Lihat juga

01.04.2025 09:13 AM

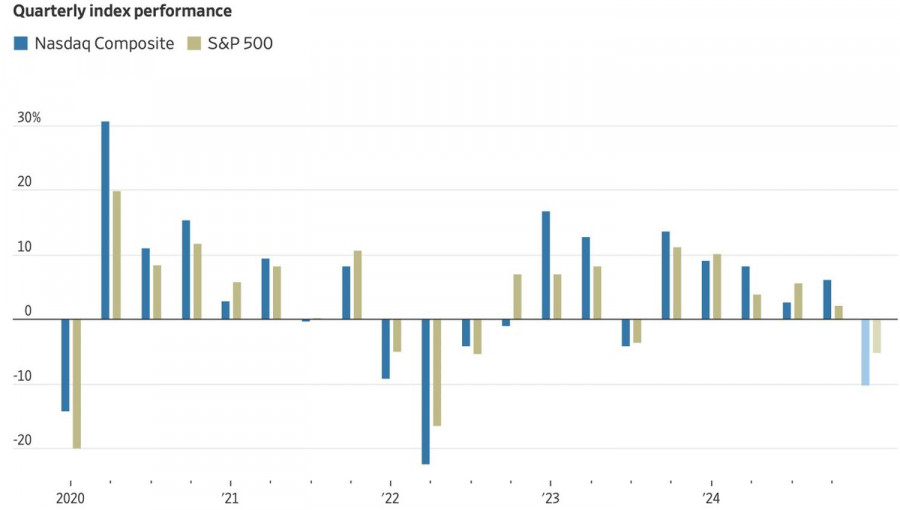

01.04.2025 09:13 AMThe S&P 500 had its worst quarter in three years. Investors are shifting capital from North America to Europe. Once-booming US tech stocks have collapsed. Major banks and respected institutions are raising the odds of a recession for the American economy. That's a lot of bad news for a broad stock index, isn't it? However, buying the dip towards the lower boundary of the sideways range at 5,500–5,790 has borne fruit — just in time for America's "Liberation Day".

Performance of US stock indices

Donald Trump's policies have caused turmoil not only in financial markets but also among the general public. According to the latest Associated Press poll, nearly 60% of Americans disapprove of the president's protectionist stance, and 58% are dissatisfied with his overall handling of the US economy. The market sell-off reflects investor skepticism, but the Republican leader remains undeterred. He insists the country must endure short-term pain to reclaim a golden era for America.

That "Liberation Day" will come on April 2, when the White House is set to announce new tariffs. According to Wall Street Journal sources, the president is weighing two options: blanket 20% import tariffs or tailored, reciprocal tariffs. The former could send another shock through financial markets, while the latter might calm nerves.

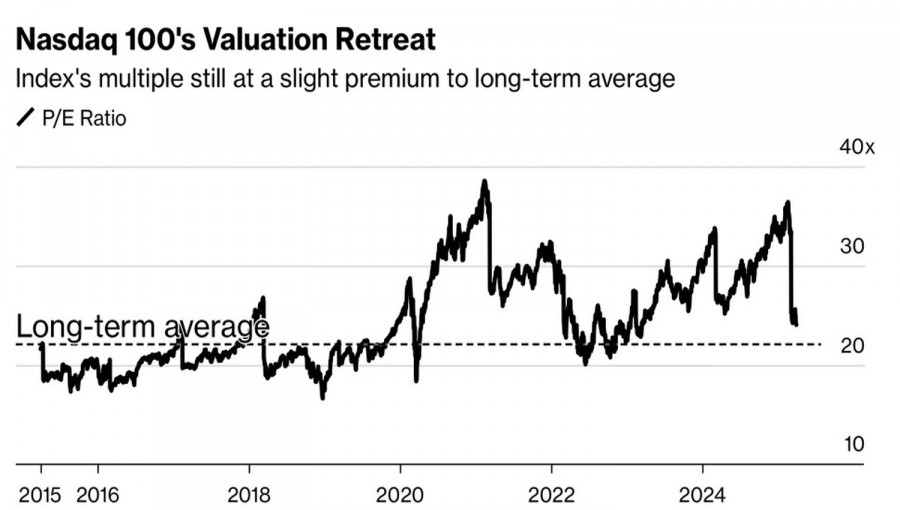

Following JP Morgan and Moody's Analytics, Goldman Sachs has raised the probability of a US recession from 20% to 35%. Yet investors have found new reasons for optimism. After a massive sell-off in tech stocks, forward P/E ratios are now approaching historical averages. In other words, stocks are no longer overvalued, making them more attractive.

US tech sector P/E trends

The White House's new tariffs could also slow capital outflows from North America to Europe. A full-blown trade war would likely hit the EU harder due to its large trade surplus with the United States. Moreover, part of the capital shift was driven by a 4.6% gain in the euro against the dollar in the first quarter. As a result, European investors lost about 13% on US-listed assets.

According to Wells Fargo, the dollar's January-March slide was temporary. Looking ahead, tariffs and trade tensions could boost the greenback by 1.5% to 11%, with maximum gains expected if America's trade partners avoid a full-scale retaliatory response.

From a technical standpoint, the S&P 500 has bounced off the lower boundary of the previously established 5,500-5,790 consolidation range. Long positions opened at the 5,500 level appear to be worth holding. A break above the resistance levels at 5,625 (pivot) and 5,670 (fair value) would allow for additional long positions.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pada hari Khamis, pasangan mata wang GBP/USD ditutup di bawah garisan purata bergerak, dan dolar mengukuh selama tiga hari berturut-turut. Walau bagaimanapun, segala-galanya berubah pada separuh kedua hari itu. Seperti

Apakah hidup ini kalau bukan satu permainan? Pasaran, seperti kanak-kanak, sebaik sahaja menguasai satu permainan, mereka diberikan yang lain. Pada tahun 2024, pelabur terfokus pada berapa kali Fed akan memotong

Penentangan domestik terhadap Donald Trump semakin mendapat momentum, yang boleh menjadi kejutan yang tidak menyenangkan bagi bekas presiden itu. Perkembangan ini mungkin akan mengehadkan usahanya untuk mengubah landskap ekonomi

Sangat sedikit laporan makroekonomi yang dijadualkan pada hari Khamis. Kalendar peristiwa makroekonomi untuk Jerman, United Kingdom, dan Zon Euro adalah kosong. Hanya Amerika Syarikat yang akan mengeluarkan laporan mengenai KDNK

Pada hari Rabu, pasangan mata wang GBP/USD diniagakan dengan sedikit penurunan, namun sukar untuk mempercayai pengukuhan lanjut dolar AS dalam keadaan semasa. Di satu pihak, dolar telah menyusut nilai dengan

Pasangan mata wang EUR/USD tidak berprestasi baik untuk dolar pada hari Rabu seperti mana ia lakukan dalam dua hari sebelumnya. Walau bagaimanapun, hari Isnin dan Selasa tidak boleh digambarkan sebagai

Seperti yang dijangkakan, Reserve Bank of New Zealand (RBNZ) telah menurunkan kadar faedah sebanyak 25 mata asas kepada 3.25% selepas mesyuaratnya pada bulan Mei. Ini menandakan pusingan keenam pelonggaran dasar

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.