Lihat juga

14.02.2025 10:35 AM

14.02.2025 10:35 AMIt appears that both American investors and those involved in the local stock market have largely dismissed strong inflation data from the U.S. But why is that?

This week's reports on consumer and producer inflation in the U.S. exceeded expectations, clearly indicating to investors that the prevailing inflation trend essentially rules out the possibility of the Federal Reserve continuing its rate-cutting cycle. Moreover, Fed Chair Jerome Powell recently stated during congressional hearings that the central bank has no reason to consider rate cuts at this time. Despite these inflationary signals, investors are choosing to overlook them. Why is this the case?

In traditional market evaluation models, stock market outlooks are closely linked to inflation dynamics and, by extension, interest rates, as borrowing costs directly affect market liquidity, particularly through the bond market. However, the current situation is atypical, largely due to the economic and political strategies of Donald Trump. His policies aimed at stimulating and protecting domestic manufacturers serve as key drivers for real-sector stocks, which in turn are propelling equity indices higher.

Additionally, the geopolitical actions of the 47th president are putting pressure on Europe and other regions, effectively drawing financial resources and even production capacities away from them. The U.S. is being positioned as a more attractive location for investment and manufacturing, further enhancing capital inflows into the local financial market. This influx of capital is another critical factor supporting stock indices.

There is potential for further growth, especially if annual consumer inflation stabilizes around 3% without accelerating. In this scenario, the Fed is likely to maintain a pause on interest rate cuts, allowing the stock market to continue reaching new highs. However, if inflation continues to rise—which is a highly probable scenario—the Fed may be compelled to raise rates unless it succumbs to pressure from Trump and changes its broader monetary policy framework. Currently, this framework operates under the assumption of historically low interest rates around 2%. If the Fed decides to adjust its approach and raises the acceptable inflation threshold to, for example, 3%, rate hikes may not occur even if inflation rises to 3.5%. However, that would alter the situation significantly.

Futures on major U.S. stock indices are showing positive momentum. If this sentiment continues, we can anticipate a continuation of the short-term rally in equities, leading to higher stock indices. This trend could exert downward pressure on the U.S. dollar while potentially pushing cryptocurrency prices higher.

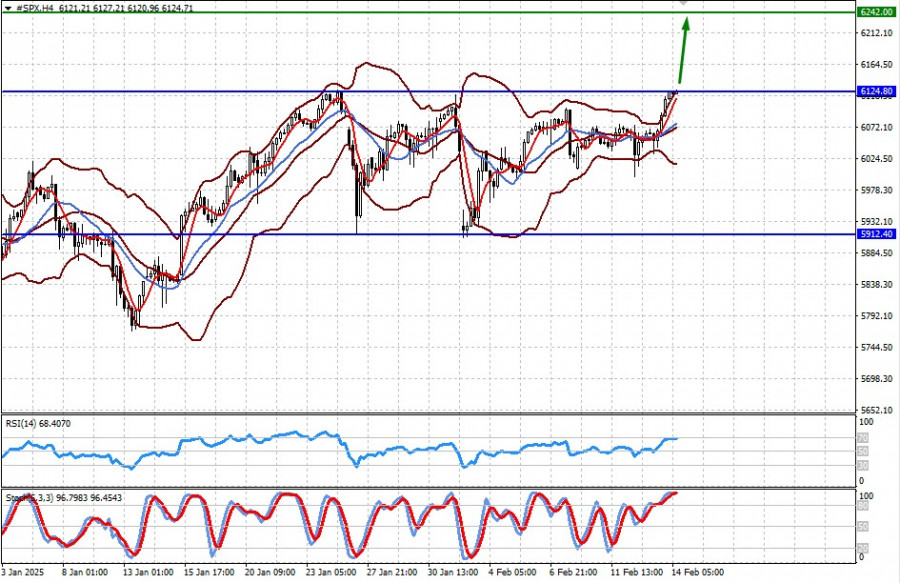

#SPX – The CFD contract on the S&P 500 futures has reached the upper boundary of the 5912.40–6124.80 range. If this level is breached, further growth toward 6242.00 can be expected.

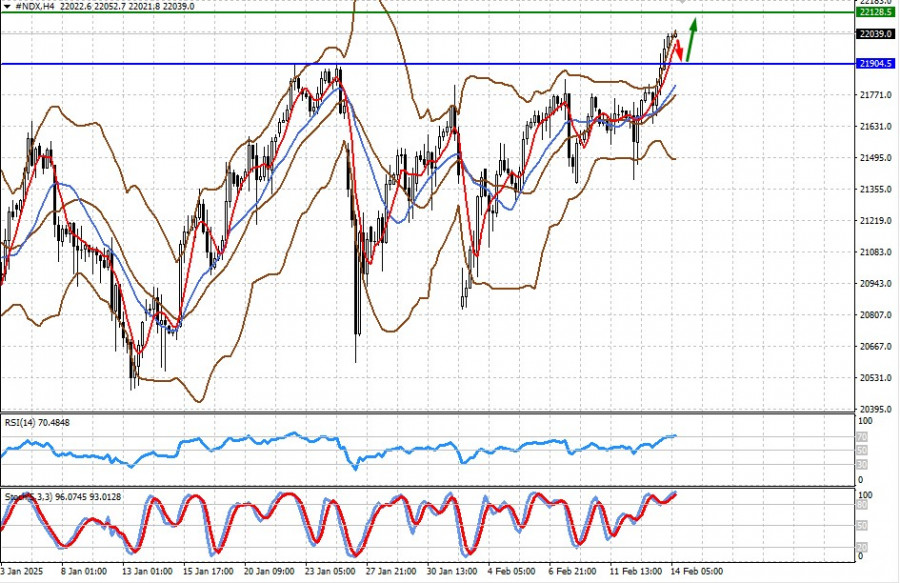

#NDX – The CFD contract on the NASDAQ 100 futures is also approaching a local high in the 22128.50 area. However, there is also a chance of a corrective decline toward 21904.50 before resuming its upward movement.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pasaran terus bertindak secara membabi buta di tengah-tengah tindakan kacau balau Donald Trump, yang cuba mengeluarkan A.S. daripada krisis mendalam dan menyeluruh seperti Baron Munchausen menarik dirinya keluar dari paya

Projek yang diperlukan pada waktu yang salah. Dewan Perwakilan telah meluluskan inisiatif pemotongan cukai Donald Trump. Presiden berharap ia akan membantu merangsang ekonomi dan mengimbangi kekurangan dalam dasar perdagangan. Masalahnya

Pada hari Khamis, pasangan mata wang GBP/USD didagangkan dengan agak tenang, tetapi seperti EUR/USD, ia telah meningkat selama dua minggu. Pada pandangan pertama, seseorang mungkin berfikir apakah alasan pedagang bagi

Pasangan mata wang EUR/USD diperdagangkan secara relatifnya tenang pada hari Khamis, namun ia telah meningkat dengan ketara sepanjang dua minggu lalu. Pergerakan ini boleh ditafsirkan dalam beberapa cara. Dari sudut

Sangat sedikit laporan makroekonomi dijadualkan pada hari Jumaat. Hanya dua yang patut diberi perhatian: anggaran akhir KDNK suku pertama Jerman dan data jualan runcit UK untuk bulan April. Laporan KDNK

Pada masa ini, Donald Trump sedang memberi tumpuan kepada mempromosikan apa yang beliau gelar sebagai "Undang-Undang Besar dan Indah". Dalam perang perdagangan, Trump telah melakukan segala yang mampu — beliau

Dalam ulasan baru-baru ini, saya telah berulang kali membincangkan topik dasar monetari Rizab Persekutuan, jangkaan pasaran, dan realiti yang kita semua alami. Saya percaya jangkaan pasaran terhadap pelonggaran Fed kekal

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.