan

Open chart in a new window

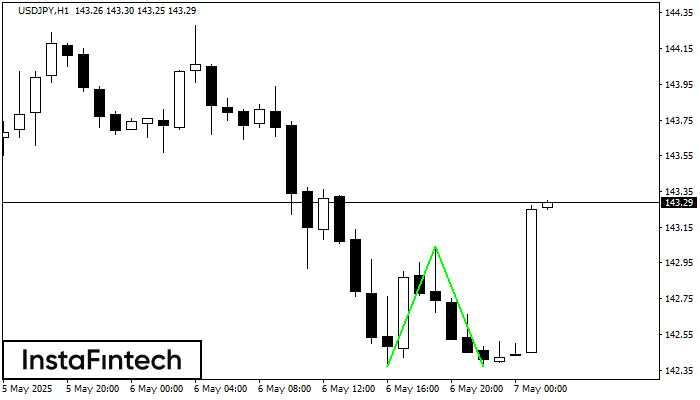

Double Bottom

was formed on 07.05 at 01:00:39 (UTC+0)

signal strength 4 of 5

Corak Double Bottom telah dibentuk pada USDJPY H1. Ciri-ciri: tahap sokongan 142.37; tahap rintangan 143.04; lebar corak 67 mata. Sekiranya tahap rintangan ditembusi, perubahan aliran boleh diramalkan dengan titik sasaran

Open chart in a new window