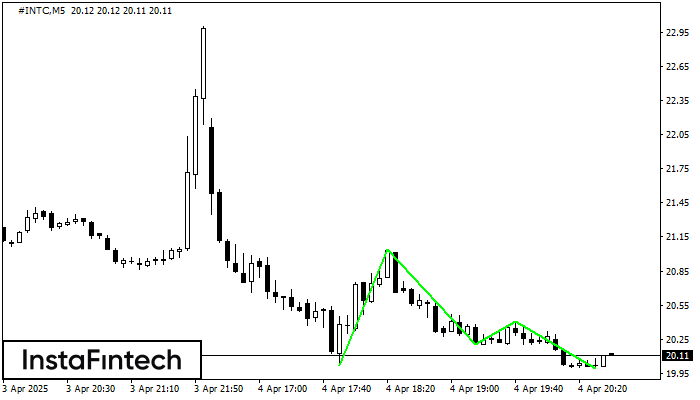

Triple Bottom

was formed on 04.04 at 19:40:28 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of #INTC M5. Features of the pattern: The lower line of the pattern has coordinates 21.04 with the upper limit 21.04/20.41, the projection of the width is 102 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 20.02, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

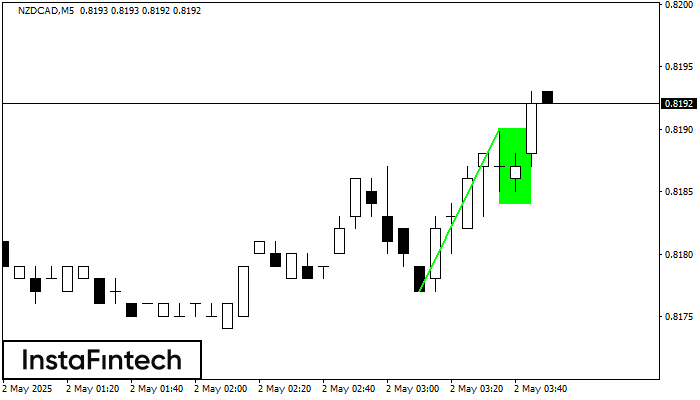

Bullish Flag

was formed on 02.05 at 02:50:29 (UTC+0)

signal strength 1 of 5

The Bullish Flag pattern has been formed on NZDCAD at M5. The lower boundary of the pattern is located at 0.8184/0.8184, while the higher boundary lies at 0.8190/0.8190. The projection

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

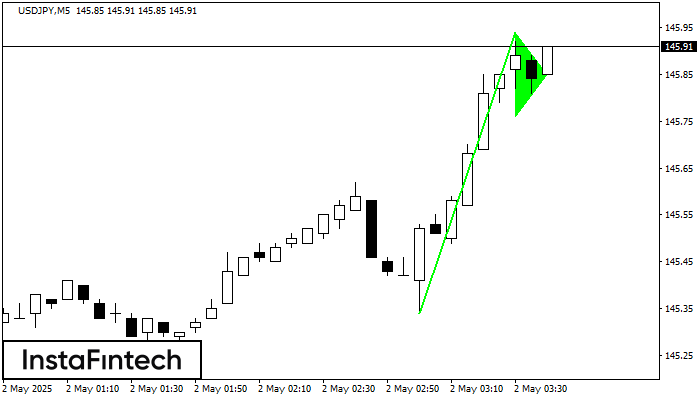

Bullish pennant

was formed on 02.05 at 02:43:36 (UTC+0)

signal strength 1 of 5

The Bullish pennant signal – Trading instrument USDJPY M5, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 145.94, with the prospect

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Rectangle

was formed on 02.05 at 02:17:39 (UTC+0)

signal strength 3 of 5

According to the chart of M30, NZDCHF formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border

Open chart in a new window