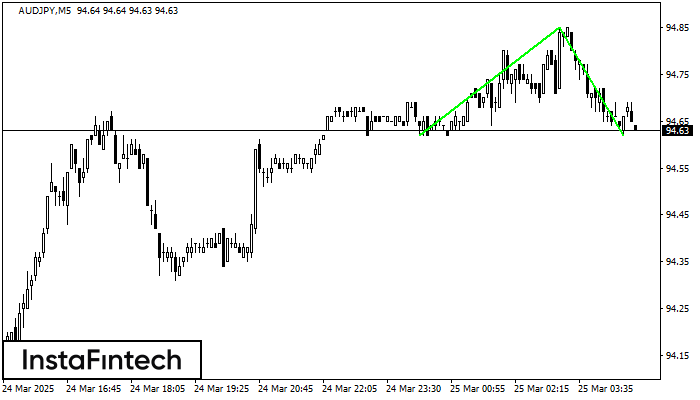

Double Bottom

was formed on 25.03 at 04:45:36 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDJPY M5; the upper boundary is 94.85; the lower boundary is 94.62. The width of the pattern is 23 points. In case of a break of the upper boundary 94.85, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

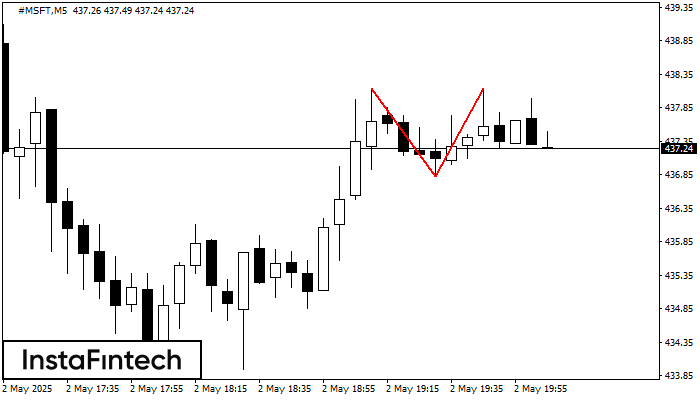

डबल टॉप

was formed on 02.05 at 19:05:29 (UTC+0)

signal strength 1 of 5

डबल टॉप पैटर्न #MSFT M5 पर बना है। यह संकेत देता है कि प्रवृत्ति ऊपर से नीचे की ओर बदल गई है। संभवतः, यदि 436.83 पैटर्न का आधार टूट जाता

M5 और M15 समय सीमा में अधिक फाल्स एंट्री पॉइंट्स हो सकते हैं।

Open chart in a new window

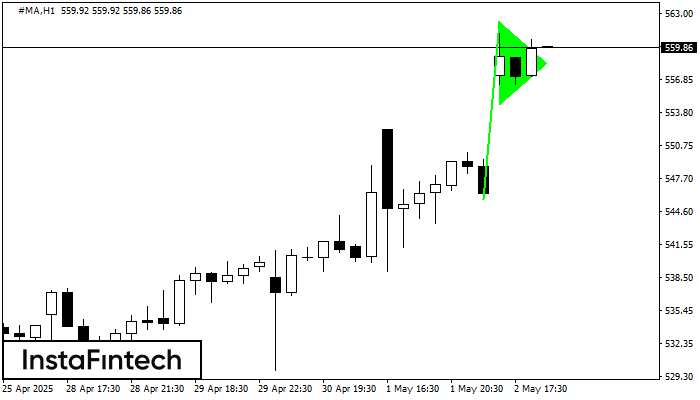

बुलिश पताका

was formed on 02.05 at 18:30:27 (UTC+0)

signal strength 4 of 5

बुलिश पताका ग्राफ़िक पैटर्न #MA H1 इंस्ट्रूमेंट पर बना है। यह निरंतरता पैटर्न की श्रेणी में आता है। इस मामले में, यदि भाव उच्च स्तर पर टूटता है, तो इसके

Open chart in a new window

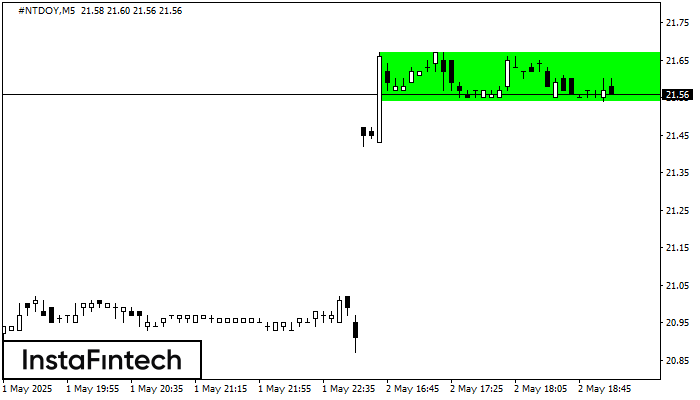

बुलिश आयत

was formed on 02.05 at 18:06:10 (UTC+0)

signal strength 1 of 5

M5 के चार्ट के अनुसार, #NTDOY से बुलिश आयत बना। पैटर्न एक प्रवृत्ति निरंतरता को इंगित करता है। ऊपरी सीमा 21.67 है, निचली सीमा 21.54 है। सिग्नल का मतलब है

M5 और M15 समय सीमा में अधिक फाल्स एंट्री पॉइंट्स हो सकते हैं।

Open chart in a new window