Lihat juga

31.03.2025 03:21 AM

31.03.2025 03:21 AMThere are very few macroeconomic events scheduled for Monday. The only somewhat interesting reports will come from Germany. Retail sales and inflation data for March will be released. However, we'd like to remind you that Germany is just one of 27 countries in the European Union, so EU-wide indicators are naturally much more important for the euro. Nevertheless, German inflation data allows for a relatively accurate forecast of eurozone inflation overall. The Consumer Price Index is expected to remain at 2.3% for March.

There are no significant fundamental events scheduled. No speeches from central bank representatives of the EU, UK, or US are planned. No other fundamental developments are expected either. As a result, Monday is shaping up to be quite uneventful. However, let's not forget that Donald Trump remains the market's most powerful driver. Last Thursday, he imposed tariffs on car imports, and on April 2, he may introduce an additional package of tariffs against several countries around the world, mainly targeting the European Union.

On the first trading day of the new week, both currency pairs may resume the declines that have been building over recent weeks. However, the upcoming week will be filled with significant news and data releases, so traders won't be able to ignore everything. On top of that, Donald Trump is planning to "liberate America." Presumably from unfair treatment — but in practice, this means new tariffs. In short, both currency pairs may experience significant volatility in the week ahead.

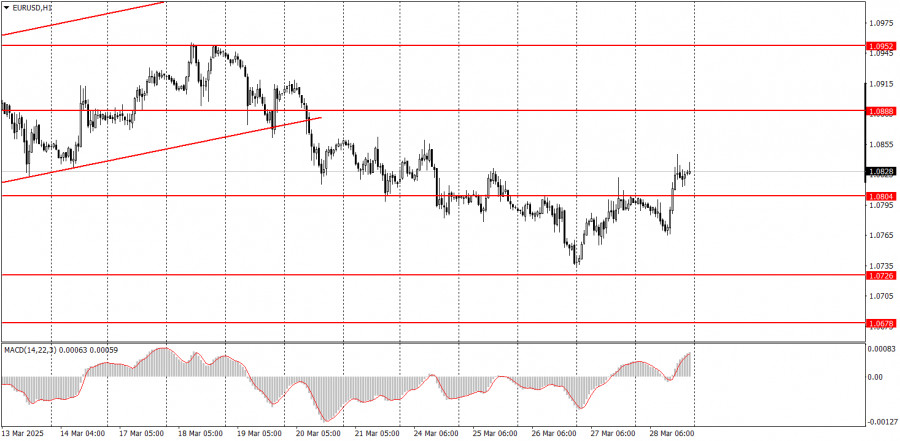

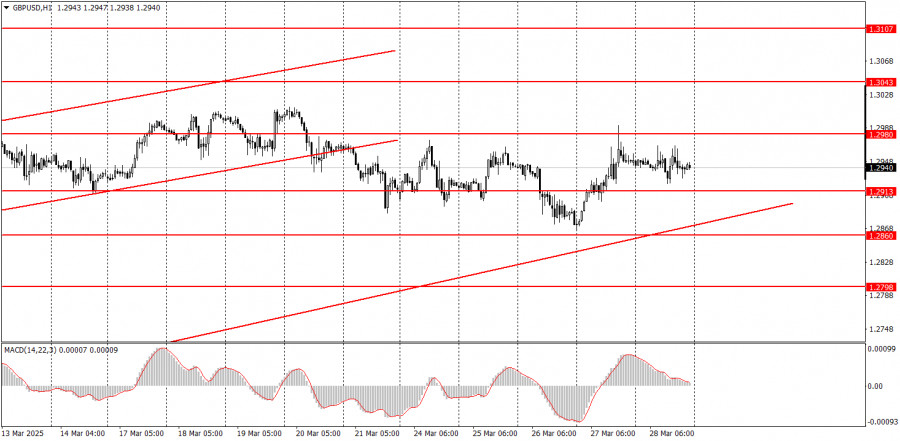

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pasangan USD/CAD sedang menghadapi kesukaran dalam usahanya untuk pulih susulan lantunan semalaman dari paras 1.3815–1.3810, yang menunjukkan kesinambungan aliran menurun sepanjang minggu ini. Harga minyak sedang meningkat semula selepas penyusutan

Kekacauan dan ketidakstabilan yang disebabkan oleh Donald Trump, baik di Amerika Syarikat mahupun di peringkat global, telah menjadi perkara biasa. Namun begitu, ia masih menyumbang kepada turun naik pasaran yang

Pasangan mata wang EUR/USD meneruskan pergerakan menaiknya pada hari Rabu. Dolar AS telah mengalami penyusutan secara berterusan selama lebih seminggu—sesuatu yang tidak berlaku sejak lebih sebulan lalu. Namun, setiap cerita

Pada hari Rabu, pasangan mata wang GBP/USD terus bergerak ke arah atas walaupun sekilas pandang, nampaknya tiada sebab yang jelas untuk itu. Ya, laporan inflasi satu-satunya keluaran pada hari tersebut

Analisis Laporan Makroekonomi: Beberapa laporan makroekonomi penting dijadualkan untuk diterbitkan pada hari Khamis. Indeks aktiviti perniagaan bagi sektor perkhidmatan dan pembuatan untuk bulan Mei akan dikeluarkan bagi Jerman, Zon Euro

Bank of England baru-baru ini menurunkan kadar faedah untuk kali kedua pada tahun 2025, dengan memberikan justifikasi keputusannya berdasarkan inflasi yang semakin perlahan dan pergerakan yang stabil ke arah tahap

Bolehkah euro dianggap sebagai mata wang yang kuat? Saya mempunyai keraguan yang ketara mengenainya. Sekumpulan penasihat ekonomi bebas kepada Friedrich Merz meramalkan bahawa ekonomi Jerman akan memasuki tempoh kemelesetan selepas

E-mel/SMS

pemberitahuan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.