Бычий симметричный треугольник

сформирован 15.04 в 02:04:07 (UTC+0)

сила сигнала 1 из 5

По NZDJPY на M5 фигура «Бычий симметричный треугольник». Характеристика: Фигура продолжения тренда; Координаты границ – верхняя 84.21, нижняя 83.88. Проекция ширины фигуры 33 пунктов. Прогноз: В случае пробоя верхней границы 84.21 цена, вероятнее всего, продолжит движение к 84.21.

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

- Все

- Все

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- Все

- Все

- Покупка

- Продажа

- Все

- 1

- 2

- 3

- 4

- 5

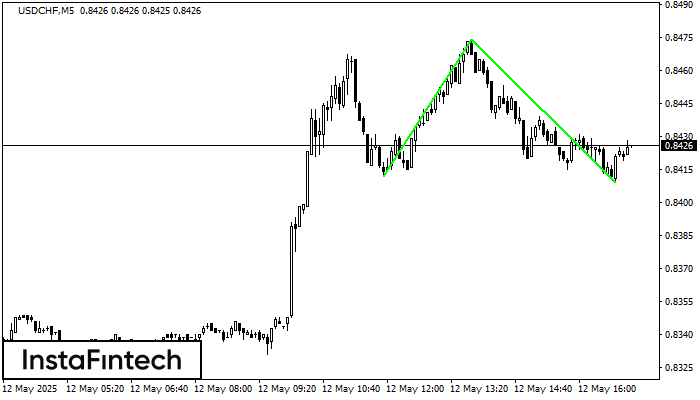

Bullish Rectangle

was formed on 12.05 at 16:15:07 (UTC+0)

signal strength 2 of 5

According to the chart of M15, USDCHF formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 0.8474, the lower border is 0.8409. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Bottom

was formed on 12.05 at 16:05:36 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on USDCHF M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

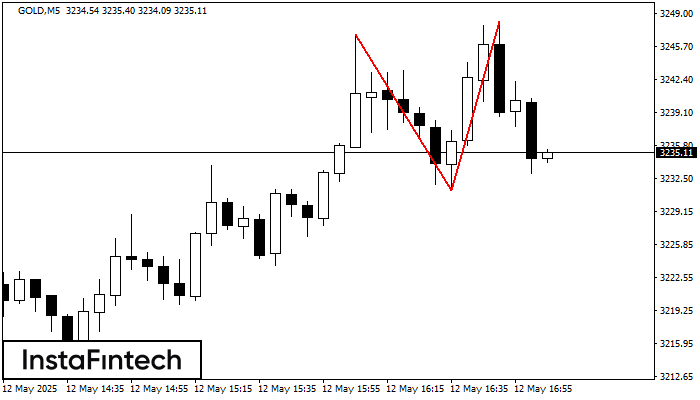

Double Top

was formed on 12.05 at 16:05:13 (UTC+0)

signal strength 1 of 5

The Double Top pattern has been formed on GOLD M5. It signals that the trend has been changed from upwards to downwards. Probably, if the base of the pattern 3231.35

The M5 and M15 time frames may have more false entry points.

Open chart in a new window