Lihat juga

04.04.2025 07:52 PM

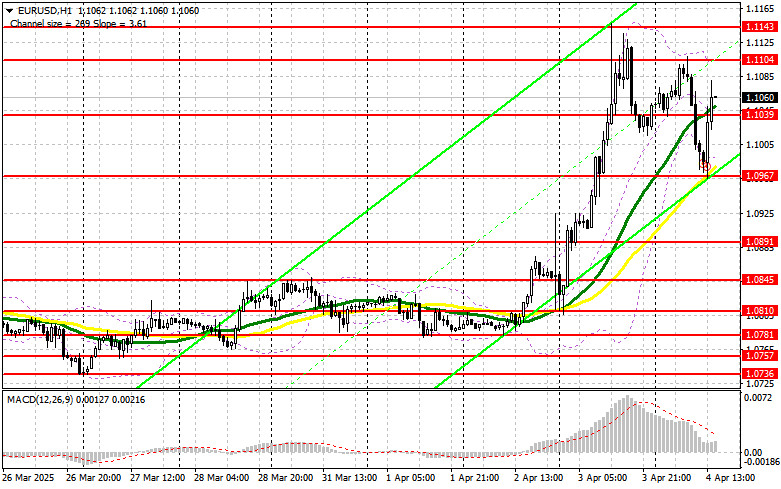

04.04.2025 07:52 PMIn my morning forecast, I highlighted the 1.0994 level and planned to base my market entry decisions on it. Let's look at the 5-minute chart and break down what happened there. A decline followed by a false breakout at that level provided an excellent entry point for long positions, resulting in a 50-point rally in the euro. The technical outlook was revised for the second half of the day.

To Open Long Positions on EUR/USD:

The euro posted a decent correction against the U.S. dollar, which large players quickly took advantage of by increasing their long positions ahead of key U.S. economic data. Two important reports lie ahead: nonfarm payrolls for March and the unemployment rate. These will determine the pair's direction.

Later in the U.S. session, Fed Chair Jerome Powell will speak and is expected to comment on the recently imposed U.S. tariffs on key trading partners, which could spark volatility in the U.S. dollar.

If the euro declines after the data release, a false breakout around the 1.1039 support will be a signal to buy EUR/USD, aiming for a bullish continuation toward 1.1104. A breakout and retest of that range from above would confirm the correct entry point for long positions, with targets at 1.1143, and the final target at 1.1179, where I will take profits.

In the scenario where EUR/USD falls and there is no buying activity near 1.1039, pressure on the euro will intensify. In this case, sellers may push the pair down to 1.0967. Only after a false breakout forms there will I consider buying. I also plan to open long positions on a rebound from 1.0891, targeting a 30–35 point intraday correction.

To Open Short Positions on EUR/USD:

Sellers tried in the first half of the day, and with some success, but failed to hold their ground. Now the outlook depends on strong U.S. data. If the reaction to the reports is negative, a false breakout at the 1.1104 resistance will offer a short entry point, targeting support at 1.1039. A breakout and consolidation below this level would be a good selling opportunity with further movement toward 1.0967, and the final target at 1.0891, where I will take profits.

If EUR/USD continues rising in the second half of the day—which seems more likely—and bears fail to act around 1.1104, I will postpone shorts until we test the next resistance at 1.1143, where I'll only sell after a failed consolidation. If there's no downward move even there, I'll consider shorts on a rebound from 1.1179, aiming for a 30–35 point pullback.

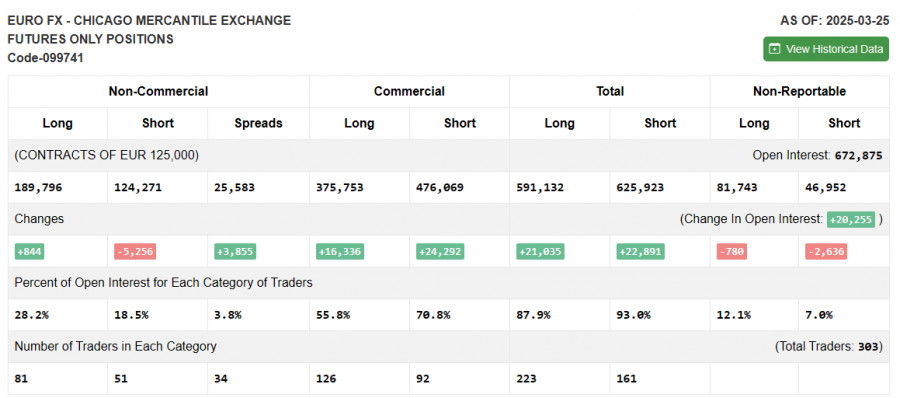

COT Report (Commitment of Traders) – March 25:

The COT report showed a slight increase in long positions and a rather sharp reduction in shorts. Interest in buying the euro is not rising significantly, but sellers continue to exit the market. Given the latest eurozone inflation data and ECB officials' comments, the central bank is likely to maintain its current stance at the April meeting, which could support the euro in the short term.

However, the extent to which U.S. tariffs impact other countries will be critical. The greater the perceived threat to global growth, the more pressure there will be on risk assets—including the euro. Long non-commercial positions rose by 844 to 189,796 and short non-commercial positions fell by 5,256 to 124,271. The gap between longs and shorts widened by 3,855

Indicator Signals:

Moving Averages Trading is taking place above the 30- and 50-period moving averages, indicating a new bullish market for the euro.Note: The author uses H1 (hourly) charts to determine moving averages, which may differ from D1 (daily) chart readings.

Bollinger Bands In case of a decline, the lower band around 1.1000 will serve as support.

Indicator Descriptions:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Selasa, pasangan GBP/USD mengalami pertumbuhan yang signifikan, meskipun tidak ada pemicu yang jelas di baliknya. Pada hari Senin, dolar naik karena alasan tertentu, tetapi pada hari Selasa turun

Pada hari Selasa, pasangan mata uang EUR/USD hampir sepenuhnya pulih dari penurunan hari Senin. Seperti yang telah terbukti, diperlukan alasan kuat agar dolar AS menguat, seperti kemajuan dalam negosiasi perdagangan

Pada hari Selasa, pasangan mata uang GBP/USD dengan mudah pulih dari penurunan yang dialaminya pada hari Senin. Sekali lagi, kita melihat bahwa pound Inggris naik lebih kuat daripada euro

Pada pasangan mata uang EUR/USD, dengan mudah memulihkan sebagian besar kerugian hari Senin. Pada hari Senin, dilaporkan bahwa tarif impor antara Tiongkok dan AS telah dikurangi, yang dapat dianggap sebagai

Tidak ada acara makroekonomi yang dijadwalkan untuk hari Jumat. Perkembangan fundamental juga akan terbatas, tetapi sama sekali tidak jelas faktor mana yang memengaruhi pembentukan harga. Pound dan euro memiliki alasan

Pada hari Kamis, pasangan GBP/USD melanjutkan penurunan berombaknya dalam saluran menyamping dan gagal untuk menembus keluar, berbeda dengan pasangan EUR/USD. Dari sudut pandang kami, pound Inggris memiliki dua kali lebih

Pada hari Kamis, pasangan mata uang EUR/USD tiba-tiba keluar dari channel datar tempatnya telah diperdagangkan selama tiga minggu. Ini terjadi selama sesi perdagangan AS, meskipun tidak ada rilis data makroekonomi

Pada hari Kamis, pasangan mata uang EUR/USD menunjukkan tren yang sangat menarik. Sebagai pengingat, hasil pertemuan FOMC diumumkan pada Rabu malam, dan sekali lagi kami menganggapnya hawkish. Penting untuk diingat

Pada hari Kamis, pasangan mata uang GBP/USD terus trading dalam saluran menyamping, yang terlihat dalam kerangka waktu per jam. Dua pertemuan bank sentral — yang masing-masing dapat dianggap menguntungkan bagi

Dalam prediksi pagi saya, saya fokus pada level 1.3286 dan merencanakan entri pasar berdasarkan level tersebut. Mari kita lihat grafik 5-menit dan analisis apa yang terjadi. Terjadi penembusan dan pengujian

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.