Lihat juga

03.04.2025 09:02 AM

03.04.2025 09:02 AMBitcoin and Ethereum rose even before Trump's decision and the announcement of trade tariffs, but pressure on risk assets increased significantly afterward. It's hard to say that the newly announced tariffs directly affect the cryptocurrency market—for instance, the forex market and its risk assets rose against the dollar. However, a sharp drop in U.S. stock indices also pulled cryptocurrencies down.

Another failed attempt by Bitcoin to hold above the $88,000 level led to a sell-off. It is now trading at around $83,200. Ethereum also faced setbacks: after reaching $1,950 during the U.S. session yesterday, it is now trading around $1,821.

On a positive note, Fidelity has announced the launch of a retirement plan that allows direct investments in cryptocurrency. This is undoubtedly a significant step, signaling the growing recognition of digital assets within traditional financial institutions. Ordinary households can now include Bitcoin and other cryptocurrencies in their retirement portfolios, opening new opportunities for diversification and potentially higher returns. However, it's important to remember that despite their appeal, cryptocurrencies carry substantial risks, as demonstrated by yesterday's developments surrounding Trump's trade policy.

Market volatility and unpredictable regulation may present challenges, making it unlikely that households will rush to invest in Bitcoin at the risk of their retirement savings.

I will continue to focus on significant pullbacks in Bitcoin and Ethereum for the crypto market, anticipating a continuation of the medium-term bull market, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

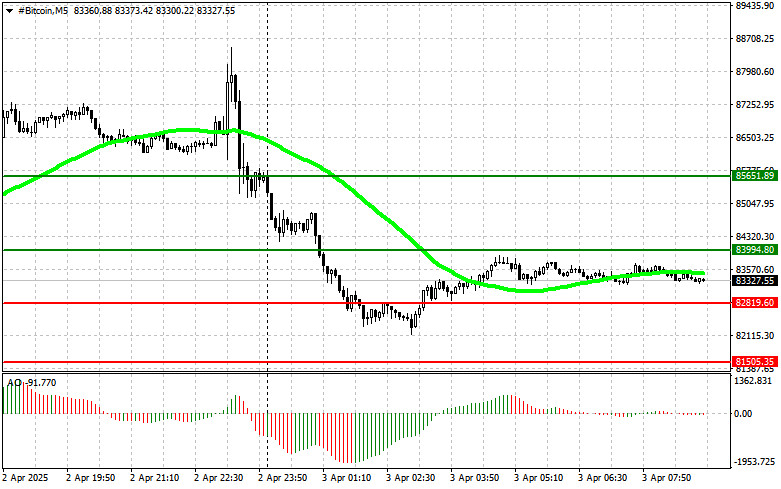

Scenario #1: Buy Bitcoin today at the entry point near $84,000 with a target of $85,600. I'll exit long positions around $85,600 and sell immediately on a bounce. Before a breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy from the lower boundary at $82,800 if there is no market reaction to a breakout, aiming for a rebound toward $84,000 and $85,600.

Scenario #1: Sell Bitcoin today at the entry point near $82,800 with a target of $81,500. Exit short positions at $81,500 and buy immediately on a bounce. Before a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell from the upper boundary at $84,000 if there is no market reaction to a breakout, aiming for a return toward $82,800 and $81,500.

Scenario #1: Buy Ethereum today at the entry point near $1,844 with a target of $1,893. Exit long positions at $1,893 and sell immediately on a bounce. Before a breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy from the lower boundary at $1,808 if there is no market reaction to a breakout, aiming for a rebound toward $1,844 and $1,893.

Scenario #1: Sell Ethereum today at the entry point near $1,808 with a target of $1,770. Exit short positions at $1,770 and buy immediately on a bounce. Before a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell from the upper boundary at $1,844 if there is no market reaction to a breakout, aiming for a return toward $1,808 and $1,770.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Bitcoin gagal bertahan di atas level $110.000, sementara Ethereum kembali menunjukkan pertumbuhan yang cukup baik, didorong oleh berita tentang kemungkinan peningkatan signifikan dalam batas gas per blok di blockchain. Kemarin

Kemarin, Bitcoin dan Ethereum terus menarik permintaan dari para trader dan investor, mempertahankan prospek kuat untuk kelanjutan pasar bullish. Sementara itu, International Monetary Fund (IMF) menyatakan bahwa mereka akan bekerja

Pada chart 4 jam dari mata uang kripto Bitcoin, nampak muncul Divergensi antara pergerakan harga Bitcoin dengan indikator Stochastic Oscillator, dimana hal tersebut memberi petunjuk kalau dalam waktu dekat

Bitcoin mencapai $110,000 tetapi gagal mempertahankan reli sepanjang hari, melanjutkan konsolidasinya. Namun, jeda ini sama sekali bukan tanda kelelahan. Di balik layar, aktivitas semakin memanas: institusi membeli spot ETF, trader

Meskipun sempat terhenti sejenak, Bitcoin dan Ethereum tampaknya belum selesai dengan pergerakan naik mereka. Sementara Bitcoin sedikit mundur selama sesi perdagangan Asia hari ini, Ethereum sudah menembus level tertinggi mingguan

Permintaan untuk bitcoin dan ether terus berlanjut di awal minggu ini. Bitcoin tetap berada di atas angka $109,000, sementara Ethereum mencoba untuk mengkonsolidasikan di atas $2,600. Berita kemarin bahwa Strategy

Permintaan untuk Bitcoin dan Ethereum kembali meningkat pada awal minggu ini. Bitcoin telah menembus di atas level $109.000, sementara Ethereum berusaha untuk terkonsolidasi di atas angka $2.550. Kemarin, CEO Tether

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.