Lihat juga

03.04.2025 06:10 AM

03.04.2025 06:10 AMThe GBP/USD currency pair continued to trade in a total flat on April 2. What caused the dollar to stop falling? After all, Trump announces new tariffs or teases upcoming ones almost every week. First, we want to emphasize that such an important event as the announcement of a new U.S. trade policy shouldn't be analyzed hastily. Recall that it's not uncommon for EUR/USD to move strongly in one direction right after a Federal Reserve meeting, only to retrace the next day. The same could happen here, as these are events of similar scale. It's best to conclude only after some time has passed.

Let's also recall that just a week ago, Trump imposed tariffs on all automobile imports into the U.S., and the dollar didn't significantly decline. Why? In our view, the market is simply tired of Donald Trump. Yes, tired—after less than 2.5 months of his presidency. It brings to mind the first four years of Trump in office: two impeachment attempts, hostile remarks toward journalists, a trade war with China, and an average of 14.6 false statements per day (official data). So, if anyone truly believed Trump would end the Ukraine conflict in 24 hours, they were likely very naive.

Likewise, Trump promises to "Make America Great Again" but fails to mention who will pay for his plans. It might seem like the rest of the world, who've "robbed America for years." However, the Trump administration is slapping an additional 10–25% cost on any imported goods. And who pays for these goods? American companies and consumers. So, who's footing the bill for America's future greatness? Americans themselves.

Demand for European and Chinese goods will fall, and the EU and China will suffer from the tariffs. But they will suffer—Americans will pay. Trump wants to lower taxes and introduce various tax breaks, but it all looks like: "We'll raise prices by 25%, then give a 5% discount." In any case, the American people elected Trump, and at this point, there's no use crying over spilled milk. They knowingly chose a leader with a well-documented governing style—they had four years to observe it. That choice signals that they accept the consequences. Previously, many Americans criticized high spending under Democrats on aid to Ukraine, Israel, and NATO. With Trump, Washington will spend less, and Americans will pay more for the same goods they used to buy.

The British pound maintains a short-term uptrend while the long-term downtrend persists. We don't see strong reasons for a sustained rally in the British currency.

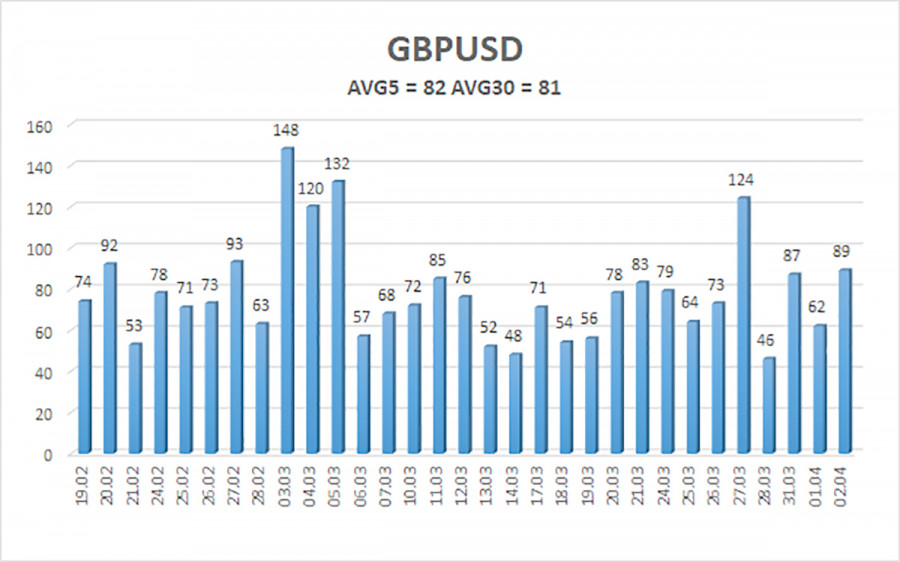

The average volatility of the GBP/USD pair over the last five trading days is 82 pips, which is considered "average" for this currency pair. On Thursday, April 3, we expect the pair to trade within a range limited by 1.2881 to 1.3045. The long-term regression channel has turned upward, but the downtrend remains intact on the daily timeframe. The CCI indicator has not recently entered overbought or oversold territory.

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

R1 – 1.3062

R2 – 1.3184

R3 – 1.3306

GBP/USD maintains a medium-term downtrend, while the 4-hour chart shows a weak correction that could end as the market avoids buying the dollar. We still do not consider long positions, as the current upward move appears to be a technical correction on the daily timeframe that has become illogical. However, if you trade based purely on technicals, long positions are possible with targets at 1.3045 and 1.3062—but the market is still range-bound. Short positions remain more attractive, with targets at 1.2207 and 1.2146, because sooner or later, the upward correction on the daily chart will end (assuming the previous downtrend hasn't ended already). The British pound looks extremely overbought and unjustifiably expensive, but it's hard to predict how long the dollar's Trump-driven decline will last.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Seperti yang diantisipasi, ECB memangkas semua suku bunga utama sebesar seperempat poin, menurunkan suku bunga deposito menjadi 2,25%. Pada pertemuan ini, tidak ada proyeksi staf baru yang dirilis, dan mengingat

Gelombang euforia baru telah melanda pasar. Banyak yang percaya ini bukan kebetulan: ambil semuanya dari seseorang dan kemudian berikan mereka sedikit saja, dan mereka akan merasakan kebahagiaan. Jadi, apa yang

Sejumlah besar peristiwa makroekonomi dijadwalkan pada hari Rabu. Semua peristiwa tersebut adalah laporan Indeks Manajer Pembelian (PMI) untuk bulan April di sektor jasa dan manufaktur. Indeks-indeks ini akan dipublikasikan

Pada hari Selasa, pasangan mata uang GBP/USD diperdagangkan dengan lebih tenang, sekali lagi menunjukkan tanda-tanda pola "maxed-out flat". Seperti yang telah disebutkan sebelumnya, dolar AS belakangan ini hanya memiliki

Pada hari Selasa, pasangan mata uang EUR/USD diperdagangkan lebih tenang dibandingkan hari Senin. Dolar AS berhasil menghindari penurunan lebih lanjut, tetapi masih terlalu dini untuk merayakannya. Dolar bisa saja jatuh

Ketakutan dapat melumpuhkan, tetapi tindakan tetap berlanjut. Para investor perlahan-lahan mengatasi kekhawatiran mereka terhadap serangan Donald Trump terhadap independensi Federal Reserve dan mulai mengunci keuntungan pada posisi panjang EUR/USD

Pelan tapi pasti memenangkan perlombaan! Bitcoin diam-diam menembus level tertingginya sejak awal Maret di tengah serangan Donald Trump terhadap Jerome Powell. Ketika independensi Federal Reserve dipertaruhkan dan kepercayaan terhadap dolar

Setelah mencapai rekor tertinggi baru di $3500 dalam kondisi overbought, harga emas mengalami penurunan. Namun, sentimen bullish tetap kuat karena kekhawatiran yang terus-menerus mengenai potensi dampak ekonomi dari kebijakan tarif

Pada hari ini, pasangan EUR/GBP mengalami penurunan setelah dua hari berturut-turut mengalami kenaikan, diperdagangkan mendekati level psikologis 0,8600. Pound mendapatkan dukungan dari optimisme seputar negosiasi perdagangan yang sedang berlangsung antara

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.