Bullish Symmetrical Triangle

was formed on 01.04 at 18:50:43 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #AAPL formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 221.96/222.64 whereas the upper border goes across 223.40/222.64. If the Bullish Symmetrical Triangle pattern is in progress, this evidently signals a further upward trend. In other words, in case the scenario comes true, the price of #AAPL will breach the upper border to head for 222.79.

The M5 and M15 time frames may have more false entry points.

Juga lihat

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

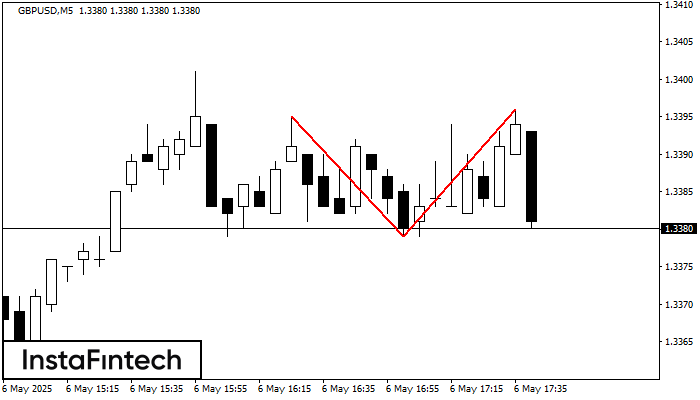

Double Top

was formed on 06.05 at 16:45:22 (UTC+0)

signal strength 1 of 5

Corak pembalikan Double Top telah dibentuk pada GBPUSD M5. Ciri-ciri: sempadan atas %P0.000000; sempadan bawah 1.3395; sempadan bawah 1.3379; lebar corak adalah 17 mata. Dagangan menjual adalah lebih baik untuk

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

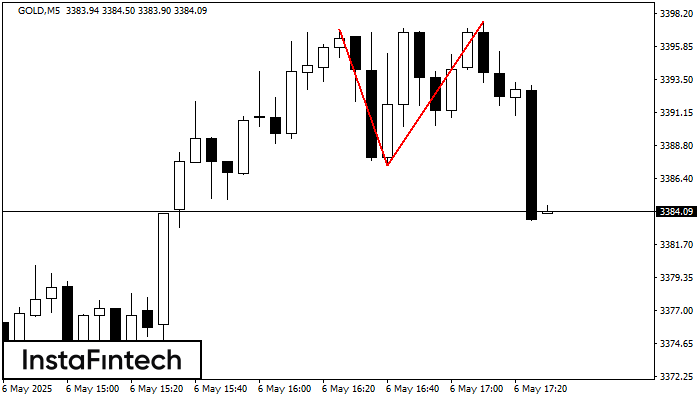

Double Top

was formed on 06.05 at 16:30:12 (UTC+0)

signal strength 1 of 5

Corak pembalikan Double Top telah dibentuk pada GOLD M5. Ciri-ciri: sempadan atas %P0.000000; sempadan bawah 3397.08; sempadan bawah 3387.33; lebar corak adalah 1031 mata. Dagangan menjual adalah lebih baik untuk

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

Inverse Head dan Shoulder

was formed on 06.05 at 16:00:15 (UTC+0)

signal strength 3 of 5

According to M30, EURCHF is shaping the technical pattern – the Inverse Head dan Shoulder. In case the Neckline 0.9350/0.9349 is broken out, the instrument is likely to move toward

Open chart in a new window