Lihat juga

04.04.2025 09:03 AM

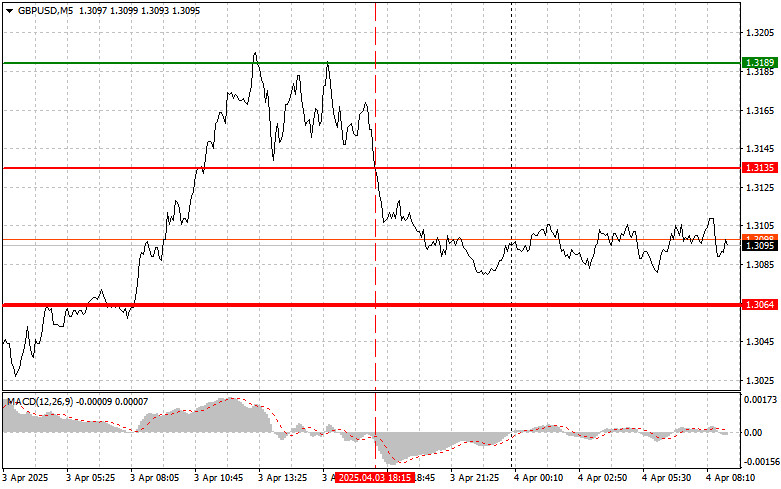

04.04.2025 09:03 AMThe price test at 1.3135 occurred when the MACD indicator moved significantly below the zero line, limiting the pair's downside potential. For this reason, I did not sell the pound—especially considering the bullish market observed in the first half of the day.

According to rumors, British politicians are expected to begin trade negotiations with Trump soon regarding tariffs, and if the dialogue proves successful, this could strengthen the pound. However, it's worth noting that the success of these talks is far from guaranteed. Trump is known for his unpredictability and uncompromising stance on trade agreements. Any concessions from the UK may require significant compromises, potentially triggering domestic criticism. Nevertheless, the prospect of interest rate cuts by the Bank of England remains highly appealing for the British economy, which has recently shown signs of slowing growth.

Today, investors are paying close attention to the upcoming release of the UK Construction Purchasing Managers' Index (PMI). This index is a key economic indicator, as the construction sector responds sensitively to changes in interest rates, consumer demand, and the overall economic environment. The PMI reading will reflect current activity in the construction sector, including new project volumes, employment, and material costs. A value above 50 points indicates expansion, while a reading below 50 signals contraction. Strong figures will likely trigger another wave of growth for the pound against the dollar.

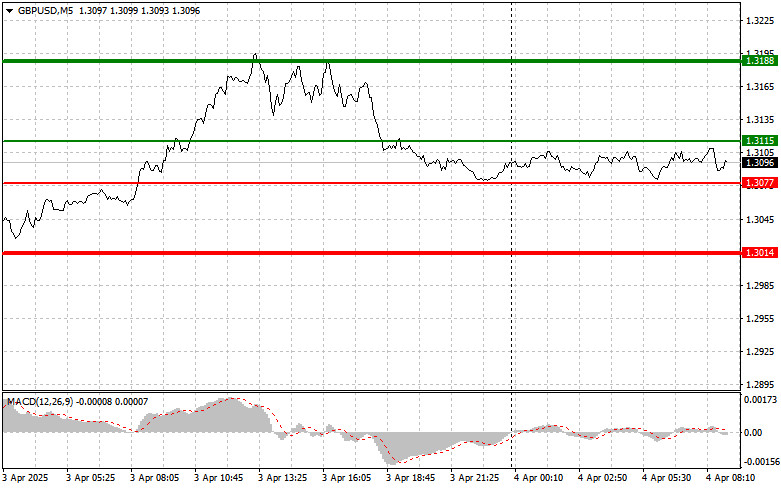

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today at the entry point around 1.3115 (green line on the chart), targeting 1.3188 (thicker green line on the chart). Around 1.3188, I plan to exit the long trade and open a short position in the opposite direction (expecting a 30–35 pip move). The pound's rise may continue within the context of the ongoing uptrend. Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3077 level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger an upward reversal. A rise toward 1.3115 and 1.3188 can be expected.

Scenario #1: I plan to sell the pound today after the 1.3077 level is broken (red line on the chart), which could lead to a rapid decline in the pair. The main target for sellers will be 1.3014, where I plan to exit the short trade and immediately open a buy position in the opposite direction (expecting a 20–25 pip move). There is no need to rush to sell the pound. Important! Before selling, make sure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3115 level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels of 1.3077 and 1.3014 can be expected.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji level 142,32 terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli dolar

Pengujian harga pada 1,1382 di paruh kedua hari ini bertepatan dengan dimulainya pergerakan turun indikator MACD dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya, pasangan

Uji harga di 1.3285 terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Ulasan dan Saran Trading USD/JPY Tidak ada pengujian terhadap level yang saya tandai di paruh pertama hari ini. Pada paruh kedua hari ini, investor dan trader akan fokus pada indikator

Analisis Trading dan Saran Trading untuk Pound Inggris Pengujian level 1,3325 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi entri pasar yang benar. Namun, seperti yang

Analisis Trading dan Tips untuk Trading Euro Uji level harga 1.1405 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli euro

Pengujian harga di 14068 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Uji level harga 1.3356 bertepatan dengan saat indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Akibatnya, pasangan ini turun lebih

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.