Lihat juga

04.04.2025 08:00 AM

04.04.2025 08:00 AMThe euro and the pound are once again in demand, while the U.S. dollar is under heavy pressure. I believe the reason behind this is apparent, although few likely expected such a breakout in risk assets on the currency market.

Yesterday, the euro and the pound posted substantial gains amid a broad weakening of the U.S. dollar following the introduction of trade tariffs by Donald Trump. The dollar's decline was tied to a downward revision in growth forecasts for the U.S. economy. Meanwhile, the euro's strength was supported by upbeat PMI data from eurozone countries, indicating a recovery in the region's economy. This boosted expectations for the European Central Bank to slow its active rate-cutting cycle. However, some traders believe the rally is temporary and simply a negative market reaction to Trump's policies, while others argue that the euro has room to strengthen further if eurozone economic performance continues to improve.

This morning, data on German industrial orders and a series of reports from Italy are expected. Investors will also be paying close attention to updates from the U.S. labor market.

Positive economic readings from Germany and Italy will create additional tailwinds for the euro. On the other hand, weaker data could trigger a correction. The UK will also publish its construction PMI, which could further support pound strength.

If data aligns with economist expectations, the Mean Reversion strategy is preferable. If data deviates significantly from forecasts, a Momentum strategy is preferred.

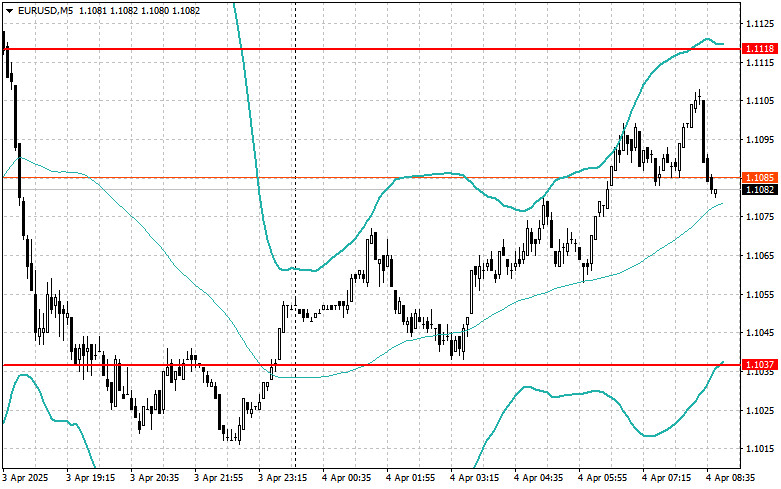

Buying on a breakout above 1.1097 may lead to a rise toward 1.1143 and 1.1179.

Selling on a breakout below 1.1039 may lead to a decline toward 1.0994 and 1.0946.

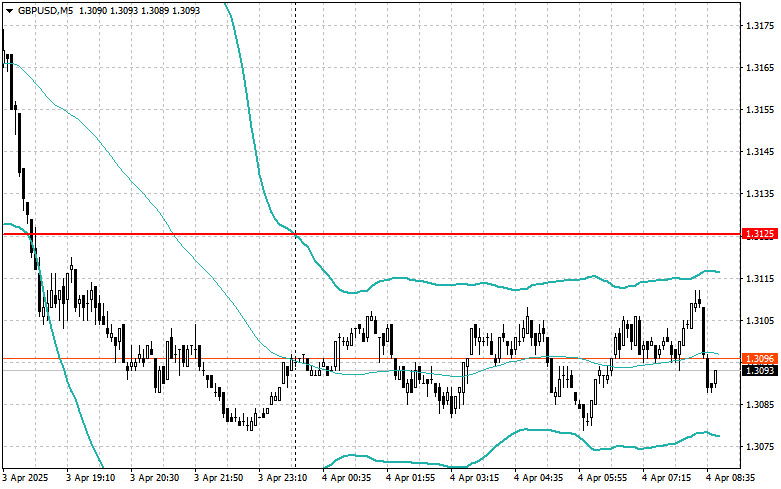

Buying on a breakout above 1.3128 may lead to a rise toward 1.3171 and 1.3204.

Selling on a breakout below 1.3080 may lead to a drop toward 1.3027 and 1.2976.

Buying on a breakout above 145.93 may lead to a rise toward 146.22 and 146.49.

Selling on a breakout below 145.60 may lead to a decline toward 145.28 and 144.95.

I'll look to sell after a failed breakout above 1.1118 and a return below this level.

I'll look to buy after a failed breakout below 1.1037 and a return back to this level.

I'll look to sell after a failed breakout above 1.3125 and a return below this level.

I'll look to buy after a failed breakout below 1.3070 and a return back to this level.

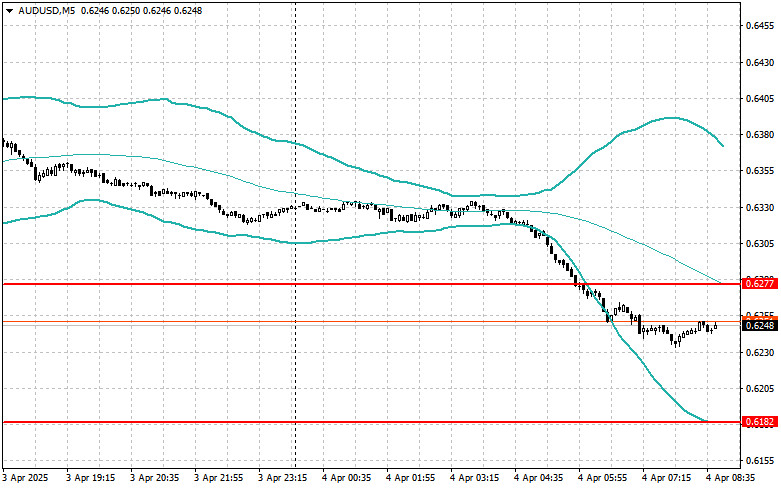

I'll look to sell after a failed breakout above 0.6277 and a return below this level.

I'll look to buy after a failed breakout below 0.6182 and a return back to this level.

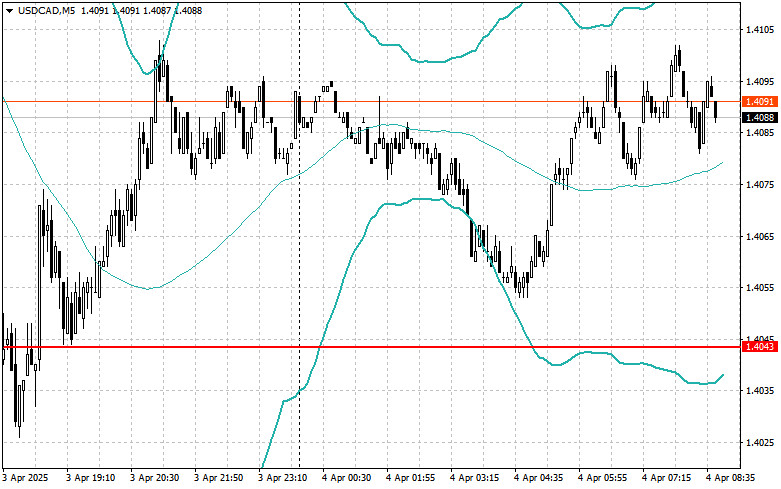

I'll look to sell after a failed breakout above 1.4124 and a return below this level.

I'll look to buy after a failed breakout below 1.4043 and a return back to this level.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian level 144,86 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar dan menghasilkan kenaikan lebih dari

Uji level 1,3342 pada paruh kedua hari terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua level ini terjadi

Uji harga pada 1.1312 di paruh kedua hari itu bertepatan dengan indikator MACD yang sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua pada

Euro dan pound kembali mengalami penurunan segera setelah kepercayaan pasar terhadap tercapainya kesepakatan dagang AS dengan mitra utama meningkat. Setelah menandatangani perjanjian dagang dengan Inggris, komentar lembut Donald Trump mengenai

Analisis dan Tips Trading untuk Pound Inggris Uji harga di 1.3330 pada paruh pertama hari ini bertepatan dengan indikator MACD yang baru mulai bergerak turun dari level nol, mengonfirmasi titik

Analisis dan Tips Trading untuk Euro Uji harga di 1.1321 terjadi tepat saat indikator MACD mulai bergerak turun dari titik nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya

Uji harga di 143,18 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual dolar. Situasi serupa terjadi dengan

Pengujian level harga 1,3359 pada paruh kedua hari itu bertepatan dengan indikator MACD yang sudah naik secara signifikan di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Tak lama

Pengujian level harga 1,1348 pada paruh kedua hari itu bertepatan dengan indikator MACD yang baru mulai bergerak ke bawah dari garis nol, mengonfirmasi kebenaran titik masuk jual untuk euro. Akibatnya

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.