Lihat juga

23.01.2023 04:46 PM

23.01.2023 04:46 PMThere is nothing scarier than a crowd. A crowd that carries you in the direction it wants to go, not where you want to go. And the bigger it gets, the higher the chances are that all those people are wrong. This was the case in October, when the market was abuzz with pessimism. The energy crisis would finish off the eurozone and British economies, the pandemic would swallow China, and the Fed's most aggressive monetary restriction would sweep the U.S. off its feet. The crowd was wrong, EURUSD reversed. Why wouldn't the major currency pair do it now?

Indeed, the situation has turned upside down in less than four months. The number of "bullish" forecasts for the euro is dizzying. MUFG puts $1.12 at the end of the year, Nordea and others are talking about $1.15. Thanks to good weather and low gas demand, the eurozone may avoid a recession. China has opened its economy despite COVID-19, and the likelihood of a soft landing of the U.S. economy is growing by leaps and bounds. At the same time, the U.S. bond market, which predicts a dovish Fed reversal as early as 2023, looks overly pessimistic. Stocks, on the contrary, are the optimists. The truth may actually be somewhere in between.

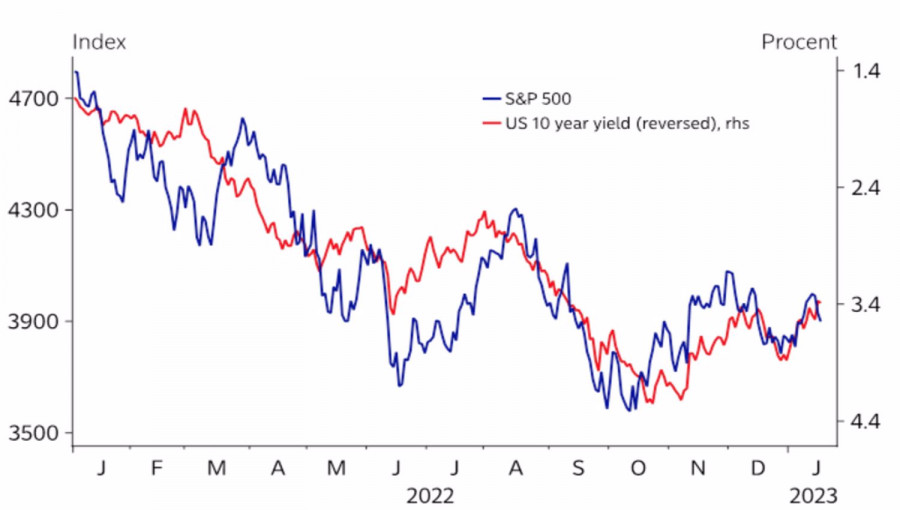

S&P 500 and Treasury yields

A strong external background will support the U.S. labor market and make wage growth and high inflation a long-term process. The Fed will hold rates longer than currently expected. This will allow U.S. Treasury bond yields to rise. Stock indices will face headwinds in the form of deteriorating U.S. macroeconomic statistics, weak corporate reporting, high Fed rates and capital outflows to Europe and emerging markets. They will look better than the U.S. As a result, the conjuncture that led to the USD index rally for most of 2022 will return.

The situation is aggravated by Greed. The change in the external background forced speculators to actively sell the U.S. dollar, whose net short positions reached their highest levels since June 2021.

Dynamics of the USD index and speculative positions on the U.S. dollar

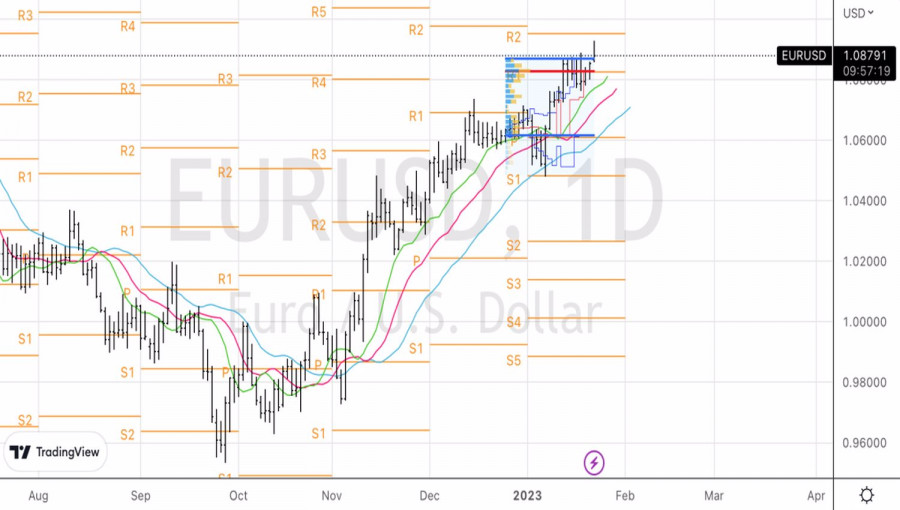

Does the madness of the crowd mean that the EURUSD trend will break again? I don't think so. But it is likely that the time for a correction has come. That said, the euro is starting to look overbought and vulnerable not only on the short-term investment horizon, but also on the long-term.

This winter, the German economy survived without Russian gas thanks to good weather, reduced demand and LNG supplies from Norway and the Netherlands. However, the reserves of blue fuel in the latter two countries are rapidly declining, and it is necessary to look for new sources of energy. There is time, but will Berlin be able to accomplish the impossible?

Technically, EURUSD's inability to cling to the upper limit of the fair value range of 1.061–1.087, as well as the formation of a pin bar with a long upper shadow, are alarming signs. A fall below 1.087 and 1.083 could open the way for a correction.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Bank Rizab Australia (RBA) mengikut senario yang paling dijangkakan pada mesyuarat bulan Mei, dengan menurunkan kadar faedah sebanyak 25 mata asas. Walau bagaimanapun, penjual AUD/USD tetap terdedah akibat kelemahan keseluruhan

Meskipun gencatan senjata selama 90 hari telah dipersetujui antara Beijing dan Washington, keadaan pasaran kekal sangat tegang. Para pelabur masih tidak pasti apa yang akan berlaku selepas tempoh tiga bulan

Apabila orang ramai mengenal pasti seorang pemimpin, mereka tanpa henti terus bergerak ke hadapan, menyingkirkan segala yang menghalang. Pelabur runcit mengikut seruan Morgan Stanley untuk "membeli semasa pasaran menurun"

Pasangan mata wang GBP/USD diperdagangkan lebih tinggi pada hari Isnin, dan kita boleh "mengucapkan terima kasih" kepada agensi penarafan Moody's untuk itu. Seperti yang dinyatakan dalam ulasan EUR/USD, penarafan kredit

Pasangan mata wang EUR/USD menemui alasan untuk menyambung kejatuhannya pada hari Isnin. Seperti yang telah dinyatakan sebelum ini, kedudukan dolar AS kelihatan sangat rapuh. Ia telah meningkat selama lebih sebulan

Analisis Laporan Makroekonomi: Tiada acara makroekonomi dijadualkan pada hari Selasa, jadi latar belakang makroekonomi tidak akan memberi kesan kepada pergerakan harga hari ini. Walau bagaimanapun, laporan dan pelepasan data jarang

Rizab Persekutuan terus berdiam diri pada tahun ini. Walaupun European Central Bank telah memotong kadar faedah sebanyak tiga kali dan Bank of England sebanyak dua kali, FOMC menahan diri daripada

Bank Rizab Australia (RBA) akan mengakhiri mesyuaratnya pada hari Selasa, 20 Mei, yang mungkin mengakibatkan pelonggaran parameter dasar monetari. Senario lebih berhati-hati adalah yang paling dijangkakan, tetapi ia tidak dimuktamadkan

Secara keseluruhan, kekuatan aliran menaik EUR/USD kekal utuh. Penghakisan keyakinan terhadap dolar AS mengatasi perbezaan dasar monetari antara Rizab Persekutuan dan ECB. Tinjauan Teknikal: Pada carta harian EUR/USD, corak pembalikan

InstaTrade

Akaun PAMM

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.