CADHUF (Canadian Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

24 Mar 2025 10:08

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/HUF pair is quite popular among some Forex traders. This trading instrument is a cross rate against the US dollar, which has a significant impact on the pair. So, when comparing the CAD/USD and USD/HUF charts, we can get an almost clear picture of CAD/HUF movements.

Features of CAD/HUF

The Canadian dollar is highly correlated with global oil prices. Canada is one of the largest oil-exporting countries. For this reason, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. Therefore, the CAD/HUF pair is dependent on the world price of this fuel.

Although Hungary is part of the European Union, it has its own national currency, the forint.

The Hungarian economy depends strongly on the organizations and countries that do business in its territory. The state is characterized by a high share of foreign capital in the economy.

A large part of Hungary's income is generated by tourism. In addition, such sectors of the economy as engineering, metallurgy, chemical industry, and agriculture are also flourishing in the country. Most of the production is exported abroad. Hungary's main trading partners are the EU countries and Russia. Therefore, when assessing the future exchange rate of the Hungarian forint, special attention should be paid to the economic indicators of these regions.

How to trade CAD/HUF

When trading cross rates, remember that brokers usually set a higher spread on such pairs than on more popular currency pairs. Therefore, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

The CAD/HUF pair is a cross rate. Therefore, the US dollar has a significant impact on each of the currencies in this trading instrument. For this reason, when predicting the movement of the pair, it is necessary to take into account the major US economic indicators. These include the refinancing rate, GDP growth, unemployment, number of new jobs, and many others. Notably, the currencies mentioned above may react differently to changes taking place in the US economy. Therefore, CAD/HUF could be an indicator of fluctuations in these currencies.

See Also

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2743

Technical analysisTrading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2563

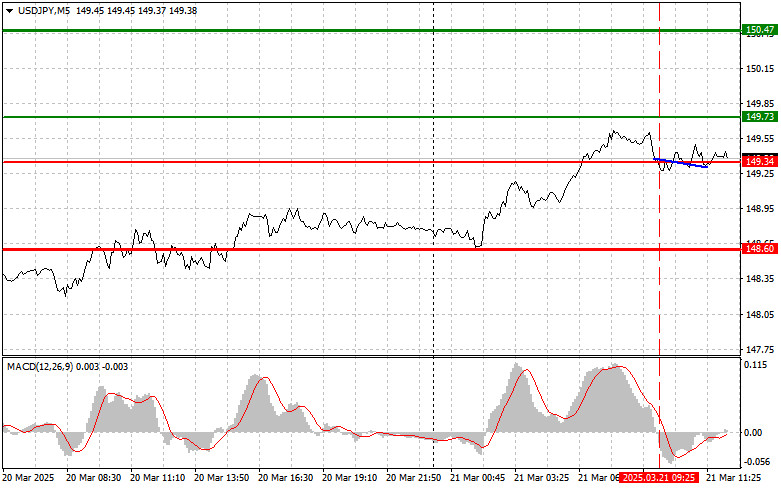

USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Author: Jakub Novak

19:30 2025-03-21 UTC+2

2443

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

2353

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

2263

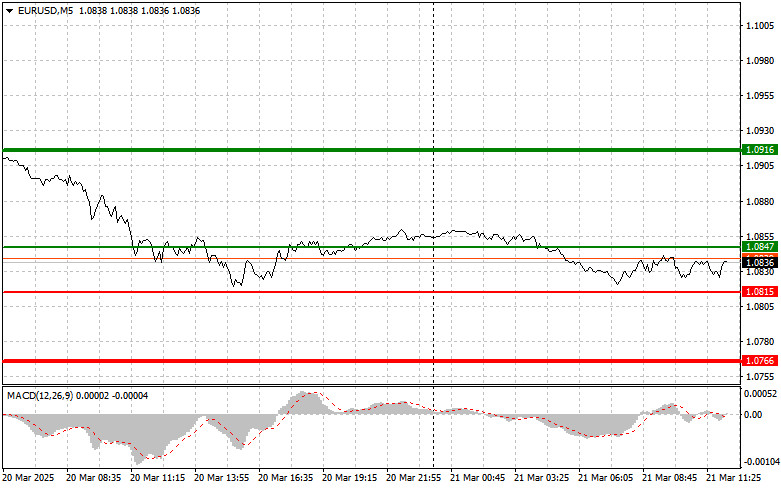

EURUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Author: Jakub Novak

19:09 2025-03-21 UTC+2

2188

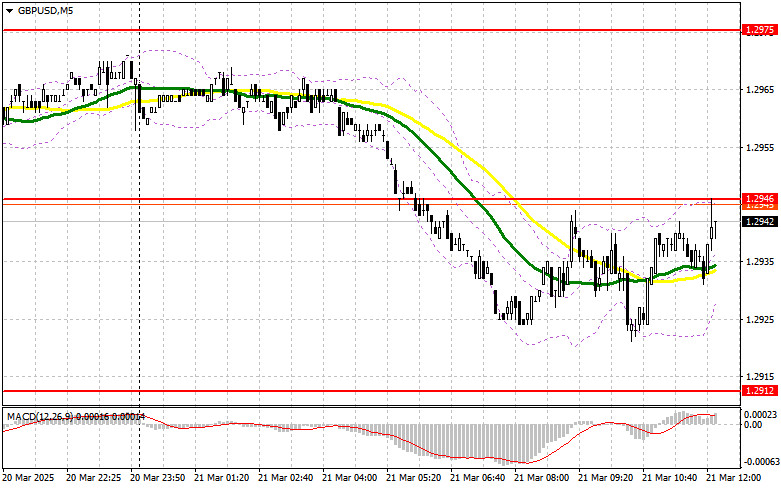

- GBPUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:17 2025-03-21 UTC+2

2188

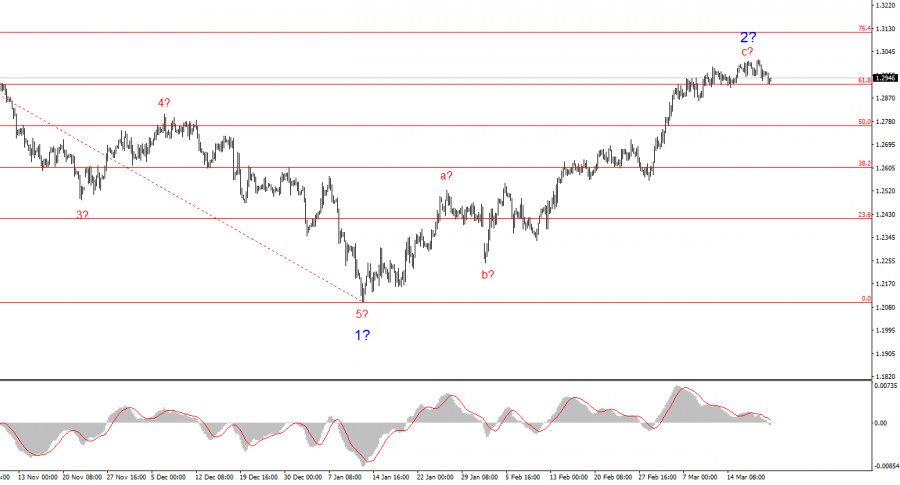

In my morning forecast, I focused on the 1.2946 level and planned to make trading decisions from that pointAuthor: Miroslaw Bawulski

19:04 2025-03-21 UTC+2

2053

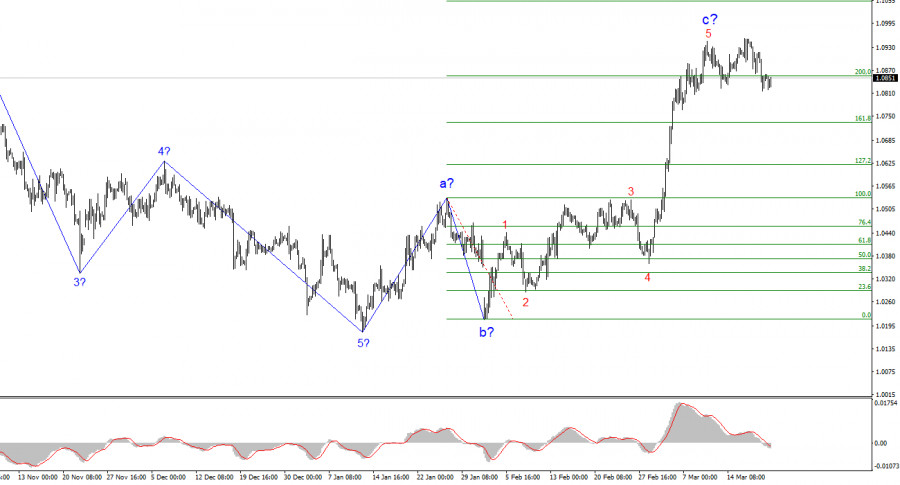

In my morning forecast, I highlighted the 1.0856 level and planned to make trading decisions around it.Author: Miroslaw Bawulski

18:59 2025-03-21 UTC+2

2023

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2743

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2563

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:30 2025-03-21 UTC+2

2443

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

2353

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

2263

- EURUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:09 2025-03-21 UTC+2

2188

- GBPUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:17 2025-03-21 UTC+2

2188

- In my morning forecast, I focused on the 1.2946 level and planned to make trading decisions from that point

Author: Miroslaw Bawulski

19:04 2025-03-21 UTC+2

2053

- In my morning forecast, I highlighted the 1.0856 level and planned to make trading decisions around it.

Author: Miroslaw Bawulski

18:59 2025-03-21 UTC+2

2023