Lihat juga

01.04.2025 11:32 AM

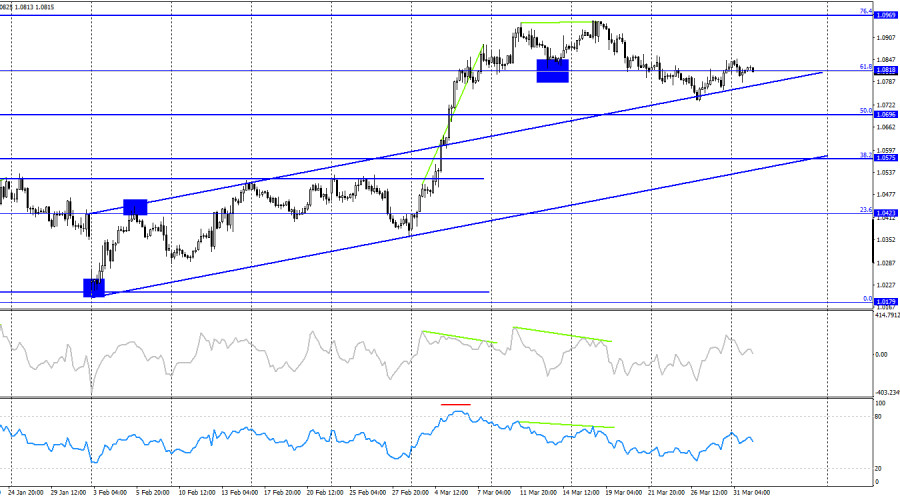

01.04.2025 11:32 AMOn Monday, the EUR/USD pair continued its upward movement and even rebounded from the support zone at 1.0781–1.0797. However, believing in a further rise of the euro is becoming increasingly difficult. According to wave analysis, the trend has turned bearish, meaning we should expect a decline. The recent growth of the pair is merely a corrective pullback. Therefore, I expect a consolidation below the 1.0781–1.0797 zone and a further fall toward the Fibonacci levels at 1.0734 and 1.0622.

The wave pattern on the hourly chart has shifted. The last completed upward wave barely broke the previous high, and the most recent downward wave broke below the previous low. Thus, the waves currently indicate a trend reversal to the bearish side. Donald Trump introduced new tariffs last week, which caused the bears to retreat again. Trump is likely to impose more tariffs this week, allowing the bulls another attempt at an advance. However, bulls are weakening with each passing day.

The fundamental backdrop on Monday did not support the bulls. Retail sales in Germany exceeded expectations, but the more important inflation report showed a slowdown to 2.2% y/y. While this figure matched forecasts, the fact that inflation is now nearing the ECB's target level cannot be overlooked. This suggests the ECB's monetary policy may become even more dovish—bad news for the euro. Trump's trade wars have been supporting the bulls for several weeks, but that alone is not enough to sustain continued euro purchases and dollar selling. Traders have already priced in the tariff news, and now other economic drivers are needed for this strategy to remain viable. At the moment, there are none. A large volume of important statistics will be released this week, starting in just a few hours with eurozone inflation data. If inflation also slows, the bears will resume their attack.

On the 4-hour chart, the pair made a slight upward move, but I expect a new reversal in favor of the U.S. dollar and a further decline toward the 50.0% correction level at 1.0696 and the 38.2% level at 1.0575. While a major drop in the euro is unlikely for now, a 200-point decline would still be timely. No divergence signals are observed on any indicators today.

Commitments of Traders (COT) Report:

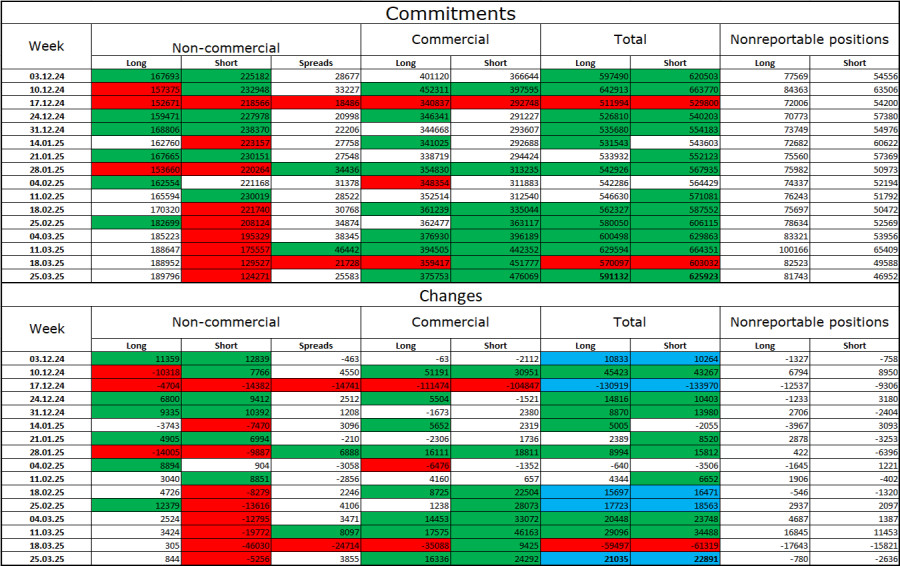

During the most recent reporting week, professional traders opened 844 new long positions and closed 5,256 short positions. The sentiment of the "Non-commercial" group turned bullish again—thanks to Donald Trump. The total number of long positions held by speculators is now 190,000, while short positions have decreased to 124,000.

For twenty weeks in a row, large players had been offloading euros, but for the past seven weeks, they've been reducing short positions and building long ones. While the divergence in ECB and Fed monetary policy continues to favor the U.S. dollar, Trump's policy is becoming a more influential factor for traders, as it may have a dovish impact on the FOMC's approach and even lead to a recession in the U.S. economy.

News Calendar for the U.S. and Eurozone:

On April 1, the economic calendar includes a large number of important events at various times throughout the day. The fundamental backdrop may strongly influence market sentiment all day long.

EUR/USD Forecast and Trader Recommendations:

Selling the pair is possible today after a bounce from the 1.0857 level on the hourly chart, with targets at 1.0797 and 1.0734, or after a close below the 1.0781–1.0797 zone. Buying will be possible after a bounce from the 1.0781–1.0797 zone on the hourly chart with a target at 1.0857.

Fibonacci levels are drawn from 1.0529–1.0213 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dengan munculnya Convergence antara pergerakan harga instrument komoditi Platinum dengan indikator Stochastic Oscillator serta ditunjang oleh pergerakan harganya yang bergerak diatas WMA (210) yang juga memiliki kemiringan yang menukik keatas

Bila Kita perhatikan chart 4 jam dari pasangan mata uang komoditi USD/CAD, nampak terlihat munculnya Divergence antara pergerakan harganya dengan indikator Stochastic Oscillator, sehingga meski saat ini The Lonnie masih

Rencana trading kami untuk beberapa jam ke depan adalah menjual euro di bawah puncak saluran tren turun, dengan target di 1.1189, dan menutup celah yang tertinggal minggu lalu sekitar 1.1150

Emas meninggalkan celah lain pada 8 Mei di sekitar level 3.325 dan kemungkinan akan menembus ke atas 3.250. Prospeknya mungkin bullish, dan kita mungkin mengantisipasi emas menutup celah

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.