Lihat juga

07.04.2025 09:00 AM

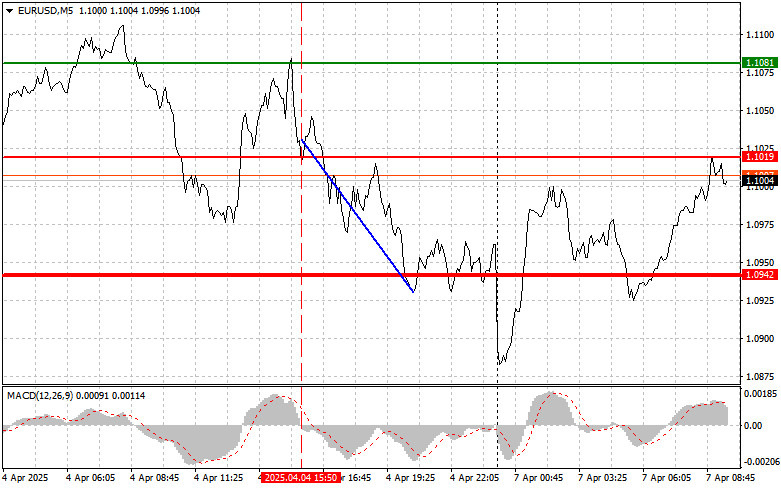

07.04.2025 09:00 AMThe price test at 1.1019 occurred when the MACD indicator had just started moving downward from the zero level, confirming a correct entry point for a short position on the euro. As a result, the pair declined toward the target level of 1.0942.

Despite the impressive increase in U.S. nonfarm payrolls in March, the rise in the unemployment rate to 4.2% dampened traders' enthusiasm for the dollar. While an increase in unemployment is certainly a negative factor, it can also indicate an influx of new participants into the labor force, reflecting optimism about job prospects. As a result, the market reaction was muted as participants awaited further guidance from the Federal Reserve regarding future monetary policy—which ultimately did not materialize.

This morning, investor confidence data from the eurozone (Sentix) and eurozone retail sales figures are expected. If the economic data is weak, pressure on the EUR/USD pair will likely return. The market is closely watching macroeconomic data from the eurozone. The Sentix index reflects investor sentiment, while changes in retail sales offer insight into consumer activity. Both indicators are crucial for assessing the region's economic conditions and growth prospects. Worse-than-expected data may trigger euro selling, while positive data may support the euro—especially under current trade tensions. Strong investor confidence and rising retail sales suggest economic stability, potentially attracting euro buyers.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the euro today if the price reaches around 1.1040 (green line on the chart), targeting a rise to 1.1117. At 1.1117, I plan to exit the market and open a short position, expecting a pullback of 30–35 pips from the entry point. You can expect euro growth in the morning after strong data. Important! Before entering a long position, ensure the MACD indicator is above the zero line and beginning to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.0975 level while the MACD indicator is in the oversold area. This will limit downside potential and may trigger a reversal to the upside. A rise to 1.1040 and 1.1117 can be expected.

Scenario #1: I plan to sell the euro after the price hits 1.0975 (red line on the chart), targeting 1.0887, where I plan to exit and immediately enter a long position, anticipating a 20–25 pip pullback. Downward pressure could return quickly today. Important! Before entering a short position, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1040 level while the MACD is in the overbought area. This will limit upside potential and may lead to a downward reversal. A decline toward 1.0975 and 1.0887 is possible.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Analisis Trading dan Tips untuk Trading Euro Uji level harga 1.1405 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli euro

Pengujian harga di 14068 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Uji level harga 1.3356 bertepatan dengan saat indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Akibatnya, pasangan ini turun lebih

Uji level harga 1,1460 pada paruh kedua hari itu bertepatan dengan indikator MACD yang mulai bergerak turun dari garis nol, mengonfirmasi titik entri yang tepat untuk menjual euro. Akibatnya, pasangan

Euro dan pound merosot tajam, bersama dengan beberapa aset sensitif risiko lainnya yang dipasangkan dengan dolar AS—dan ada alasan objektif untuk ini. Kemarin, Donald Trump menyatakan kesiapannya untuk menurunkan tarif

Minyak dan gas terus bermain sesuai aturan politik besar. Setiap pernyataan Trump, setiap keputusan Federal Reserve, dan setiap langkah baru dari Tiongkok seperti kartu baru dalam permainan energi yang kompleks

Analisis Trading dan Tips Trading untuk Yen Jepang Uji pertama level 140.35 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli

Analisis dan Kiat-kiat Trading untuk Pound Inggris Uji level 1,3394 terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk pasar yang valid. Akibatnya, pasangan

Rincian Trading dan Kiat-kiat untuk Trading Euro Pengujian level 1,1521 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk posisi jual

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.