AUDCZK (Australian Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

24 Mar 2025 13:48

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The AUD/CZK pair is not in high demand among forex traders. This is a cross-rate pair. Thus, a trader buys USD for CZK at the current USD/CZK exchange rate, and buys AUD for dollars at the current AUD/USD exchange rate.

The US dollar has a significant impact on both currencies. So, when trading this instrument, speculators should take into account important US macroeconomic indicators such as GDP, the interest rate, unemployment rate, and labor market figures, etc. Notably, the Australian dollar and Czech koruna react to the release of US economic data at a different speed. This is why the AUD/CZK pair can serve as an indicator of the swings in the rate of both currencies.

Main features. How to trade AUD/CZK

The Czech Republic is one of the most industrially developed countries in Europe as well as one of the most prosperous and stable countries in the euro area. Besides, the country can boast of robust economic growth. This is why its population has a high per capita income.

The Czech Republic is on the list of the world's top car manufacturers. Most of the produced cars are exported. In addition, the country is the main exporter of beer and shoes. The Czech Republic is one of the leaders when it comes to the production of electronics. The country generates electricity in various ways: at nuclear power plants, thermal power plants, hydroelectric power plants as well as with the help of solar and wind power plants.

The AUD/CHF pair has rather low liquidity compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this instrument, it is necessary to focus on the pairs traded against the US dollar.

If you want to start trading cross-rates, please carefully read the trading conditions of your broker. Usually, spreads for these instruments are higher than for the main currency pairs.

See Also

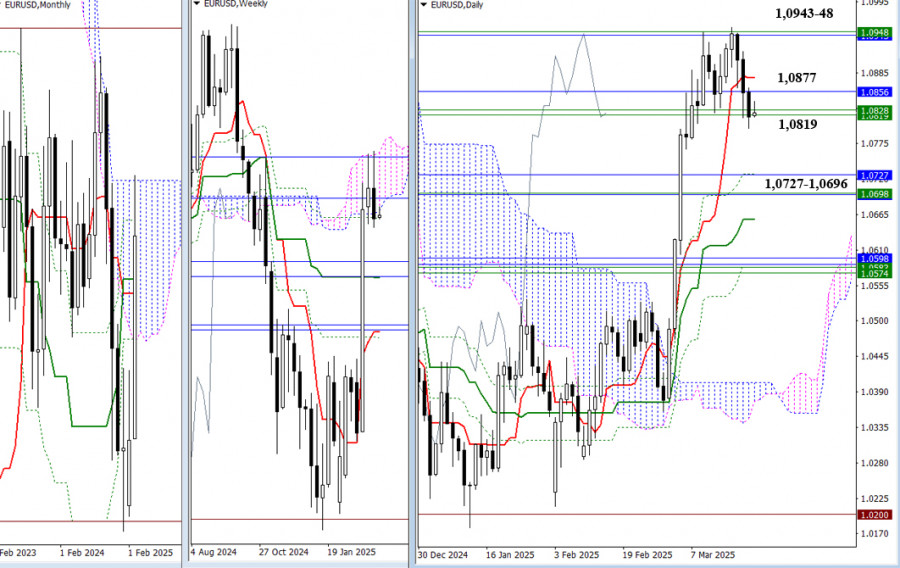

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.Author: Irina Manzenko

07:52 2025-03-24 UTC+2

778

Technical analysisTechnical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.Author: Irina Yanina

11:25 2025-03-24 UTC+2

733

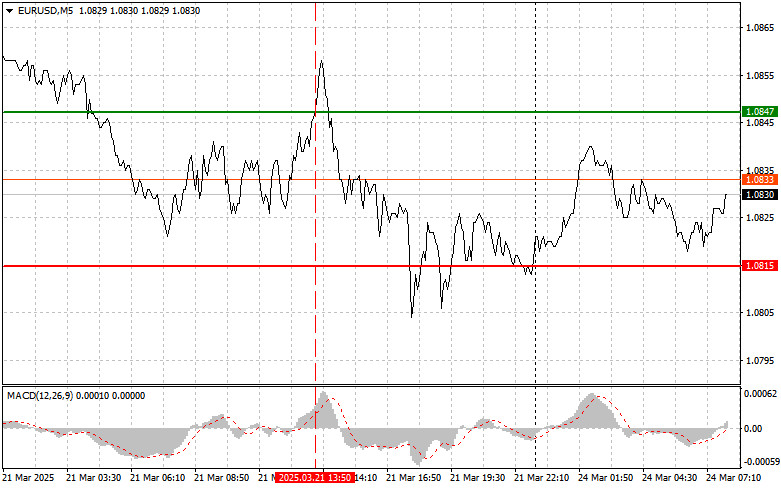

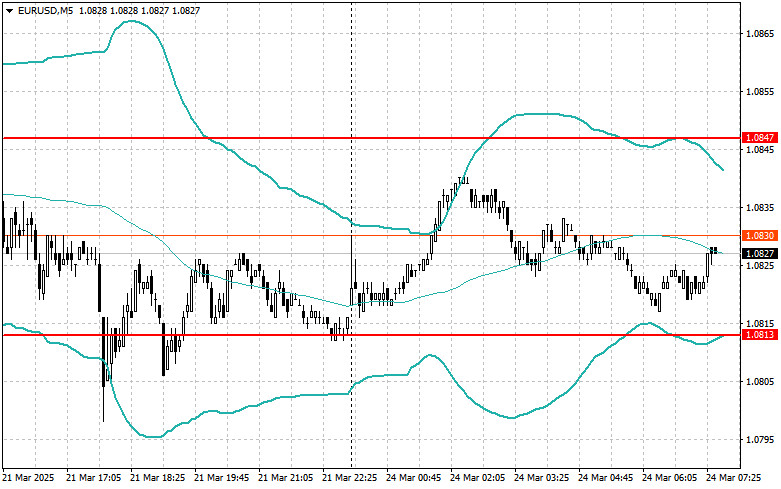

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

718

- Intraday Strategies for Beginner Traders on March 24

Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

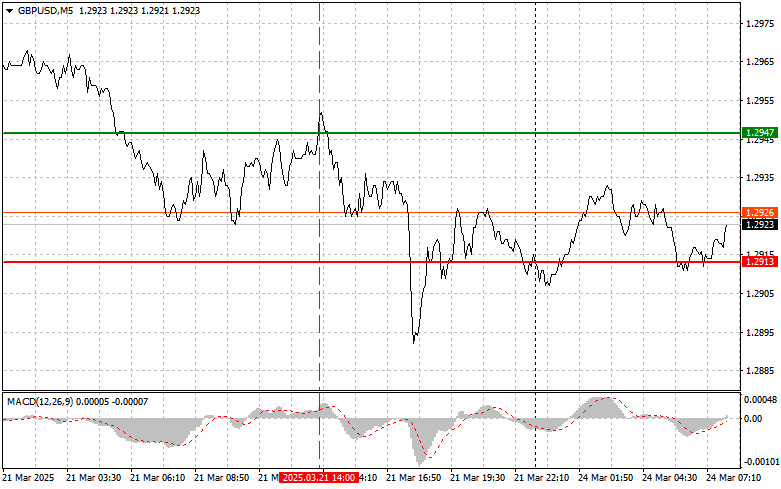

Type of analysisGBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

Trading Recommendations for the Cryptocurrency Market on March 24Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Author: Irina Manzenko

07:52 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

733

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

718

- Intraday Strategies for Beginner Traders on March 24

Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

- Trading Recommendations for the Cryptocurrency Market on March 24

Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643