Lihat juga

27.06.2023 09:03 PM

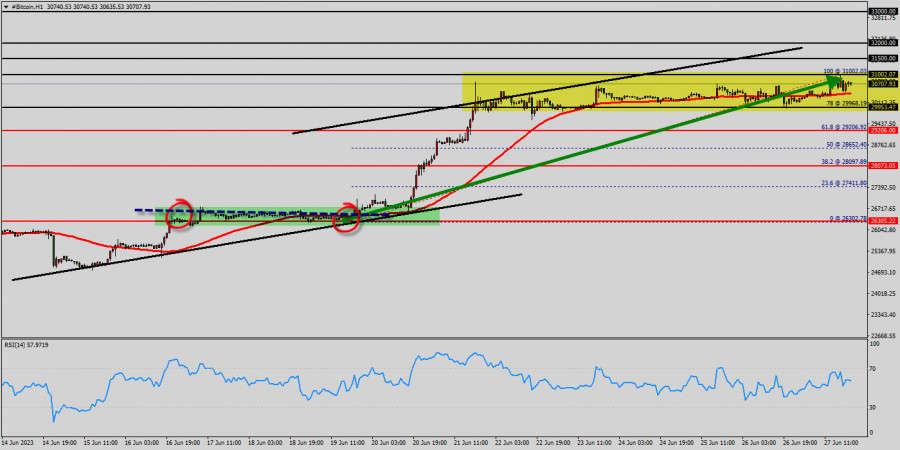

27.06.2023 09:03 PMTechnical market outlook :

Bitcoin price :

After finding bids reach to $ 29,223, bitcoin price recovered above $ 30,000 and $ 31,000. Initial Bitcoin resistance lies near the $ 32,031 level (50% of Fibonacci retracement levels). A decent breakout and follow-up move above $ 32,031 could open the gate for a push towards the $ 33,604 level. The main resistance remains near the area of $ 33,604 - $ 34,000. Also it should be noted that Bitcoin and cryptocurrencies unite as the bears lose their momentum. The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

Trading BTC/USD :

Uptrend scenario : An uptrend will start as soon, as the market rises above resistance level $ 32,000, which will be followed by moving up to resistance level $ 33,000. Further close above the high end may cause a rally towards $ 33,604.

Nonetheless, the weekly resistance level and zone should be considered. Downtrend scenario : On the downside, the $ 30,000 level represents support. The next major support is located near the $ 30,000, which the price may drift below towards the $ 30,000 support region.

Forecast (BTC/USD) :

The volatility is very high for that the BTC/USD is still moving between $ 30,000 and $ 33,604 in coming hours. Consequently, the market is likely to show signs of a bullish trend again. So, it will be good to buy above the level of $ 31,000 with the first target at $ 32,000 and further to 1,33,604 in order to test the daily resistance. However, if the BTC/USD is able to break out the daily support at $ 29,223, the market will decline further to $ 28,200 to approach support 2 today.

Crypto industry news : Lawyers Take Aim at Russia's Crypto Legislation. As many other cryptos and tech stocks soared, bitcoin (BTC) tanked, said Arca, stressing that the reason behind this is leverage, as it exacerbates price action when something organic causes sell pressure - which is what happened last week. Mining news : In a coded letter today, Bitmain's co-founder Jihan Wu said he has resigned as the CEO and Chairman of Bitmain today. "The disagreement between Micree and myself, the two co-founders of Bitmain, has been finally settled in an amicable and, more importantly, a constructive manner," he said. According to Jihan Wu, Micree Zhan, another co-founder of the company, purchased almost half of the Bitmain shares owned by Bitsource, "which is a code name that represents a group of founding shareholders" including Jihan Wu, for USD 600m. Also, he announced changes in their business structure, claiming that their new "model will be highly streamlined which will make it much easier to go for an [initial public offering]."

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dengan pergerakan harga Emas pada carta 4 jam yang berada di atas WMA (21) dengan cerun menaik, Emas berpotensi untuk bergerak ke paras 3365.45 dalam masa terdekat. Jika paras

Jika kita melihat carta 4 jam bagi pasangan mata wang silang GBP/AUD, nampaknya terdapat Divergence di antara pergerakan harga GBP/AUD dan penunjuk pengayun Stochastic, ditambah dengan kemunculan corak Bearish

Pada awal sesi dagangan Amerika, emas didagangkan sekitar 3,335, selepas melantun dari paras Purata Bergerak Ringkas 21 hari (21SMA) pada 3,327. Sekiranya emas mengukuh di atas paras 3,320 dalam beberapa

Pada awal sesi dagangan Amerika, euro didagangkan sekitar 1.1377, menjalani pembetulan teknikal selepas mencapai paras tertinggi 1.1418 semasa sesi Eropah. Euro mencapai paras harga yang dilihat pada akhir April

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

Akaun PAMM

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.