Lihat juga

04.04.2025 11:50 AM

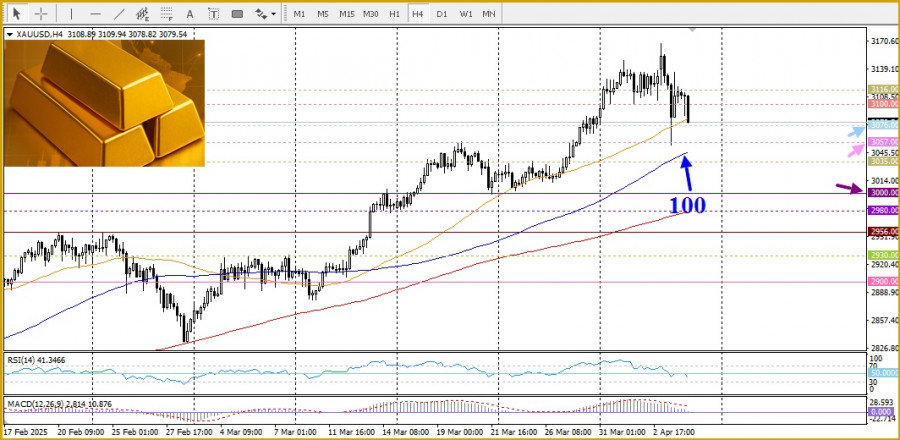

04.04.2025 11:50 AMGold is attracting some sellers for the second day in a row, despite the absence of any clear fundamental catalyst for a decline. Most likely, this is due to trading repositioning ahead of the key U.S. Nonfarm Payrolls (NFP) report, as well as a corrective move in the U.S. dollar driven by short-covering.

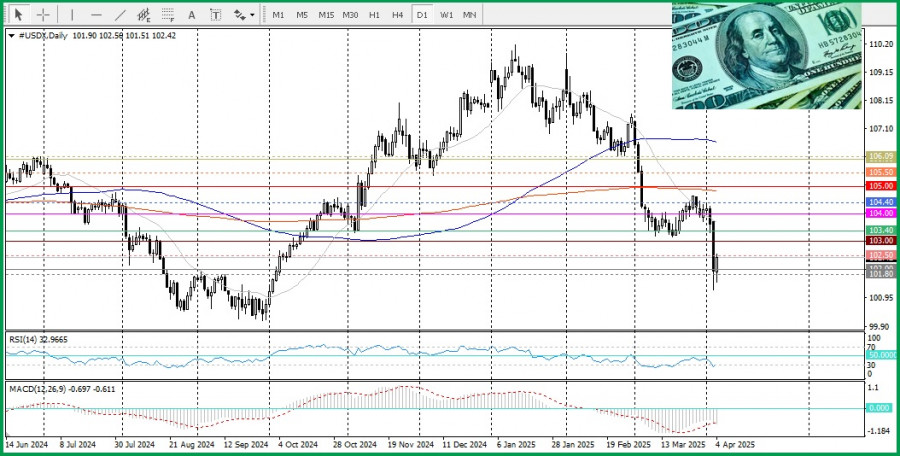

Recent actions by U.S. President Donald Trump—who announced reciprocal tariffs on imports—have shaken global financial markets and heightened concerns about potential negative impacts on the global economy. This has led to increased expectations that the Federal Reserve will resume its rate-cutting cycle, which in turn supports interest in gold as a safe-haven asset.

Interestingly, the yield on 10-year U.S. Treasury bonds has fallen below 4% for the first time in six months, preventing the dollar from recovering. At the same time, data on U.S. services sector activity indicated a slowdown, which further weighs on the dollar and supports the precious metal.

From a technical perspective, gold may find support near the $3057 area, which aligns with the 100-period simple moving average (SMA) on the 4-hour chart—a key reference point for short-term traders. A break below this level could trigger technical selling, making the metal vulnerable to a deeper corrective decline toward intermediate support at $3035, en route to the psychological level of $3000.

On the other hand, the resistance zone around $3116 will be key for the bulls. A breakout above this area could signal the continuation of the multi-month uptrend during which gold reached a new all-time high—especially now that oscillators on the daily chart have exited overbought territory.

For more actionable trading opportunities today, it is advisable to focus on the release of the NFP employment data, which could significantly impact market direction.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dimulainya negosiasi yang sebenarnya dapat menyebabkan penurunan signifikan pada harga emas dalam waktu dekat. Dalam artikel sebelumnya, saya menyatakan bahwa harga emas yang sebelumnya melonjak dapat mengalami koreksi besar akibat

Pada hari Kamis, pasangan mata uang GBP/USD trading lebih tinggi, tetap mendekati level tertinggi 3 tahun. Meskipun pound Inggris mengalami reli yang kuat dalam beberapa bulan terakhir, koreksi masih jarang

Pada hari Kamis, pasangan mata uang EUR/USD terus diperdagangkan dengan tenang, meskipun volatilitas tetap relatif tinggi. Minggu ini, dolar AS menunjukkan beberapa tanda pemulihan—sesuatu yang sudah bisa dianggap sebagai keberhasilan

Beberapa peristiwa makroekonomi dijadwalkan pada hari Jumat, tetapi ini tidak terlalu penting, karena pasar terus mengabaikan 90% dari semua publikasi. Di antara laporan yang lebih atau kurang signifikan hari

Minggu lalu, Bank of Canada mempertahankan suku bunga tidak berubah pada 2,75%, seperti yang diharapkan. Pernyataan yang menyertainya bersifat netral, menekankan ketidakpastian yang sedang berlangsung. Sulit untuk mempertahankan kepercayaan ketika

Presiden AS Donald Trump kembali mengomentari Ketua Federal Reserve Jerome Powell, secara terbuka menyatakan ketidakpuasan dengan laju penurunan suku bunga. Ini adalah ungkapan ketidaksetujuan publik lainnya terhadap kebijakan

Pasar semakin peka terhadap berita baik, tetapi hari-hari terbaiknya sudah berlalu. Nilai ekuitas AS sebagai persentase dari MSCI All Country World Index mencapai puncaknya pada bulan Desember. Menurut Jefferies Financial

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.