Lihat juga

01.04.2025 10:53 AM

01.04.2025 10:53 AMTrade Review and EUR Trading Advice

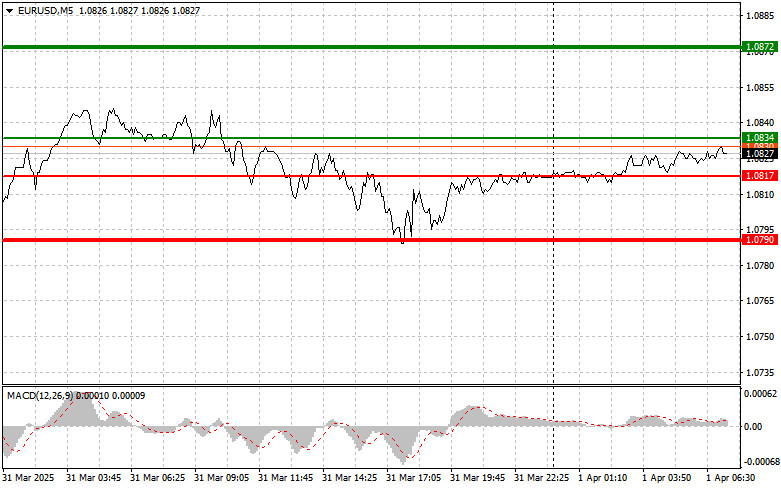

The test of the 1.0810 level occurred just as the MACD indicator began to move down from the zero mark, confirming a valid entry point for selling the euro and resulting in a decline of more than 20 points.

Today, the Eurozone is set to release several key data points that could significantly influence the direction of the EUR/USD pair. It begins with manufacturing PMI figures, which still reflect serious problems in the sector, so euro buyers may not respond positively. However, the main focus will be on the Consumer Price Index and core inflation data from the Eurozone. If a slowdown in inflation is recorded for March, it will be welcomed by the European Central Bank and could support continued rate cuts. On the other hand, if the core index rises, the ECB will likely delay its next rate cut until the summer.

The market's response will also depend on how much actual figures deviate from forecasts. If inflation is much lower than expected, the euro may weaken. Conversely, higher-than-expected inflation figures will strengthen the euro by reducing the chances of aggressive rate cuts. The Eurozone unemployment rate for February is not expected to affect the euro much, as it will likely match economist forecasts. Nonetheless, these numbers will provide a more complete picture of the Eurozone economy.

For the intraday strategy, I will focus mainly on implementing Scenarios #1 and #2.

Buy Scenarios

Scenario #1: Today, buying the euro is possible when the price reaches around 1.0834 (green line on the chart) with a target of rising to 1.0872. I plan to exit the market at 1.0872 and open short positions in the opposite direction, aiming for a 30–35 point retracement from the entry point. Buying the euro in the first half of the day is only advisable after strong Eurozone data. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.0817 price level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a market reversal to the upside. A rise toward 1.0834 and 1.0872 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the euro after reaching the 1.0817 level (red line on the chart), with a target of 1.0790, where I'll exit short positions and immediately open long positions in the opposite direction (targeting a 20–25 point retracement from the level). Selling pressure could return today if the data is weak. Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0834 level while the MACD is in the overbought zone. This would limit the pair's upward potential and lead to a downward reversal. A decline toward 1.0817 and 1.0790 can be expected.

Chart Key:

Important: Beginner traders in the Forex market should be extremely cautious when deciding to enter a trade. It's best to stay out of the market ahead of important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly, especially if you don't use proper money management and trade with large volumes. And remember: successful trading requires a clear trading plan, like the one presented above. Making impulsive trading decisions based on current market noise is an inherently losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga pada 145.,20 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Namun, hal ini tidak mencegah penjualan dolar AS, karena pengujian

Pengujian harga di 1,1105 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol. Namun, setelah rilis data utama AS, ini tidak menghalangi masuknya pembelian euro dengan harapan terbentuknya

Ulasan dan Kiat-kiat untuk Trading Yen Jepang Uji harga di 146,88 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang valid ke pasar

Ulasan Trading dan Kiat-kiat Trading untuk Pound Inggris Pengujian harga di 1,2887 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk

Ulasan Trading dan Kiat-kiat untuk Trading Euro Pengujian harga di 1,0974 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk menjual

Pengujian level harga 144,80 terjadi ketika indikator MACD bergerak jauh di bawah titik nol, sehingga membatasi potensi penurunan pasangan ini. Pengujian kedua pada 144,80 terjadi ketika MACD berada di zona

Uji harga di 1.2803 terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Uji harga di 1,1055 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang valid untuk membeli euro dan menghasilkan kenaikan 30 pip pada pasangan

Uji level harga 147,13 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang valid untuk membeli dolar. Akibatnya, pasangan ini naik 40 pip sebelum

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.