Lihat juga

01.04.2025 09:31 AM

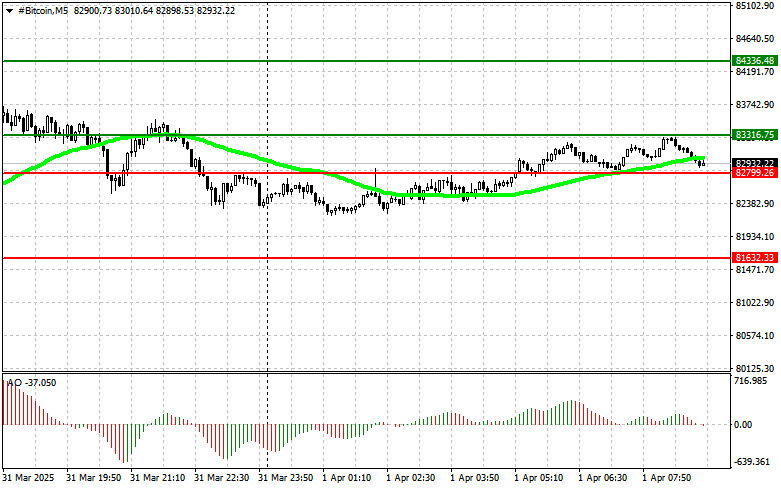

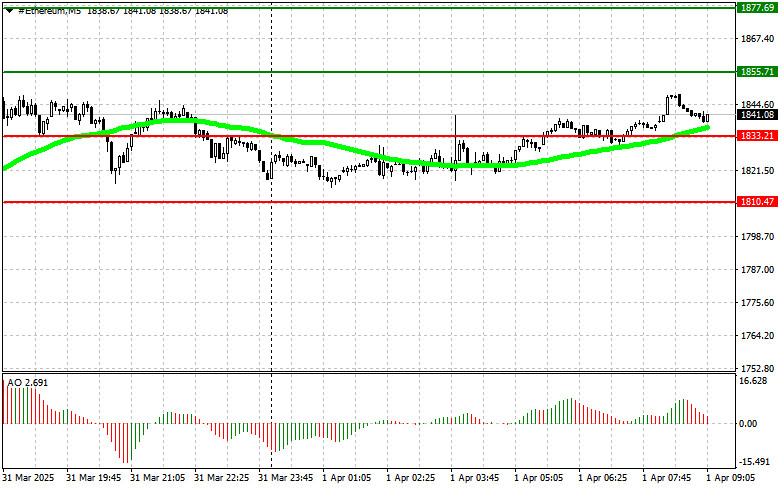

01.04.2025 09:31 AMBitcoin and Ethereum have fallen in response to a further decline in the US stock market. Currently, BTC and ETH exhibit an obvious correlation with US stock indices. However, trading in a sideways channel now attracts sellers more than buyers. So, caution is needed when adding long positions. Bitcoin's repeated failed attempts to break through the $83,800 level have triggered its sell-off. The leading crypto is now trading at around $83,000. Ethereum had better luck: after updating the $1,848 level and a slight correction, demand for the instrument revived during today's Asian session.

According to Santiment, an interesting trend is emerging amid recent volatility in the cryptocurrency market: one of the most active groups of whales, holding wallets with balances between 1,000 and 10,000 BTC, resumed their active buying of Bitcoin. This could indicate that major players have faith in the long-term bullish outlook for BTC despite short-term fluctuations. Alongside robust active purchases, there has been a rise in Bitcoin withdrawals from centralized exchanges. This trend has been steady since March 23, suggesting that investors are looking to store their assets outside exchange platforms, which potentially reduces selling pressure on the market and strengthens Bitcoin's position.

The combined effect of these two factors — increased purchases by large holders and Bitcoin withdrawals from exchanges — could positively influence Bitcoin's price in the medium term.

As for the intraday strategy in the cryptocurrency market, I will continue to trade on any significant dips in Bitcoin and Ethereum, expecting further development of a bullish market in the medium term, which has not gone away.

Regarding short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy scenario

Scenario #1: I will buy Bitcoin today at the entry point of about $83,300, aiming for a rise to $84,300. I will exit the buy position at around $84,300 and sell immediately on the rebound. Before buying on a breakout, I need to ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Bitcoin can be bought from the lower border at $82,800 if there is no market reaction to its breakout, aiming for $83,300 and $84,300.

Sell scenario

Scenario #1: I will sell Bitcoin today if the entry point reaches around $82,800, aiming for a decline to $81,600. I will exit the sell position at around $81,600 and buy immediately on the dip. Before selling on a breakout, I need to ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Bitcoin can be sold from the upper border of $83,300 if there is no market reaction to its breakout, aiming for levels of $82,800 and $81,600.

Ethereum

Buy scenario

Scenario #1: I will buy Ethereum today if the entry point reaches around $1,855, aiming for a rise to $1,877. I will exit long positions at around $1,877 and sell immediately on a rebound. Before buying on a breakout, I need to ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Ethereum can be bought from the lower border at $1,833 if there is no market reaction to its breakout, aiming for levels of $1,855 and $1,877.

Sell scenario

Scenario #1: I will sell Ethereum today if the entry point reaches around $1,833, aiming for a decline to $1,810. I will exit the sell position at around $1,810 and buy immediately on a dip. Before selling on a breakout, I need to ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can be sold from the upper border of $1,855 if there is no market reaction to its breakout, aiming for levels of $1,833 and $1,810.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Bitcoin dan Ethereum meneruskan pembetulan mereka, jatuh dengan ketara sepanjang semalam. Penurunan ini berlanjutan ke sesi dagangan Asia hari ini, dengan Bitcoin menyemak harga kepada $104,500 dan Ethereum menguji $2,560

Bitcoin telah menunjukkan pemulihan yang agak kukuh, memanjat semula ke atas paras $108,000 dan menembusi $109,000. Carta di bawah menyoroti pecahan pagi melalui tahap $108,100. Statistik mengesahkan bahawa peserta

Permintaan Bitcoin sekali lagi menunjukkan ketahanan. Selepas penurunan singkat di bawah paras $107,000, penurunan tersebut segera dibeli, menunjukkan bahawa pembeli masih aktif dan yakin terhadap potensi kenaikan aset ini dalam

Bitcoin sedang memulakan pembetulan, manakala Ethereum menunjukkan tanda-tanda kekuatan. Semalam, Bitcoin jatuh kepada sekitar $107,000 sebelum melonjak semula dengan ketara — satu petanda bahawa ramai pedagang berhati-hati untuk membeli pada

Pengumuman bahawa Cantor Fitzgerald, salah satu peniaga utama di AS, melancarkan pinjaman bersandarkan Bitcoin telah merubah pasaran kripto. Menguruskan modal sebanyak $2 bilion untuk usaha ini, syarikat tersebut telah berjaya

Bitcoin gagal bertahan di atas paras $110,000, manakala Ethereum sekali lagi menunjukkan pertumbuhan yang baik, didorong oleh berita mengenai kemungkinan peningkatan ketara dalam had gas setiap blok dalam rantaian blok

Semalam, Bitcoin dan Ethereum terus menarik permintaan daripada pedagang dan pelabur, mengekalkan prospek yang kukuh untuk penerusan pasaran menaik. Sementara itu, Tabung Kewangan Antarabangsa (IMF) menyatakan bahawa ia akan berusaha

Dalam carta 4 jam bagi mata wang kripto Bitcoin, terdapat Divergensi antara pergerakan harga Bitcoin dan penunjuk Pengayun Stochastic , yang menunjukkan bahawa dalam masa terdekat Bitcoin berpotensi untuk meneruskan

Bitcoin mencecah paras $110,000 namun gagal mengekalkan momentum kenaikan sepanjang hari, dan meneruskan fasa pengukuhannya. Namun, ketenangan ini sama sekali bukan petanda keletihan pasaran. Di sebalik tabir, aktiviti semakin rancak

Ferrari F8 TRIBUTO

dari InstaTrade

Video latihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.