Lihat juga

04.04.2025 07:29 AM

04.04.2025 07:29 AMOnly a few macroeconomic events are scheduled for Friday, but they may trigger a new storm. The market has not yet recovered from Wednesday evening's events when Trump imposed trade tariffs on all countries worldwide. As a result, the dollar's decline may very well continue today on this factor alone. However, in the second half of the day, the U.S. will release the NonFarm Payrolls and unemployment rate reports. It goes without saying how important these reports are—especially if the actual figures deviate from forecasts. At this point, the dollar can only hope for a correction. If the data is weaker than expected, the market will eagerly continue selling off the U.S. currency.

There's no point in discussing anything other than Trump's trade tariffs. The dollar's decline may continue for several more days, and we recommend that traders pay attention to speeches from the leaders of major countries and alliances regarding retaliatory tariffs. Trump said that any response to his measures to "eliminate injustice" would be met harshly with new sanctions and tariffs. So, anyone who assumed that the tariffs introduced on Wednesday were final and their rates fixed is seriously mistaken. Lengthy and complex negotiations are about to begin with all the "sanctioned" countries that will not accept Trump's tariffs. Large players will now start implementing counter-tariffs. Today, we await a speech from Federal Reserve Chair Jerome Powell, who will undoubtedly comment on the updated trade policy.

On the last trading day of the week, both currency pairs may continue to rise, as Trump has once again done everything to push the dollar lower. This is likely far from the last shock to hit the markets in 2025. The global trade architecture is transforming, and many changes in trade flows are expected. Numerous companies and governments will seek new markets, reorient their strategies, and form trade alliances and agreements. This will lead to a significant redistribution of financial and trade flows. And in the currency market, we may see more than one storm ahead.

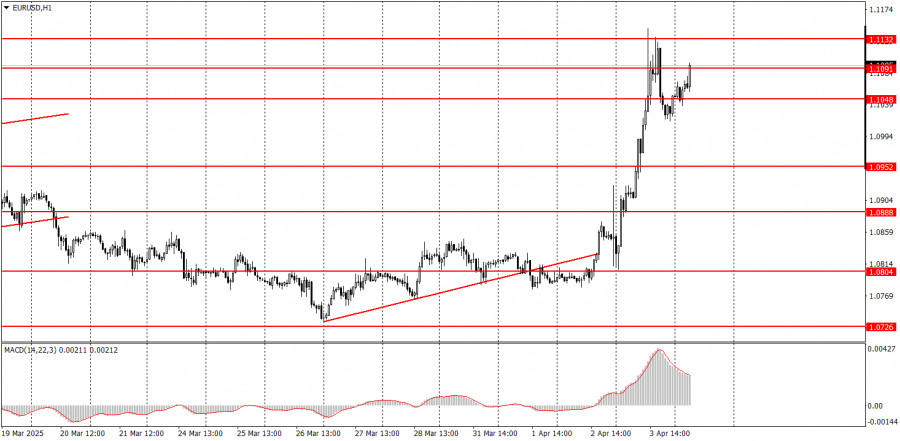

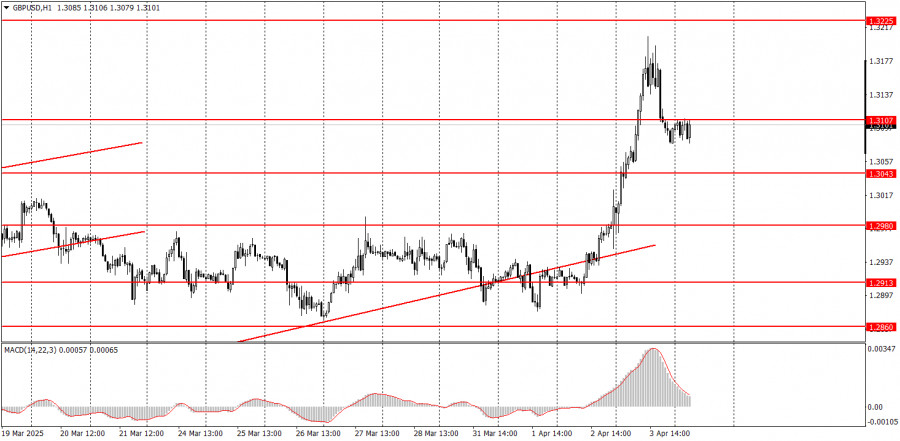

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pasar global tetap sangat dipengaruhi oleh perilaku tidak menentu Donald Trump. Dalam upayanya untuk mengurangi ketergantungan ekonomi AS yang parah pada impor, Trump terus memainkan topik tarif bea masuk. Peserta

Tidak ada acara makroekonomi yang dijadwalkan untuk hari Senin. Namun, latar belakang makroekonomi saat ini tidak terlalu menarik bagi para trader. Setidaknya, hal ini tidak menggerakkan pasangan mata uang. Oleh

Minggu lalu, EUR/USD mencatat rally paling kuat tahun ini, naik dari 1,0882 ke level tertinggi mingguan di 1,1474. Biasanya, lonjakan impulsif seperti ini diikuti oleh fase koreksi atau konsolidasi. Namun

Pada hari Jumat, pasangan mata uang GBP/USD juga diperdagangkan lebih tinggi. Namun, perlu dicatat bahwa mata uang Inggris—yang pernah dipuji karena ketahanannya yang luar biasa terhadap dolar dalam beberapa tahun

Pada hari Jumat, pasangan mata uang EUR/USD melanjutkan kenaikannya yang stabil. Pada titik ini, tidak ada lagi pertanyaan tentang apa yang terjadi di pasar mata uang—semuanya sangat jelas. Donald Trump

Akan ada beberapa peristiwa penting dalam minggu mendatang. Tentu saja, laporan seperti produksi industri, penjualan ritel, dan penjualan rumah baru perlu diperhatikan. Sekilas, laporan-laporan ini tampaknya tidak mampu mengubah sentimen

Euro menunjukkan kenaikan tajam terhadap dolar AS. Pasangan EUR/USD telah mencapai level tertinggi dalam tiga tahun dan tidak menunjukkan tanda-tanda melambat. Sementara itu, menurut survei para ekonom, pejabat di European

Pada hari Kamis, para investor menyadari bahwa saat ini tidak ada yang namanya stabilitas. Volatilitas pasar yang tinggi tetap ada dan akan terus mendominasi untuk beberapa waktu. Penyebab yang sedang

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.